EUR/USD strengthens as investors return to the ‘Sell America’ strategy

Euro Strengthens Amid Renewed US Tariff Concerns

Recent volatility sparked by Washington has once again provided a boost to the euro, as President Trump’s announcement of potential tariffs targeting eight European countries has led to a retreat in the US dollar. This market reaction closely mirrors the trends observed after Liberation Day. The EUR/USD pair has rebounded from its 200-day moving average, prompting traders to reconsider whether this surge will be short-lived if Trump ultimately decides not to follow through with the tariffs. For now, European currencies appear to have continued support. Could we be witnessing a fresh, albeit smaller, wave of the ‘Sell America’ strategy in response to these latest tariff threats?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

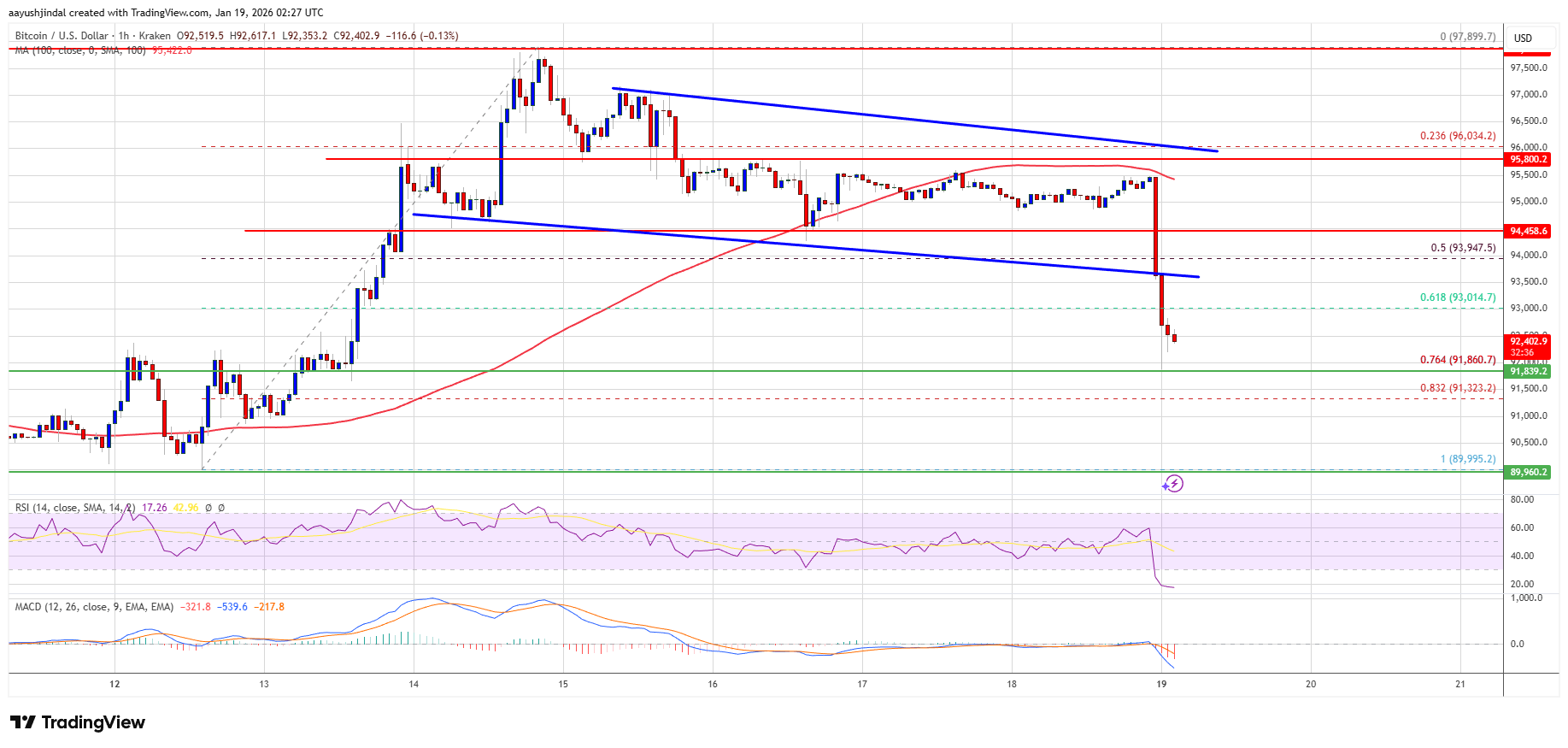

Bitcoin Price Sharp Pullback Raises One Question: Will $92K Hold?

China economy stumbles in Q4 with 4.5% growth as aluminum and coal outputs hit record

China reports its economy expanded at a 5% annual pace in 2025, buoyed by strong exports despite Trump's tariffs

China’s Housing Prices Decline in December Amid Increasing Demands for Further Measures