Today's Cryptocurrency: Bitcoin, Ethereum, and Ripple Continue to Decline as Risk Aversion Intensifies

As of Wednesday's press time, the price of bitcoin (BTC) was edging lower, approaching $86,000, due to widespread risk-averse sentiment in the cryptocurrency market. Ethereum (ETH) remained above $2,900, but its upside was capped below $3,000 as institutional investor interest waned. Ripple (XRP) was trading slightly below $1.90, despite moderate but steady inflows into exchange-traded funds (ETFs).

Data Focus: XRP ETF Inflows Continue to Grow, While BTC and ETH See Outflows

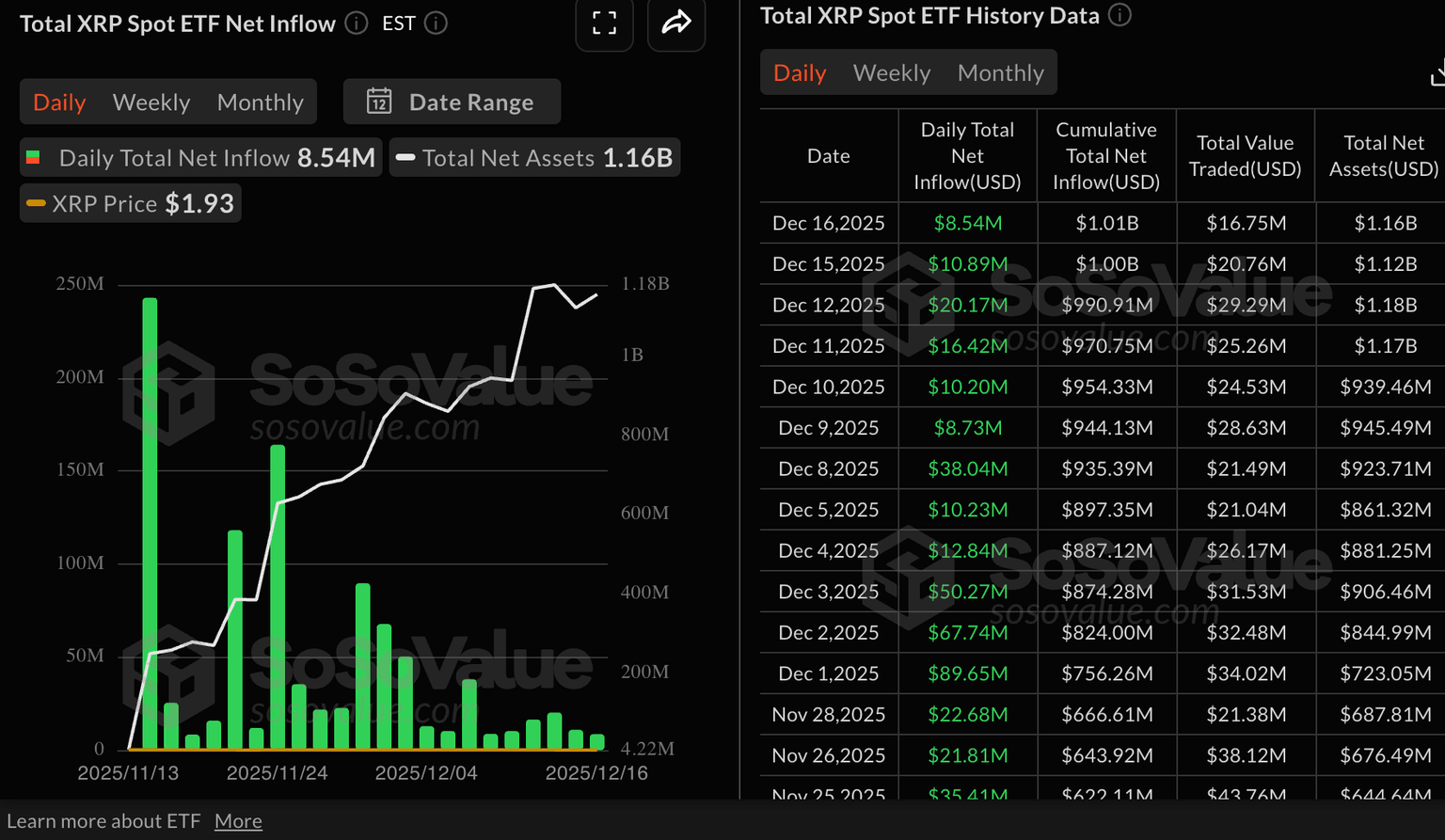

The XRP spot ETF continued its inflow momentum, with approximately $8.5 million deposited on Tuesday.

