Gold and Silver Reach New Peaks Amid Greenland Tariff Concerns

Gold and Silver Reach New Highs Amid US Tariff Announcement

Gold and silver prices soared to unprecedented levels following President Donald Trump's declaration of new tariffs targeting eight European countries that opposed his Greenland proposal.

The US president revealed a 10% tariff on imports from nations such as France, Germany, and the United Kingdom, set to begin on February 1 and escalate to 25% by June. This decision has heightened concerns about potential European retaliation, raising the specter of a significant trade conflict and boosting demand for safe-haven assets like precious metals.

Top Stories from Bloomberg

Europe Considers Response to US Tariffs

European officials are preparing for an urgent summit to discuss possible reactions to the US tariffs. Sources indicate that member countries are weighing several strategies, including the possibility of imposing counter-tariffs on $108 billion (€93 billion) worth of American products.

French President Emmanuel Macron is reportedly considering invoking the European Union’s anti-coercion mechanism, the bloc’s strongest tool for responding to economic pressure.

Precious Metals Surge as Investors Seek Safety

This year has seen a dramatic rally in precious metals, building on strong gains from 2025. The surge follows the US government’s actions in Venezuela and renewed threats regarding Greenland. Additionally, the Trump administration’s repeated criticism of the Federal Reserve has fueled investor anxiety about the central bank’s autonomy, prompting many to move away from currencies and government bonds due to rising debt concerns.

As of 7:35 a.m. in Singapore, spot gold advanced 1.7% to $4,676.22 per ounce, after reaching a high of $4,690.59. Silver jumped 3.9% to $93.6305, peaking at $94.1213. Platinum and palladium also experienced gains, while the Bloomberg Dollar Spot Index slipped by 0.1%.

Bloomberg Businessweek Highlights

© 2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

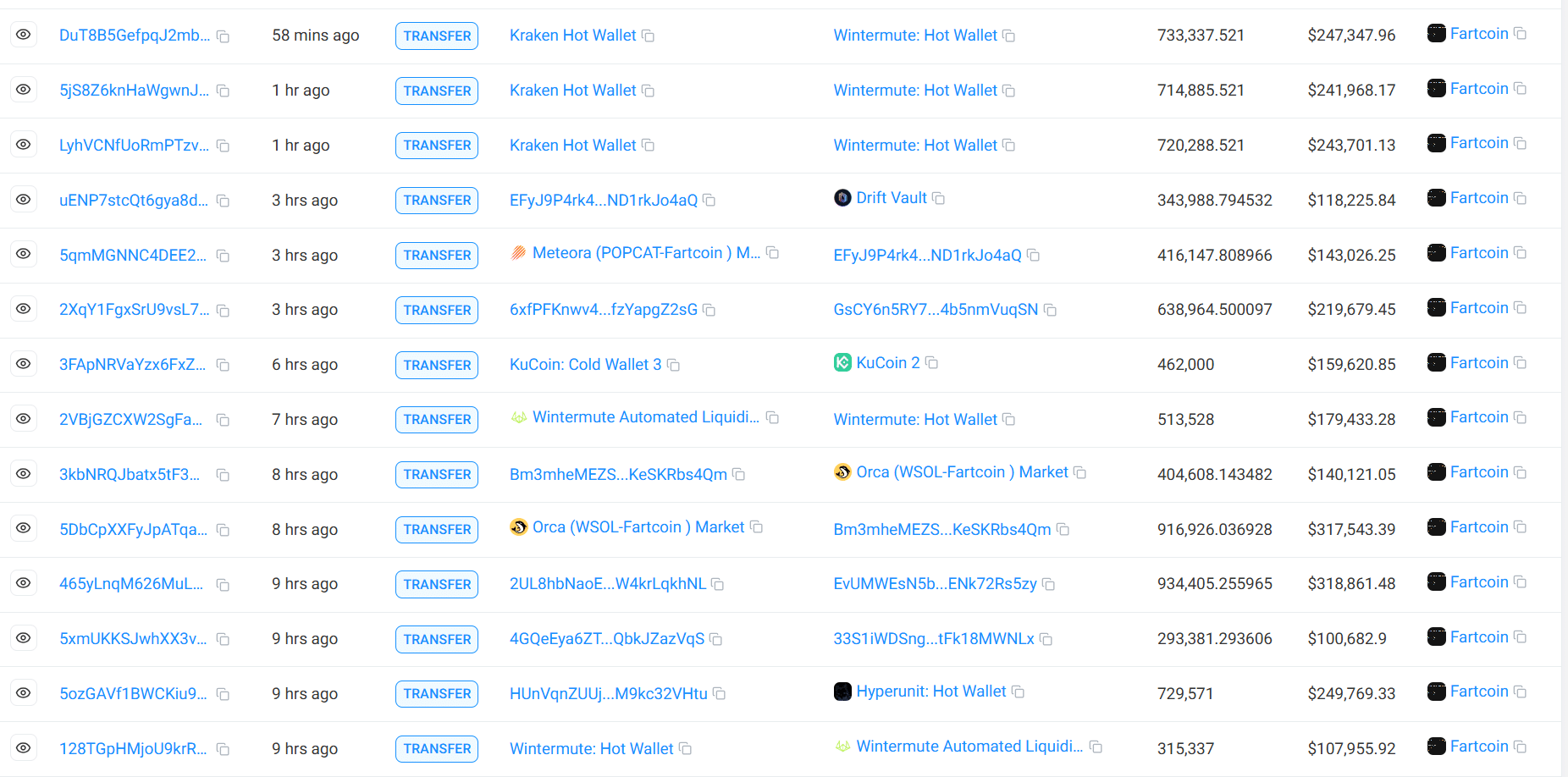

FARTCOIN falls 10%, cracks below $0.36 – Was this a liquidity trap?

USD/JPY, EUR/USD, USD/CHF: FX Futures Positions | COT Analysis

Australian Dollar remains steady as China’s economy grows in the fourth quarter of 2025

How Ethereum quietly crushed its $50 gas problem in 2026