The NFT market signaled a significant contraction in early 2026, with recent data showing a dramatic drop in participation on both the buying and selling sides. Consequently, the overall decline in transaction volume indicates a challenging phase for the sector. However, the resilience of some well-established collections and specific blockchain networks has become more apparent, highlighting disparities within the market.

Witness the Unfolding Drama in the NFT Market

NFT Participation Collapse, Bitcoin and Ethereum Dynamics

In the past week, the number of NFT buyers plummeted by over 82%, falling to approximately 61,000, while sellers saw a reduction of more than 77%, decreasing to 56,000. The total number of NFT transactions also dropped by over 23%, reaching down to the 690,000 mark. These figures vividly illustrate the marketplace’s weakening not only in terms of prices but also in participation.

This significant downturn aligns with the broader crypto market‘s trends. Bitcoin, despite maintaining the $90,000 level following last week’s recovery, contrasted with Ethereum, which weakened below the $3,100 threshold. The global cryptocurrency market value sits at $3.09 trillion, showing a slight weekly increase, and while a horizontal trend prevails in the bigger picture, the NFT domain experiences a deeper contraction.

Competition for Leadership Among Collections and Networks

A notable scenario emerged in NFT sales concerning collections. On Ethereum, CryptoPunks soared to the lead, boosting weekly sales by more than 33%. Although the number of transactions remained limited, high-value sales demonstrated the collection’s preserved prestige. YES BOND on the BNB network secured second place, while the Panini America collection on the Panini blockchain ascended to third with an increase exceeding 170%.

When examined by network, Ethereum maintained its leadership in sales volume, but a significant 86% drop in buyer numbers was notable. Bitcoin NFT sales witnessed a sharp decline, falling by over 65%. Conversely, networks like Solana and Immutable recorded a weekly sales increase, capturing partial investor interest.

Moreover, OpenSea’s recent announcement of new curation and visibility criteria for specific NFT projects sparked discussions in the market. This move, aimed at enhancing quality, is anticipated to potentially suppress transaction volumes in the short term yet foster a more sustainable NFT ecosystem in the long run.

Currently, the NFT market is transitioning from a focus on quantity to quality. The swift drop in participation indicates waning speculative interest, while the endurance of established collections and certain networks proves the market has not vanished entirely. In the upcoming period, regulations, platform policies, and the overall direction of the crypto market will be crucial factors determining the fate of NFTs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

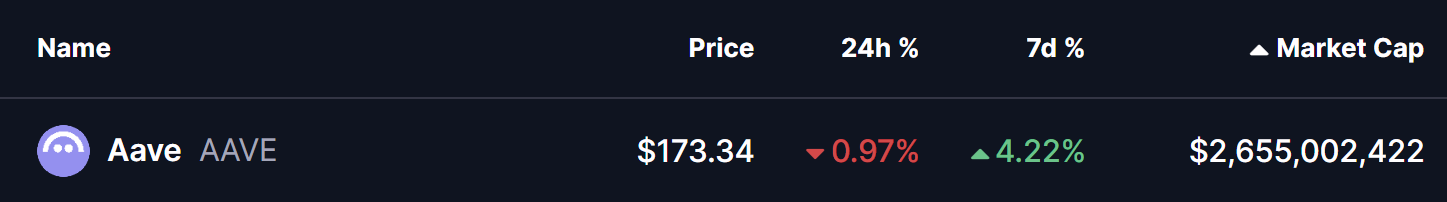

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent

Sequoia to join GIC, Coatue in Anthropic investment, FT reports