Korea drives 57 million Q2 visits but on-chain retention remains 1-2%

South Korea boasts one of the most reliable crypto audiences in the world. Readers frequent their favorite websites every day, but when it comes to actually staying on-chain, that attention drops off quickly.

- South Korea leads Asia in crypto media traffic, with its platforms attracting 57 million visits in Q2 2025—accounting for nearly 60% of all crypto-native traffic in the region.

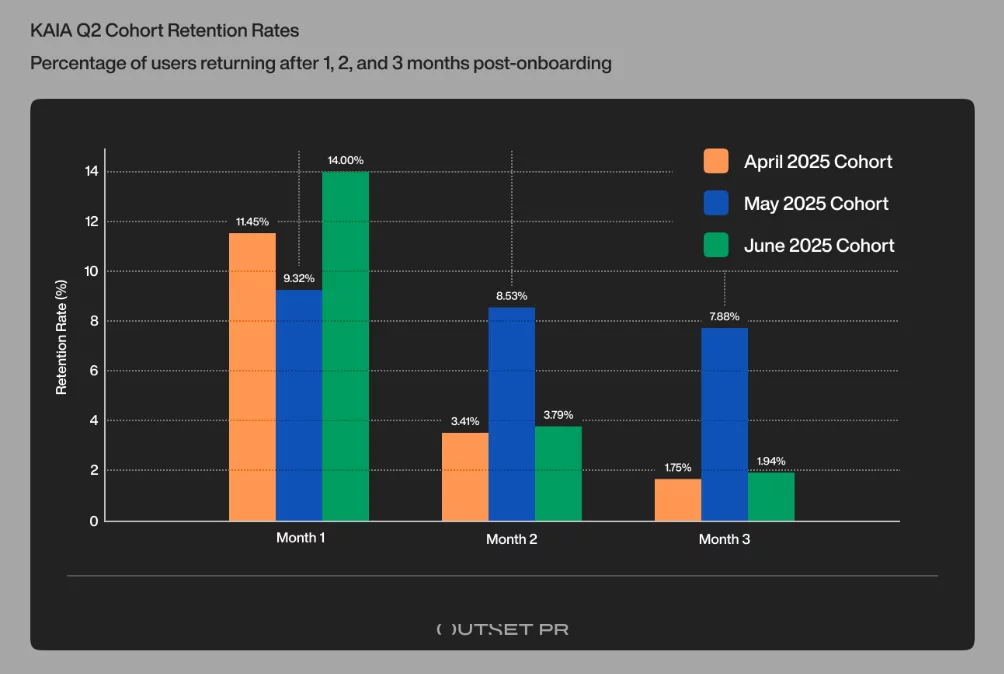

- Despite this, user retention on-chain is another story, with activity on the KAIA blockchain surging in April before plummeting by June.

- KAIA’s April cohort saw a sharp drop in user return rates from 11.45% in month one to just 1.75% by month three.

According to our latest Outset Data Pulse report, Korean crypto media drew 57 million visits during the second quarter, making it by far the most attention-rich market in Asia. South Korea alone accounted for nearly 60% of all crypto-native media traffic across Asia, far surpassing every other market in scale and consistency.

This also matches what we’re seeing across Asia more broadly. Outset Data Pulse shows crypto-native outlets becoming more visible again, largely thanks to loyal readers who return directly. At the same time, AI tools are starting to pop up as another way people stumble upon crypto content, though it’s still very early, and we don’t yet know how significant this will be.

At the same time, on-chain activity on the KAIA blockchain surged in April and then collapsed sharply, with key cohorts ending the quarter with approximately 1–2% retention. Essentially, Koreans love to read about crypto, but they don’t stay long on-chain once incentives fade.

KAIA is also uniquely representative of Korean on-chain behavior: the chain was formed by merging Klaytn and Finschia and is linked to KakaoTalk and LINE’s combined 250 million–plus user base, making it the closest proxy for Korea’s real Web3 engagement.

A market that never stops paying attention

Korea’s crypto media behavior is unusually stable. Traffic barely fluctuated throughout the quarter, with 18.6 million visits in April, almost 20 million in May, and 18.6 million in June. This makes it clear that crypto isn’t a passing trend in Korea; it’s an ingrained habit.

Much of that stability comes from loyalty. Korean readers don’t stumble onto crypto news by accident. Rather, they go directly to the same platforms every day. In practice, this shows up clearly across leading Korean crypto platforms.