The Bitwise XRP ETF led with about $6.2 million in inflows, followed by Franklin Templeton's XRPZ, which saw nearly $2.1 million. According to SoSoValue data, cumulative inflows have reached $1.01 billion, with net assets totaling $1.16 billion.

Since its debut on November 13, the XRP ETF has not experienced any outflows, highlighting growing institutional interest in altcoin-based crypto investment products.

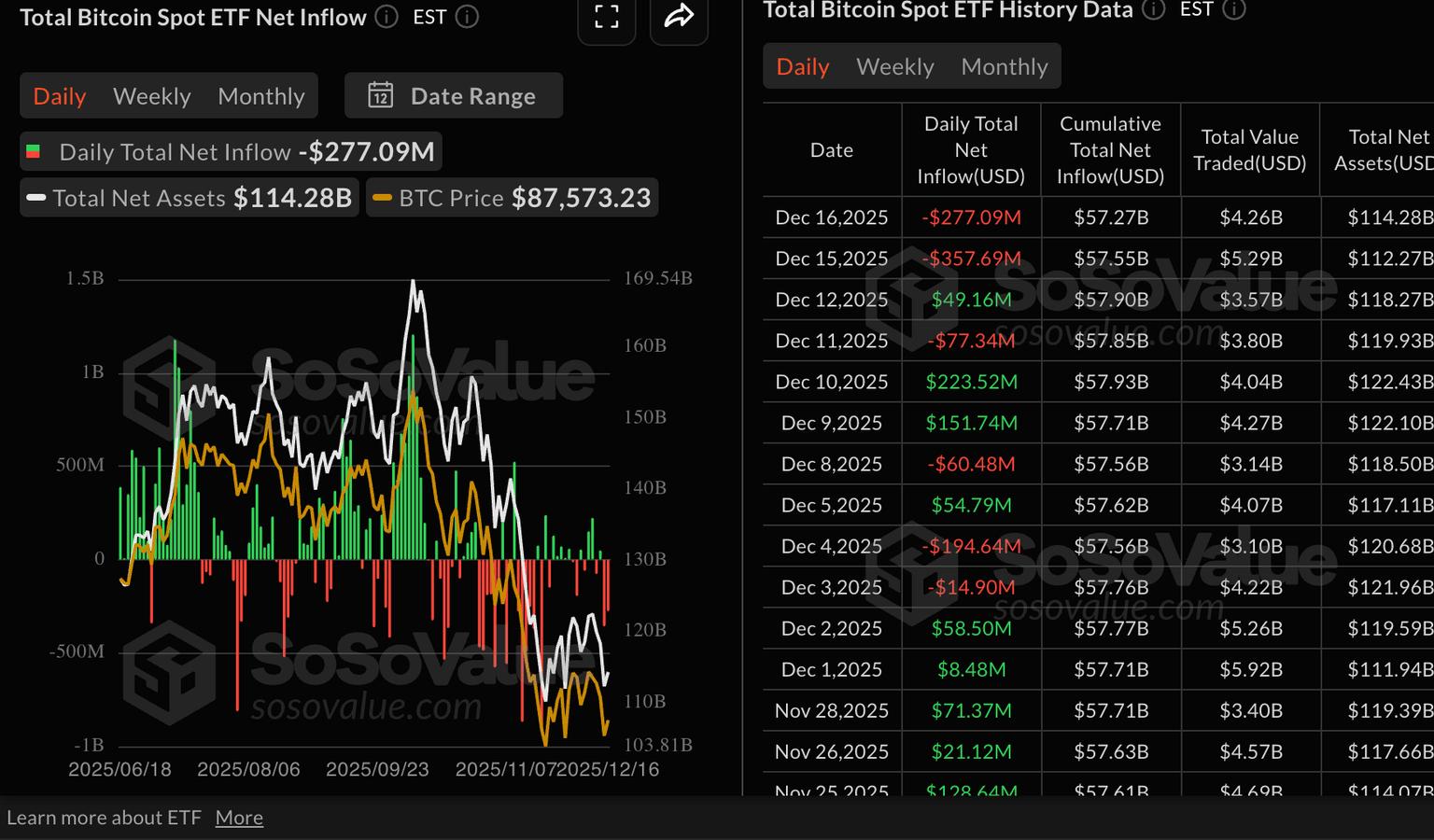

In contrast, driven by continued risk aversion among institutional investors, the bitcoin spot ETF recorded approximately $277 million in outflows on Tuesday. This marked the second consecutive day of outflows, after investors withdrew nearly $358 million on Monday.

Currently, the cumulative net inflow stands at $57.27 billion, with average net assets of $114.28 billion.

