Following today’s data release, Morgan Stanley projects a cumulative 50bp interest rate cut for June and September. Previously, reductions were expected to continue in January and April, but the recovery in the employment markets has given the Fed a chance to pause. This development is adverse for cryptocurrencies. So, what’s the current state of crypto?

Brace Yourself for the Next Big Crypto Wave

Solana’s Market Position

The Supreme Court’s tariff decision has been postponed, with a possible announcement on Wednesday. The significance of the coming days is heightened due to impending inflation data. Investors might opt for caution as employment data has been unfavorable for risk markets. This indicates that substantial weekend surges in cryptocurrencies might not be seen. Currently, BTC maintains a position above $91,000.

Solana hovers around $138, exhibiting prolonged inactivity. Analyst Jelle commented, observing the parallels to BNB, suggesting that SOL might remain flat indefinitely before rallying unexpectedly. Jelle expects similar outcomes as he continues to hold his coins.

The SOL Coin has seen over $10 million net inflows recently, generating positive interest with total assets approaching 1.5% of supply. Institutional expectations of a sudden move to $200 are likely. Solana has a strong chance of ranking as the third-best cryptocurrency due to its robust ecosystem. Despite competing for this rank with XRP Coin, Solana follows Ethereum closely as a powerful layer-1 solution.

Crypto Tony shared the above chart, hinting at a promising outlook, suggesting new highs if BTC stabilizes.

Imminent Market Swing

Current news streams suggest an imminent significant market swing. Besides the news, the VDB indicator hints at increasing volatility, though direction remains uncertain. On-Chain Mind concludes that there’s a slight edge towards bullish potential. Still, those familiar with the unpredictable nature of cryptocurrencies remain justifiably cautious.

In the event of an upward trend, a daily close above $94,000 could lead to surpassing the $98,000 threshold. Achieving the investor cost area would keep participants engaged even if enthusiasm wanes, supporting a healthy continuation of the uptrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prepare Your Portfolio: The 3 Most Significant Token Unlocks of January 2026

Trump Is Prevailing in the Battle Over Offshore Wind Even After Court Defeats

With a $100M War Chest, Experts Think ZKP Could Eclipse Solana & Sui – A True 5000x Growth Opportunity!

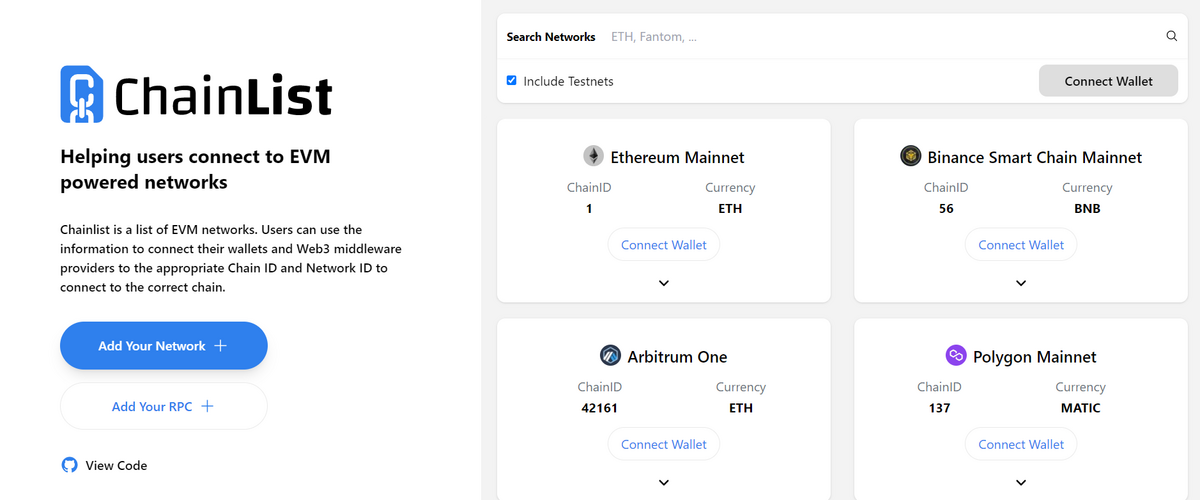

Testnets in Crypto: How To Use Test Networks to Earn Cryptocurrency