News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Bitcoin Bull Cycle Still Strong as Long-Term Holders Sell

Decline in long-term Bitcoin holdings hints that the current bull cycle is far from its peak.Long-Term Holders Are Taking ProfitsWhy This Points to a Bull Market in ProgressWhat Investors Should Watch

Coinomedia·2025/10/03 04:33

Bitcoin above $120k: Here’s 3 data points bulls must watch next

CryptoSlate·2025/10/03 04:28

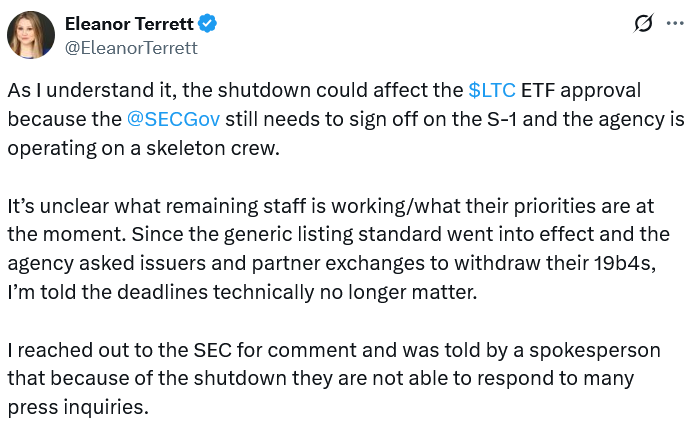

SEC silent on Canary Litecoin ETF amid gov shutdown

CryptoNewsNet·2025/10/03 04:21

Bitcoin Breaks $119,000: Analyst Says $139,000 Could Be Next

CryptoNewsNet·2025/10/03 04:21

Ethereum Price Forecast: Expert Predicts Final Impulse Wave Targeting $18,000

CryptoNewsNet·2025/10/03 04:21

September’s Scars Fade: Is Fibonacci Pointing XRP and ETH to Uncharted Highs?

CryptoNewsNet·2025/10/03 04:21

Unity Android flaw could drain gamers’ crypto wallets: How to protect yourself

CryptoNewsNet·2025/10/03 04:21

Bitcoin hits a 6-week high above $120,000, defying a government shutdown

Coinjournal·2025/10/03 04:06

Solana Holders Are Unconvinced Of 20% Price Rise; Major Selling Begins

Solana rallied nearly 20% to $230, but profit-taking by long-term holders and slowing network growth threaten its bullish momentum.

BeInCrypto·2025/10/03 04:00

Bitget COO: Payments, Tokenized Assets, and AI Will Drive 1B Crypto Users

At Token2049 Singapore, Bitget COO Vugar Usi Zade reveals why payments, tokenized assets, and AI are key to onboarding one billion crypto users worldwide.

BeInCrypto·2025/10/03 04:00

Flash

17:07

US Stock Crypto Stocks Rally, BMNR Up 9.94%BlockBeats News, December 20th, according to market data, US stock cryptocurrency-related stocks saw a general rise, including:

Bitmine (BMNR) rose by 9.94%

Bit Digital (BTBT) rose by 9.65%

SharpLink Gaming (SBET) rose by 7.98%

American Bitcoin (ABTC) rose by 7.23%

MicroStrategy (MSTR) rose by 4.08%

16:58

Fundstrat analyst: The crypto market may experience a significant decline in the first half of next year, with bitcoin possibly falling to $60,000–$65,000According to Odaily, Sean Farrell, Head of Crypto Strategy at Tom Lee’s Fundstrat, stated in the “2026 Crypto Outlook” report: “Although I believe that bitcoin and the entire crypto market still have strong long-term bullish factors, and liquidity-driven support is likely to emerge in 2026, there may still be several risks to digest in the first and second quarters of 2026, which could provide more attractive entry points. My base case is: a relatively significant decline in the first half of 2026, with bitcoin possibly dropping to $60,000–$65,000, ethereum possibly dropping to $1,800–$2,000, and SOL possibly dropping to $50–$75. These price levels will offer good opportunities for positioning before the end of the year. If this judgment proves to be wrong, I would still prefer to maintain a defensive stance and wait for confirmation signals of a strengthening trend. The year-end target for bitcoin is around $115,000, and ethereum’s year-end target could reach $4,500. Within this framework, ETH’s relative strength will become even more prominent. I think this is reasonable, as ethereum has more favorable structural capital flow characteristics, including: no miner selling pressure, not being affected by MSTR-related factors, and relatively lower concerns about quantum risks.”

16:54

Analyst: Bitcoin may rise to $170,000 within three monthsJinse Finance reported that as 2025 draws to a close, the outlook for bitcoin and the entire crypto market remains at best cautiously optimistic. However, some analysts predict that investors may see a bullish turn in 2026. After bitcoin hit a high of $126,080 on October 6 and underwent a period of sustained sell-off, it stabilized around $84,000 on November 22, indicating that the persistent selling pressure may have ended. The Relative Strength Index (RSI), which measures asset momentum, had previously fallen below the oversold level of 30. Since 2023, this situation has occurred five times, and each time, bitcoin subsequently showed a bullish trend. According to Julien Bittel, Head of Macro Research at Global Macro Investor, if history repeats itself, this pattern suggests that bitcoin could rise to $170,000 in less than three months. Matt Hougan, Chief Investment Officer at Bitwise, stated that the development trajectory of crypto ETFs is "extremely optimistic," with some major brokerages starting to enter the market. He expects 2026 to be a record year for crypto ETF inflows.

News