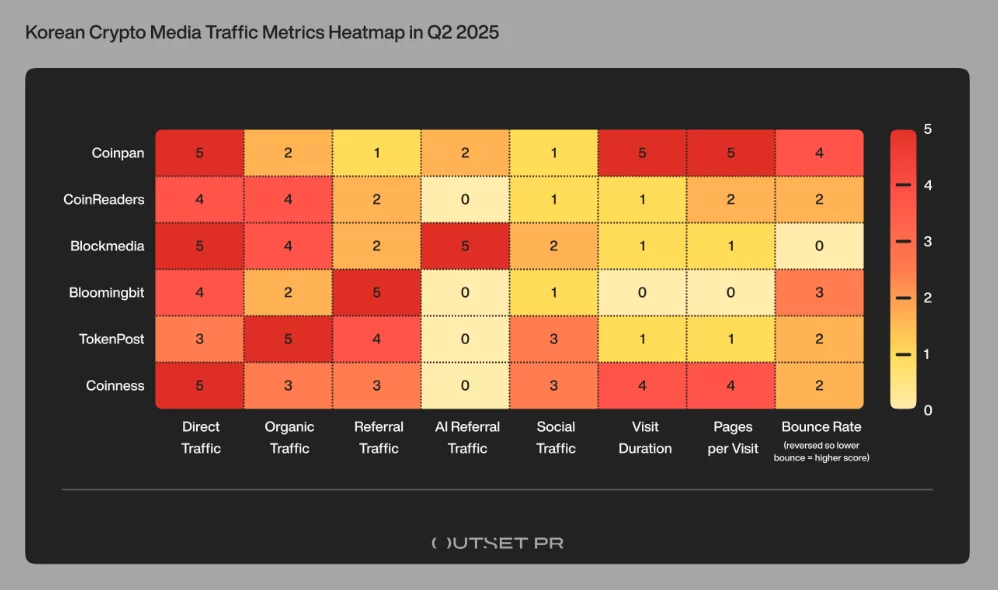

Looking at the big six — Coinpan, CoinReaders, Blockmedia, Bloomingbit, TokenPost, and Coinness — direct visits make up a striking share of overall traffic. When it comes to traffic from direct access:

- Coinpan sees around 65%

- CoinReaders about 58%

- Blockmedia roughly 60%, and

- Coinness as high as 73%.

This kind of repetition, intentional visiting points to deeply ingrained reader habits that are notably stronger than what we see in most other regions.

Image source: Outset PR

Image source: Outset PR

Forums are also important, as large community boards drive discovery and discussion in ways that differ markedly from those in Western markets. This dynamic contrasts with parts of Latin America, where discovery has become highly concentrated, as our June study found just six media brands drove nearly all of Latin America’s crypto traffic.

In Korea, referral pathways also reflect this forum-first culture: platforms such as FM Korea, DCInside, Namu Wiki, Ruliweb, Ppomppu, Clien, and AntTalk consistently rank among the top referrers for major crypto outlets, illustrating how narrative flow still depends on traditional community hubs rather than X or Telegram.

This referral dynamic was identified through our analysis of 25 Korean crypto outlets, where traffic sources, visit duration, bounce rate, device distribution, and AI-driven referrals were tracked to understand how Korean users discover and consume crypto information.

This dataset also highlighted one of the most distinctive findings in the Korean mediascape: only Blockmedia and Coinpan showed measurable AI referral traffic in Q2, with Blockmedia receiving nearly 24% of referrals from Perplexity and Coinpan receiving just under 10%.

All other major outlets recorded 0% AI-driven traffic. This confirms that AI discoverability is emerging but highly uneven, with the strongest presence among fast-paced outlets that produce short-form, high-velocity updates that AI systems index quickly.

KAIA’s April surge and cooldown

On-chain activity tells a completely different story compared to media. KAIA saw over 17 million new users join the platform in April. Weekly transactions peaked at 53 million, briefly making KAIA one of the busiest chains in Asia.

But activity was quick to drop. By the end of June, weekly transactions had plummeted to four and a half million. New user onboarding shrank each month during the quarter, while active contracts stayed largely unchanged. This implies that most activity was concentrated on a small set of mission-driven use cases rather than on general ecosystem exploration.

We saw KAIA’s own public messaging echoed this cycle: April’s posts centered on missions, giveaways, and reward-heavy campaigns; May shifted toward stablecoin integrations and exchange support (such as USDT, Bitget, Bitfinex, and SafePal); and by June the tone pivoted to long-term themes like RWAs, mini dApps, and builder events, though by that point on-chain activity had already fallen to quarterly lows.

On-chain retention explains the disconnect

When we examine Dune Analytics data on how often people returned on-chain, it’s easier to see why most of the early momentum didn’t last. The April cohort experienced retention decline from 11.45% in month one to 1.75% by month three. This implies more than 98% of users disappeared within a single quarter.

June followed a similar pattern, with short-term activity giving way to the same sharp decline. Even May’s user group, which showed slightly greater stability, still reflected engagement associated with ongoing campaign mechanics.

Outset Data Pulse frames on-chain retention as a missing link between visibility and sustainability. Without it, high traffic and record onboarding numbers don’t translate into lasting ecosystem health.

