Tom Lee Backs MrBeast with $200 Million as BitMine Stock Eyes His Digitally-Conscious Fans

Bitmine Immersion Technologies (BMNR) is making a massive bet on the future of the creator economy by partnering with the world’s most successful YouTuber. On Thursday, the Ethereum-focused treasury company announced it is committing $200 million to acquire a stake in Beast Industries, the private empire belonging to Jimmy “MrBeast” Donaldson. The deal marks a major crossover between the world of high-finance digital assets and the younger generation of digital consumers.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Why Tom Lee is Betting on MrBeast

Tom Lee, the Chairman of BitMine and founder of Fundstrat, believes that for Ethereum (ETH-USD) and decentralized finance (DeFi) to truly go mainstream, they need a front door that younger audiences trust.

During the press release, Lee explained the rationale by stating, “Beast Industries is the largest and most innovative creator-based platform in the world and our corporate and personal values are strongly aligned.” MrBeast currently boasts over 460 million subscribers and generates roughly 5 billion views every month. Through this strategic $200 million commitment, Bitmine is positioning itself to be the back-end provider for “MrBeast Financial,” a brand that recently filed for trademarks involving crypto exchanges and consumer lending.

The Financial Health of BitMine Stock

Even though the MrBeast deal is a major headline, the core of BitMine Immersion Technologies (BMNR) remains its massive digital asset stash. As of early 2026, the company owns 4.168 million Ether tokens, which represents roughly 3.45% of the entire global supply.

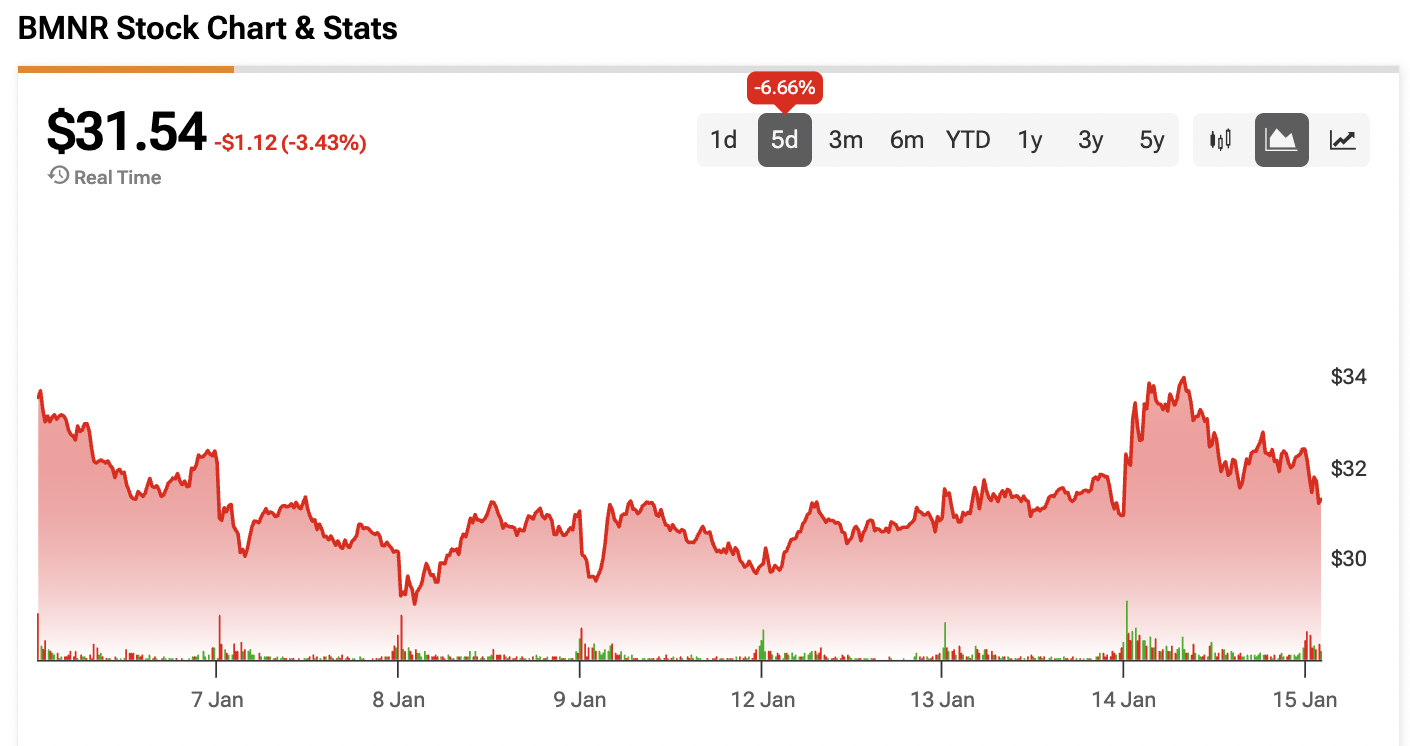

Despite this massive treasury, the stock has faced pressure due to a mini crypto winter that saw Ether lose a significant portion of its value since late 2025. This volatility is likely why BitMine stock actually dropped 3.4% today, as the market balances the excitement of the MrBeast deal against the ongoing struggles of the crypto market.

Deal Is Expected to Close on January 19

The $200 million investment is expected to officially close on January 19, 2026. Between now and then, all eyes will be on Bitmine’s annual stockholder meeting in Las Vegas, where Lee is expected to pitch a massive stock split proposal. If approved, this split would increase authorized shares from 500 million to 50 billion, potentially making the stock more accessible to the very “Gen Z” and “Gen Alpha” fans that MrBeast attracts.

Copyright © 2026, TipRanks. All rights reserved.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum : Buterin reveals major upcoming reforms

Samsung set to hand out record bonuses as AI boom translates into profits

Bitcoin Gains Traction As ETF Demand Surges

Bank of England raises concerns as hedge fund positions in gilts reach £100 billion