News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

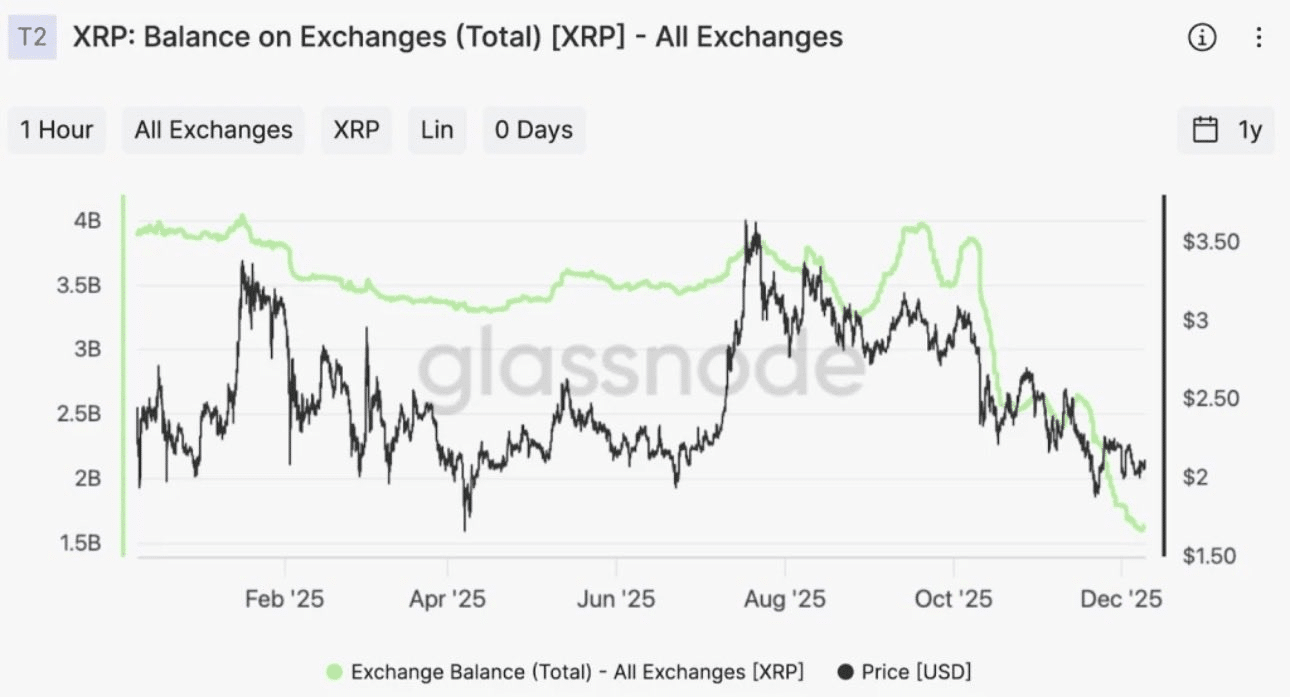

Reasons why XRP is poised to lead 2026 DESPITE drop below $2

AMBCrypto·2025/12/28 02:03

BTC Exodus: Bitcoin ETFs See $825 Million in Outflows Over Five Trading Days

The Bitcoin News·2025/12/27 23:24

Bitcoin Nears Record Stretch of 1079 Days Without Heavy Selling as Market Holds Steady at High Levels