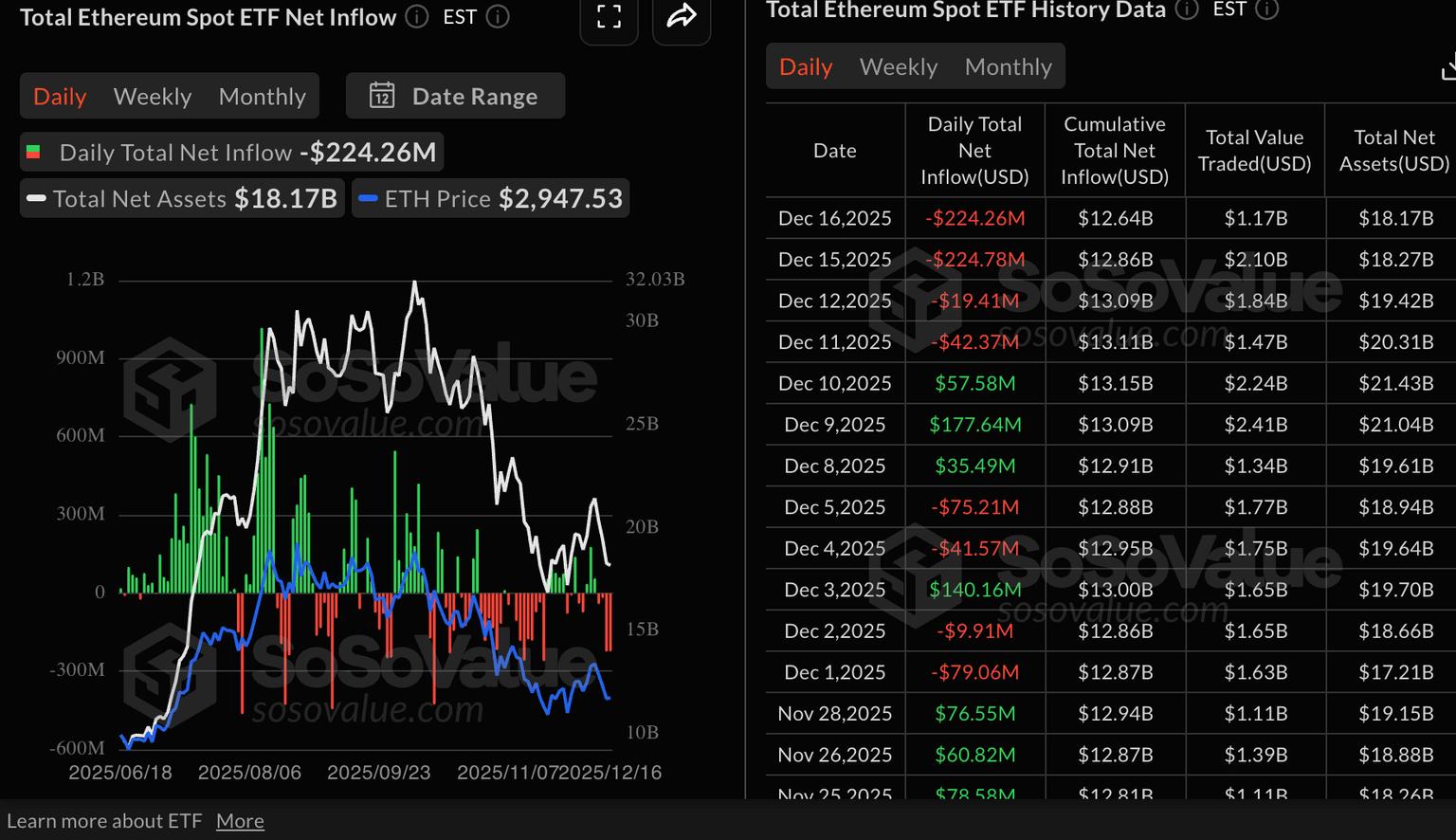

Meanwhile, the Ethereum ETF saw outflows for the fourth consecutive day, with about $224 million leaving on Tuesday. BlackRock's ETHA ETF had the largest outflow at $221 million, followed by Fidelity's FETH, which saw nearly $3 million in outflows. SoSoValue data shows cumulative inflows at $12.64 billion, with net assets of $18.17 billion.

According to a report by K33 Research, risk-averse sentiment may continue to overshadow the cryptocurrency market, especially after the Federal Reserve's December rate cut decision and hawkish comments, as well as heightened macroeconomic uncertainty at the start of the new year.

“While the rate cut brought some short-term relief, subsequent comments indicated that investors would once again adopt a ‘wait-and-see’ approach.” The Federal Reserve dampened overall market sentiment. Futures markets currently estimate a 73% probability of no change in interest rates. K33 Research stated: “At the January 28 FOMC meeting, there is a 47.6% probability of no policy change, and at the March 18 meeting, the probability of no policy change is also 47.6%.”

