On December 18, Deribit released the crypto options expiry data during uncertainty in the crypto market. The general market is down by almost 0.4% today, with a market cap of $2.94 trillion.

Deribit’s Crypto Options Expiry Details

Deribit revealed that approximately $3,18 billion in Bitcoin and Ethereum options are set to expire tomorrow at 08:00 (UTC).

$2,72 billion in BTC options will expire with a Put/Call ratio of 0.81 and a Max Pain Point of $88,000, close to BTC’s current price. Expectations are for a relatively contained expiry, in case BTC’s spot breaks range, according to the platform.

Also, $459,5 million in ETH options are set to expire with a Put/Call ratio of 1.08, and a Max Pain Point at $3,100, higher than the current price of ETH. Larger moves could be on the table if volatilty gets stronger.

Bitcoin and Ethereum Price Actions

Deribit released the crypto options expiry data in a volatile market, amidst mixed sentiments towards the end of the week.

BTC Price Trajectory

At the moment of writing this article, BTC is trading in the green, and the digital asset is priced above $88,000.

BTC price surged from $85,000 levels on December 18, topping $89,000 today, following a price spike above $90,000 yesterday, followed by a sudden drop due to long positions liquidations. In the past 24 hours, over $507 million in crypto were liquidated, more than $358 million in longs and over $148 million in shorts, CoinGlass data shows.

However, institutional interest in BTC is back following a break of two days, and on December 17, BTC ETFs saw over $457 million in inflows, with Fidelity’s FBTC as the leader – the crypto product saw over $391 million inflows, according to SoSoValue data.

Earlier today, the US inflation data was reported showing cooler numbers than expected. Inflation was 2.7% for November, compared to expectations of 3.1%. Considering that inflation came in lower than expected, the Fed should have cut interest rates by 50 bps, Anthony Pompliano believes. However, lower inflation brings optimism regarding a potential rate cut in January.

On the other hand, the markets are awaiting Japan’s decision on interest rate cuts on December 19. According to the latest reports, the Bank of Japan is poised to raise rates to a 30-year high despite economic weakness, and the crypto market expects volatilty based on historical data involving Bitcoin’s price following previous rate hikes in Japan. For instance, in January 2025, after the BoJ increased rates, BTC dropped about 30%.

We’ll see what happens tomorrow and how the markets react.

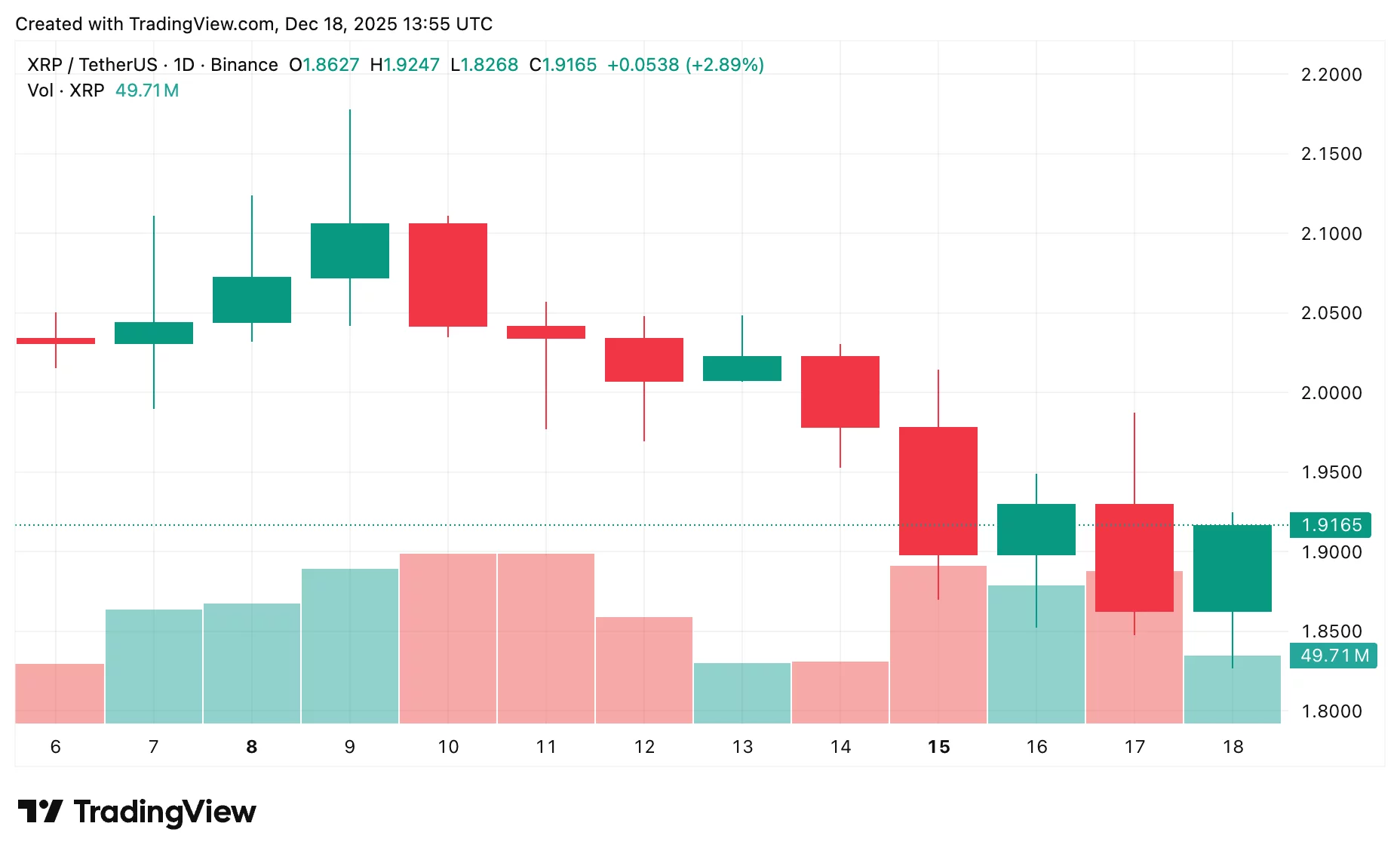

ETH Price Trajectory

At the moment of writing this article, ETH is trading at $2,960, up by over 1% in the past 24 hours.

ETH price surged from $2,794 on December 17, topping $2,993 earlier. Unlike BTC, institutional interest in ETH continues to drop. On December 17, ETH ETFs saw their fifth consecutive day of outflows at over $22 million. The biggest outflow day was on December 15, above $224 million.

However, despite the market volatilty, Bitcoin and crypto adoption continues worldwide with optimistic predictions for 2026.

BUY BTC, ETH