Analyst Sees US Dollar Flashing Bullish Signal, Warns of Record-Level Concentration in Stock Market

The founder of The Kobeissi Letter, Adam Kobeissi, says he’s seeing a sign that the US dollar may suddenly strengthen.

The macro analyst tells the 1 million followers of The Kobeissi Letter on X that the Bloomberg U.S. Economic Surprise Index is flashing bullish for the greenback.

“Is the US dollar set for a rebound? The Bloomberg US Economic Surprise Index turned positive this week for the first time since February. The index measures whether economic data comes in above or below consensus estimates. This comes as Q2 2025 GDP growth, initial jobless claims and personal spending data all surprised to the upside.

Historically, when the Economic Surprise Index rises and stays positive, the US Dollar tends to strengthen. Meanwhile, speculative USD short positions by asset managers and leveraged funds have hit their highest level since early 2021. Is a US Dollar short squeeze imminent?”

Source: The Kobeissi Letter/X

Source: The Kobeissi Letter/X

The analyst also warns of a heavy concentration in the stock market that is reminiscent of the conditions before the dot-com crash.

“Shocking stat of the day: the top 10% largest US stocks now reflect a record 78% of market cap for the US stock market. This exceeds the previous record set in the 1930s by three percentage points. This is also above the peak of the 2000 dot-com bubble, when the percentage was 74%.

By comparison, in the 1980s, the weight of the top 10% was below 50%. Meanwhile, the top 10 stocks as a percentage of the S&P 500’s market cap is at a record 41%. The market has never been so concentrated.”

Source: The Kobeissi Letter/X

Source: The Kobeissi Letter/X

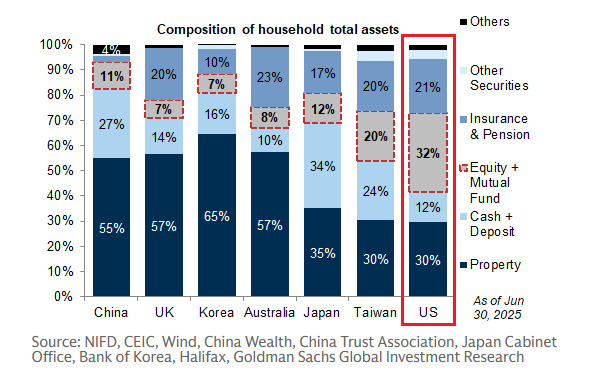

Lastly, Kobeissi points out that a large portion of American households’ wealth is in stocks.

“US households have massive exposure to equities: equities now account for 32% of total US household assets, the largest percentage among all categories. This is followed by real estate, at 30%, and insurance & pensions, at 21%.

By comparison, in China, real estate accounts for the majority of total assets at 55%, while equities make up only 11%. In the UK, Korea, and Australia, households hold 57%, 65%, and 57% in property, while equities represent only 7%, 7%, and 8%, respectively. In Taiwan and Japan, households hold 35% and 30% of their wealth in real estate, and 12% and 20% in equities. US households’ wealth is heavily tied to the stock market.”

Source: The Kobeissi Letter/X

Source: The Kobeissi Letter/X

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | After the Ethereum Fusaka upgrade, the blob base fee surged by 15 million times

Multiple blockchain industry updates: a Bitcoin OG wallet transferred 2,000 BTC; Cloudflare outage was not caused by a cyberattack; the DAT bubble has burst; Ethereum Fusaka upgrade fees have surged; LUNC has risen over 80% intraday. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Drones, Fake Birdsong, and Broken Glass Traps: Malaysia is Undergoing an Unprecedented "Bitcoin Crackdown"

The Malaysian government is intensifying its crackdown on illegal bitcoin mining, utilizing technologies such as drones and sensors to uncover numerous operations, with electricity theft causing significant losses. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still in the process of iterative improvement.

Bitwise CIO: Stop Worrying, MicroStrategy Won't Sell Bitcoin

There are indeed many concerns in the crypto industry, but MicroStrategy selling bitcoin is definitely not one of them.

A 6200-fold profit: Who is the biggest winner of Moore Threads?

On December 5, Moore Threads officially debuted on the STAR Market, opening at 650 yuan, a surge of 468.78% compared to its issue price of 114.28 yuan.