Chart of the Day: Bitcoin Under Pressure, Losses Widen

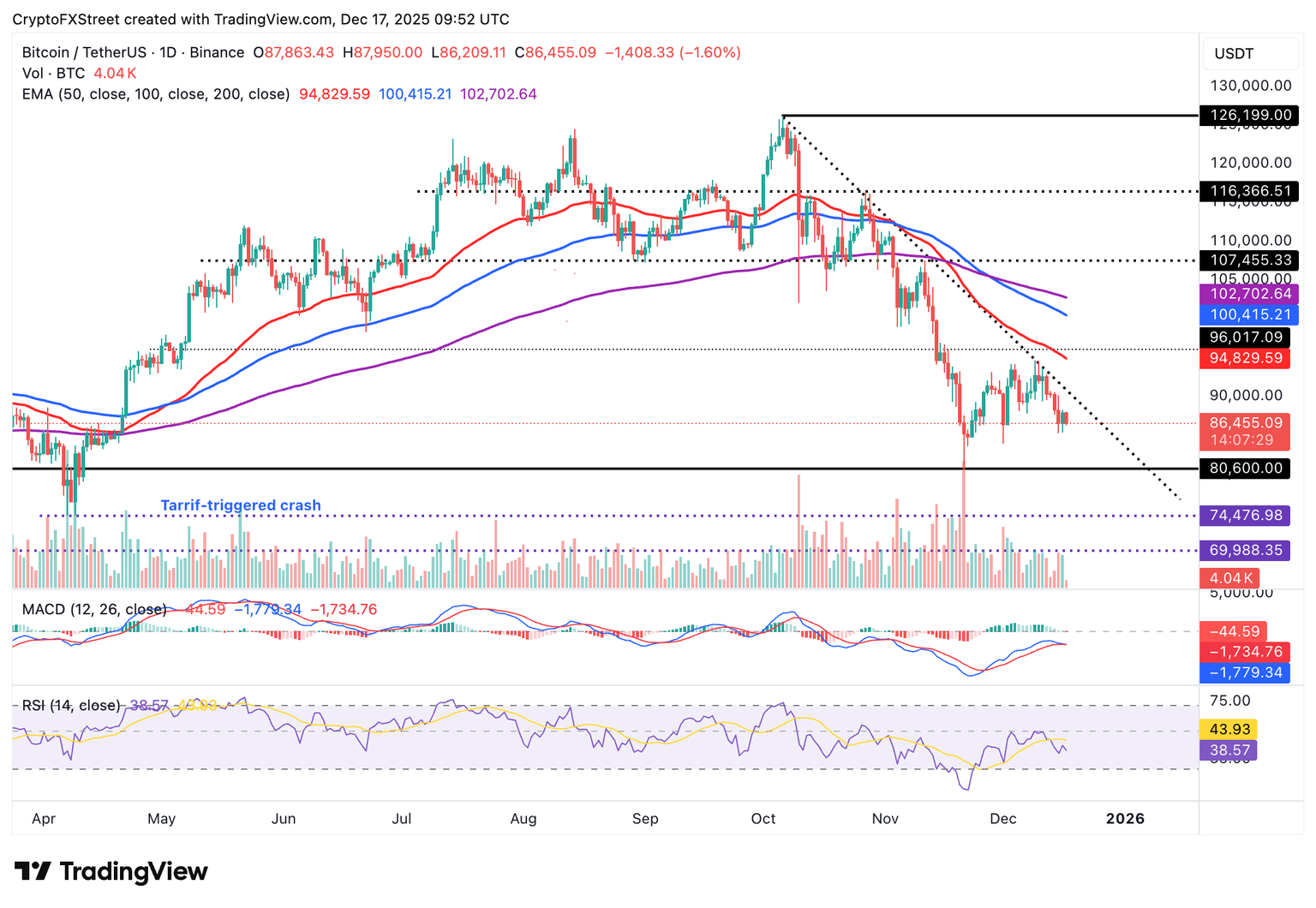

As of Wednesday's press time, bitcoin was hovering above $86,000, with sellers increasing their selling pressure across the cryptocurrency market. The 50-day Exponential Moving Average (EMA) is trending downward at $94,829; the 100-day EMA is at $100,415; and the 200-day EMA is at $102,702, all reflecting an overall bearish market outlook.

The Relative Strength Index (RSI) has dropped to 38, indicating downside momentum on the daily chart. This sell signal is likely to be confirmed by the Moving Average Convergence Divergence (MACD) indicator on the same chart, prompting investors to reduce their positions and intensifying selling pressure.

Traders should closely monitor the blue MACD line crossing below the red signal line to confirm a sell signal. If the downtrend continues, bitcoin may retest $80,600, a level last touched on November 21.

