Gold Near All-Time Highs Faces Pullback Risk as Silver Could Fall to $42, Analysts Warn of Illiquidity

In a climate of tightening macro liquidity and a surge in safe-haven assets, precious metals prices have rallied, drawing caution from traders monitoring crypto markets. Gold scaled fresh highs while silver extended gains, with analysts warning that year-end liquidity conditions could magnify volatility into the new year.

Capital Economics argues the move has stretched beyond fundamentals; they estimate silver could retreat toward around $42 by year-end next year as the gold frenzy cools. The report underscores that price action may not be fully explained by underlying drivers, a dynamic that may spill over into crypto sentiment.

UBS cautions that the rapid advance is largely the result of illiquidity, implying a swift reversal is plausible. Short-term risk in precious metals trading has risen as investors book profits near record highs, with end-of-year thin liquidity set to heighten price swings and complicate directional interpretation. Wang Yanqing of CITIC Futures adds that while longer-term drivers like de-dollarization persist, the recent surge may reflect speculative excess and could test market stability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Indian crypto industry calls for favorable tax treatment in 2026 budget

Jinping wants to curb price wars between China’s tech groups

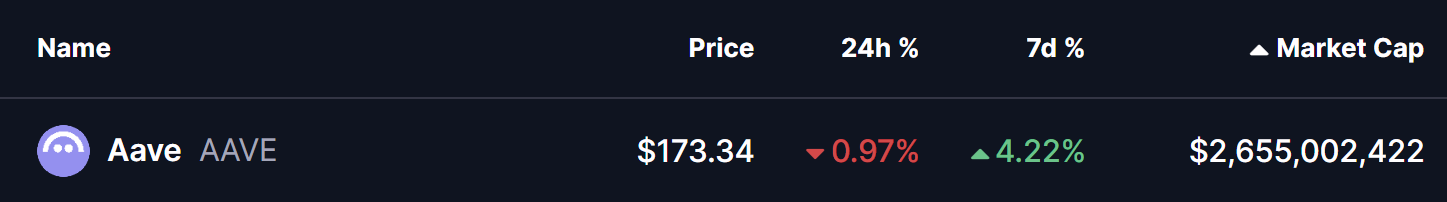

Is Aave (AAVE) Setting Up for a Potential Breakout Next Week? Key Emerging Pattern in Focus

Altcoin XRP Setting Up for the C Wave Push, Ripple’s Native Asset Prepares for Bullish Ascent