Robert Kiyosaki, author of "Rich Dad Poor Dad," breaks his silence to discuss the Federal Reserve's interest rate cuts and calls for investment in bitcoin.

Robert Kiyosaki returns and he is doing what he does best: linking the Federal Reserve’s decisions to personal wealth planning and using this as bait. Bitcoin enters the center of the debate.

After five days of silence, Kiyosaki, author of "Rich Dad Poor Dad," responded to the Federal Reserve's latest rate cut, calling it an early signal of a new round of quantitative easing and marking the return of what he calls the "fake money printing machine." Kiyosaki believes that next will come a phase where liquidity expansion outpaces actual economic output.

The key point is that the direct consequence of the Federal Reserve's easing policy is inflationary pressure, which first hits daily expenses and only later affects asset prices. Fiat currency depreciates, and only hard assets can absorb the shock—as Kiyosaki revealed, this is why he immediately increased his holdings of physical silver after the Fed took action.

Lesson 9: How to Get Richer When the World Economy Collapses.

December 17, 2025

The Federal Reserve has just announced their future plans to the world.

The Fed lowers interest rates... this signals the implementation of quantitative easing (QE), or in other words, starts up the money printing machine... Larry Lepard calls it the "Big Print"...

This is not because he needs more exposure to metals, but because he believes monetary policy is constantly transferring purchasing power out of the hands of savers.

Silver prices have already soared, so what about Bitcoin?

Yes, silver occupies a central position in his recent outlook. Kiyosaki points out that in 2024, silver prices are close to $20 per ounce, and he believes that if monetary expansion accelerates, by 2026 silver prices could reach $200 per ounce. But Bitcoin and Ethereum are both folded into the same basket; Kiyosaki treats these cryptocurrencies as monetary alternatives, not technological solutions.

Kiyosaki’s focus is not on short-term price fluctuations, but on the survival of assets in what he considers a fundamentally unstable system. He is betting that aggressive easing policies will rebuild asset bubbles faster than income growth, so he plans to position his investments in areas where devaluation spreads, rather than in areas where devaluation destroys value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dark Defender: Expect the Unexpected for XRP

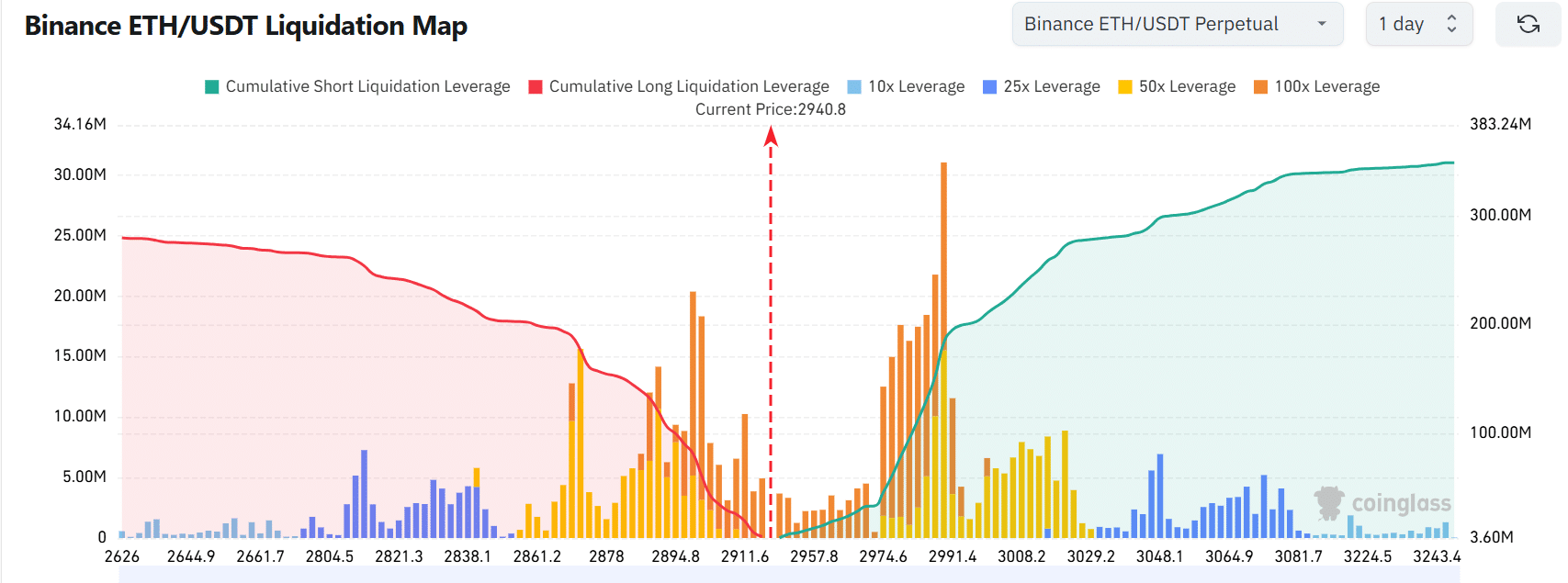

Ethereum – Can Bitmine’s $140.6M ETH buy offset a liquidity trap?

Bitcoin’s $3,000 Up-and-Down Swing Liquidates 123,200 Traders in Volatile Pump and Dump