Retention is also one of the most important indicators of ecosystem quality because it measures not only who arrives but also who remains in the chain. KAIA’s cohort model tracks month 1 retention (users who return the month after onboarding), month 2 retention (users who return two months later), and month 3 retention (users who remain active after three months). This structure makes it clear whether growth is driven by real utility or short-term incentive waves – an especially critical distinction in a campaign-heavy environment like Q2.

Image source: Outset PR

Image source: Outset PR

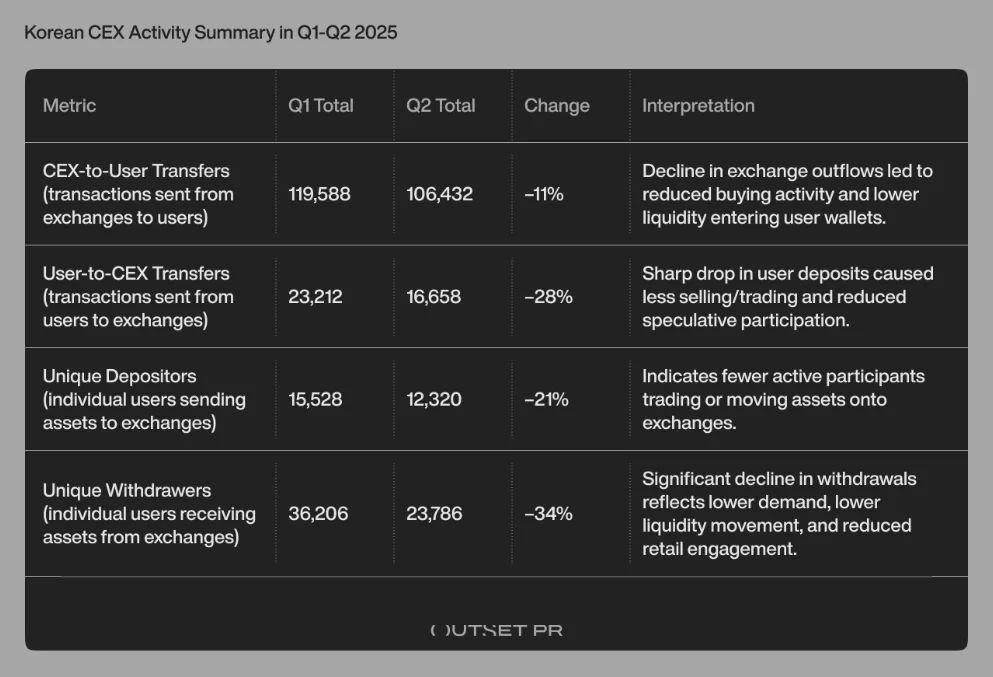

This retention collapse also aligns with exchange behavior: Korean CEX flows did not spike during KAIA’s April peak. Instead, Upbit, Bithumb, Coinone, Korbit, and GOPAX all saw activity rise four to five weeks later, peaking in early to mid-May, and suggesting that traders reacted after narratives intensified rather than driving the initial on-chain surge.

Image source: Outset PR

Image source: Outset PR

We examined how funds moved between Korean exchanges and users: who was depositing, who was withdrawing, and when activity picked up or slowed down to make sense of trader behavior during the quarter. One thing became obvious: most trading activity picked up only after the on-chain surge had already peaked

The takeaway

The data doesn’t imply a lack of interest. If anything, Korea is one of the most attentive crypto markets globally. But attention alone doesn’t equal commitment.

Korean users are willing to engage with compelling information, narratives, and campaigns. Yet at the same time, it is normal to remain highly selective about where they spend time on-chain. Unless incentives or clear utility remain in place, loyalty fades quickly.

As our Outset Data Pulse highlights, Korea’s challenge is durability. Turning one of the world’s most consistent crypto audiences into long-term on-chain users will require effort and experiences people actually want to come back to once the rewards are gone.

For KAIA and other Korean Web3 teams, that means shifting from massive onboarding waves toward deeper retention mechanics, strengthening utility around mini dApps, stablecoin payments, creator tools, and liquid staking, while smoothing the path between exchanges and on-chain activity so that users move more naturally into the ecosystem.

Platforms with high-engagement patterns, such as Coinpan and CoinReaders, may also serve as stable narrative anchors, and early AI-driven channels offer new opportunities for discovery as Korean audiences diversify how they find information.

It’s a challenge unfolding alongside regional shifts in how crypto news is consumed. Our broader Asia research shows traffic concentrating around a handful of dominant outlets, making it increasingly difficult for ecosystems to secure repeated engagement at scale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BREAKING: Trump Administration Makes a Statement on Regulation That Will Change the Cryptocurrency World

Stablecoin Market Forecast: JPMorgan’s Sobering Reality Check on the $1 Trillion Dream

Why 2025 Became the Year Crypto Stopped Chasing Hype

Bloomberg Analyst McGlone Issues “Great Depression” Warning for Bitcoin