Altcoin Updates: Ethereum and Ripple See Slight Declines

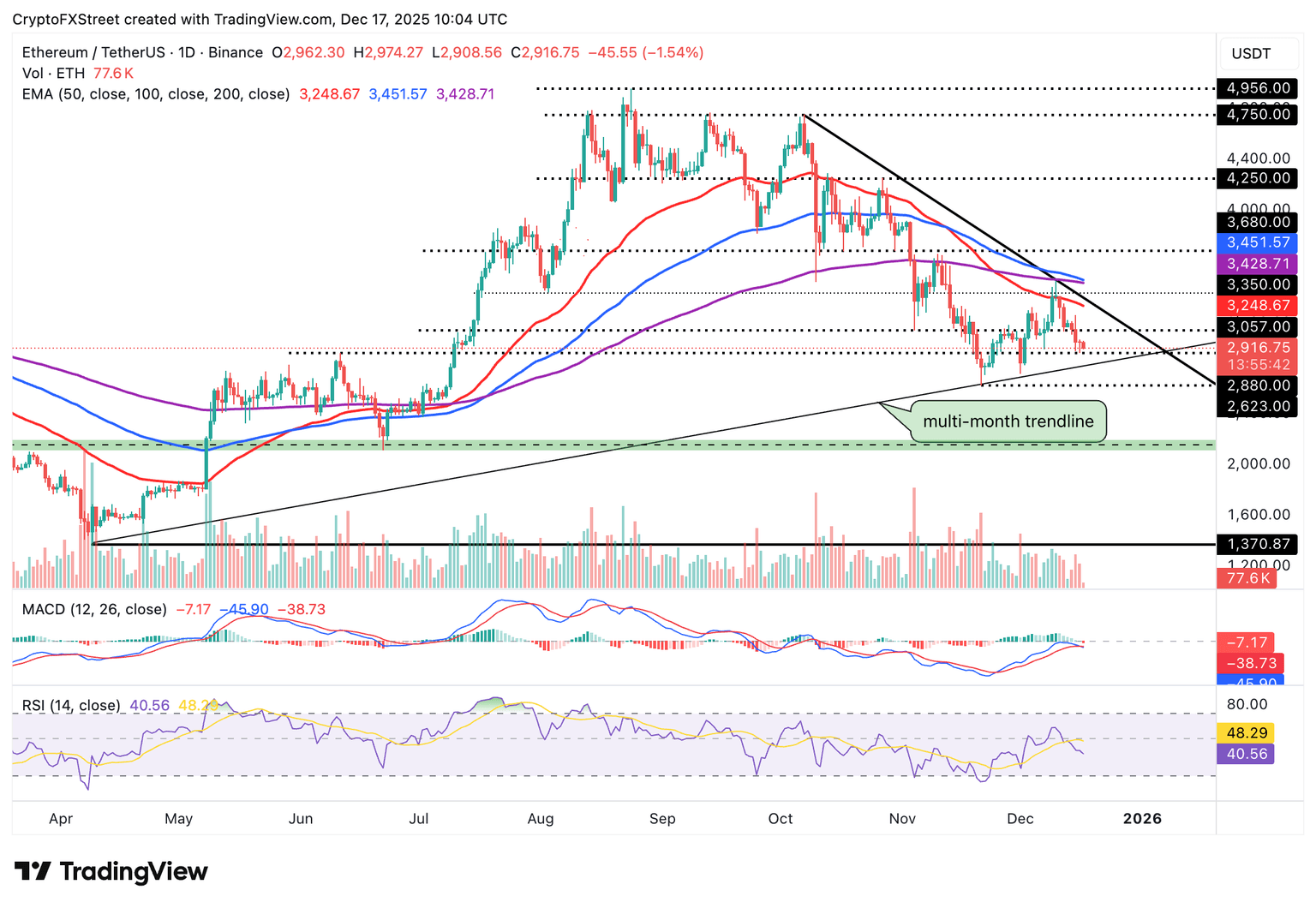

Ethereum is trading above $2,900, but its upside is limited by the $3,000 supply zone. The smart contract token is also below the 50-day moving average of $3,248, the 200-day moving average of $3,428, and the 100-day moving average of $3,451, all of which indicate a strong bearish outlook.

If the closing price falls below the short-term support at $2,900, ETH may continue to decline, approaching the November low of $2,623, especially as the daily RSI drops to 40, entering bearish territory.

If the blue line crosses below the red line, the MACD indicator on the same chart will confirm a sell signal. However, a rebound above $3,000 cannot be ruled out, especially if investors buy the dip. To solidify upward momentum, however, the price must break above the descending trendline and stabilize above the 50-day moving average near $3,248.