BlockchainReporter·2025/12/27 23:00

Ethereum’s TVL Could Explode in 2026 as Stablecoins and RWAs Expand

Coinpedia·2025/12/27 22:30

10x Research Outlines Key Events That Could Move Crypto in 2026

Coinpedia·2025/12/27 22:30

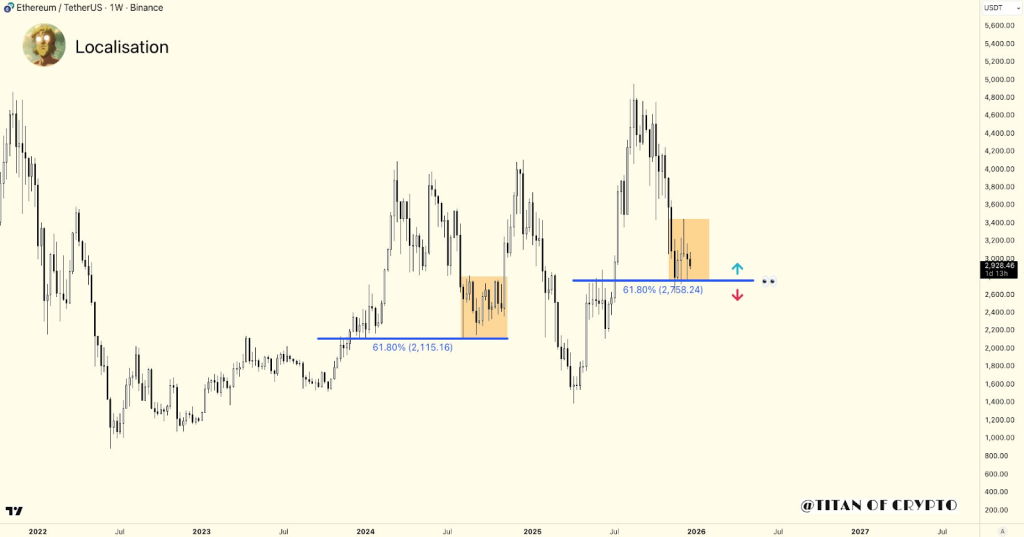

Ethereum Price at Critical Levels: Breakout or Breakdown Next?

Coinpedia·2025/12/27 22:30

Bitcoin Dominance Suggests a Mini Altcoin Season in Early January 2026

Coinpedia·2025/12/27 22:30

Galaxy Digital Admits Bitcoin 2026 Is ‘Too Chaotic’ as Price Targets Split Widely

Coinpedia·2025/12/27 22:30

At Least Five Crypto Treasury Firms Face Asset Sales or Closure in 2026, Galaxy Says

Coinpedia·2025/12/27 22:30

Bitcoin Outlook 2026: Institutions Could Drive BTC Price to $170K, Says Michael Saylor

Coinpedia·2025/12/27 22:30

Flash

02:12

Flow: The protocol fix solution has been successfully deployed, awaiting release of the final "Network Online" confirmation messageBlockBeats News, December 28th, Flow's official update on the attack incident has been accepted by network validators and successfully deployed, the network is online and producing blocks, but in a "read-only" mode, regular transaction submission remains paused. Before full recovery of operations can take place, Flow must forcibly synchronize with key ecosystem partners (cross-chain bridges, centralized exchanges, and decentralized exchanges) to ensure that its internal systems are fully in sync with the Flow ledger's recovery state. The Foundation will immediately release the final "network online" confirmation information after partner synchronization is completed.

02:11

Silver rises to the third largest global asset by market capitalization, with a total market value of $4.485 trillion.BlockBeats News, December 28, according to 8Marketcap data, the market capitalization of silver has risen to $4.485 trillions, ranking third among global assets by market cap, with the gap to Nvidia's $4.638 trillions market cap now less than 4%. In addition, bitcoin currently ranks eighth among global assets by market cap, at $1.751 trillions; ethereum currently ranks 43rd among global assets by market cap, at $355 billions.

02:09

Silver Rises to Become the World's Third-Largest Asset, with a Total Market Value of $4.485 TrillionBlockBeats News, December 28th, according to 8Marketcap data, Silver's market cap has risen to $4.485 trillion, ranking 3rd in global asset market cap, with less than a 4% gap from Nvidia's $4.638 trillion market cap.

Furthermore, Bitcoin's market cap currently ranks 8th in global asset market cap, at $1.751 trillion; Ethereum's market cap currently ranks 43rd in global asset market cap, at $355 billion.

News