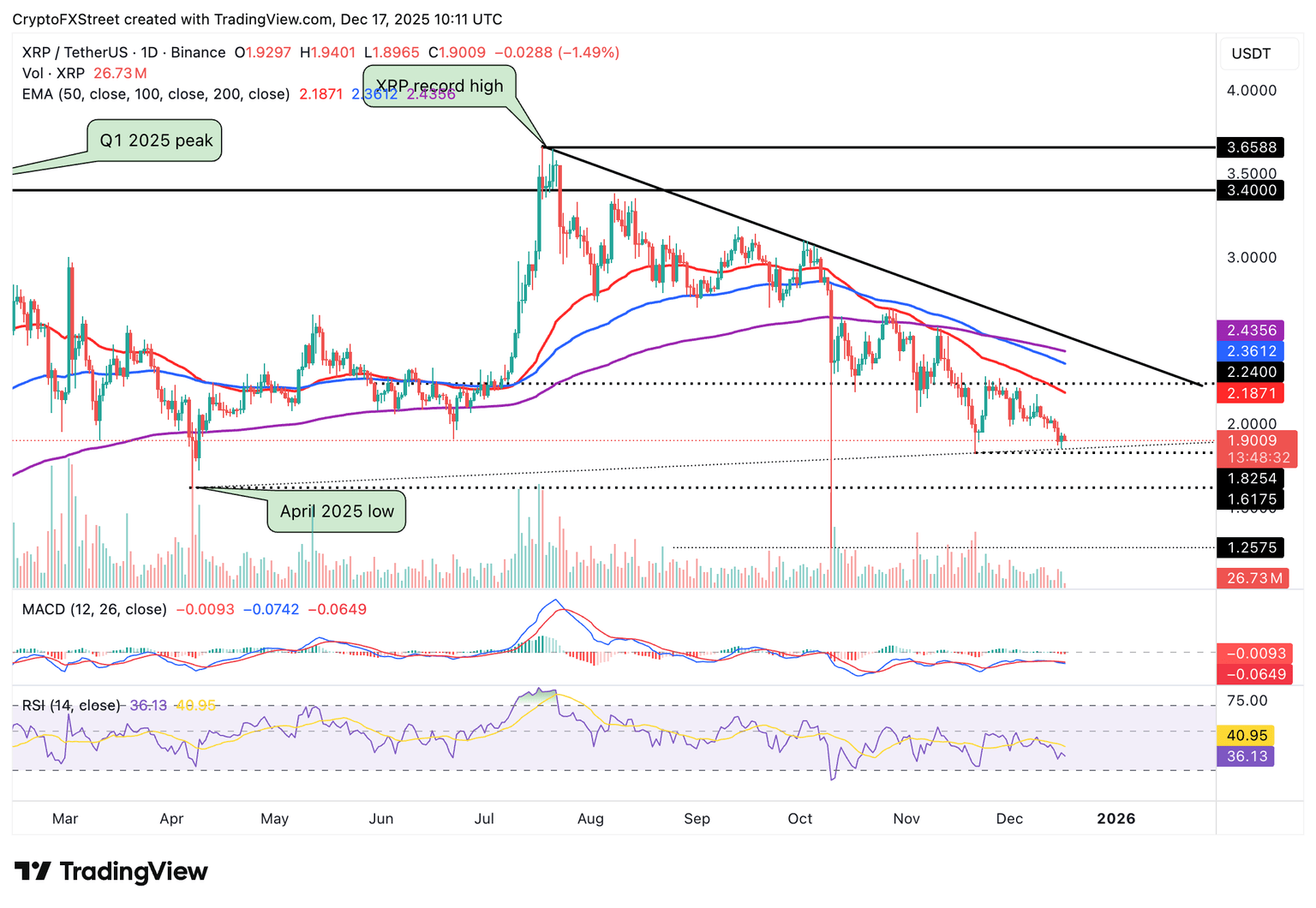

As for XRP, sellers are in control, with the price hovering below $1.90 as of Wednesday's press time. The daily chart's Relative Strength Index (RSI) is approaching the oversold region, indicating strengthening bearish momentum. Meanwhile, the MACD indicator on the same chart also confirms a sell signal, prompting investors to reduce their positions. The next key support is the November low of $1.82; if this support is breached, a further decline toward the April low of $1.61 may accelerate.

Despite the overall risk-averse sentiment in the cryptocurrency market, institutional interest in XRP remains relatively stable, with ETF inflows exceeding $1 billion and no outflows since launch. Stable ETF inflows may encourage retail investors to return to the market, boosting XRP's market acceptance and increasing the likelihood of breaking through the $2 mark in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stunning Move: Bitcoin OG Unstakes 270K ETH in Major Market Shuffle

Bitcoin Price Surge: A Stunning 1.57% Jump in Just 5 Minutes