Shiba Inu performs the worst in 2025, with its price dropping by 72%—here is the chart analysis

- Shiba Inu dropped by about 72% in 2025, ranking among the worst-performing assets of the year.

- Both Union and TradingView technical indicators show a strong sell bias.

- Some analysts suggest reallocating funds to bitcoin or ethereum instead of holding SHIB.

As 2025 draws to a close, Shiba Inu (SHIB) has unfortunately landed on the list of the worst-performing cryptocurrencies of the year. SHIB is currently trading near $0.0000078, down about 72% over the past 12 months. For investors who entered positions in the past two years, the outlook is bleak. Despite ongoing calls to "buy the dip," most are still saddled with significant unrealized losses.

As sentiment swings between hope and disappointment, attention has shifted to technical indicators to see if... SHIB still has a viable path to recovery. Several on-chain and technical analysis firms have weighed in, but the signals provided are not optimistic.

Technical indicators issue a strong sell signal.

Data from Traders Union suggests that the market outlook is extremely pessimistic. Of the 24 analysts surveyed, 19 gave a strong sell rating, with only two recommending buying at current prices. The remaining three analysts remain neutral, effectively advising investors to hold rather than increase their positions. Overall, the various signals are clearly negative, reflecting the token's tendency to quickly erase gains during brief rallies.

TradingView indicators reinforce the bearish outlook

The latest technical indicators from TradingView also convey a similar message. Moving averages remain firmly in the strong sell zone, and overall, downside risk persists. Repeated price declines have continually eroded investor confidence, making it difficult for SHIB to attract sufficient buying interest. The persistent lack of upward momentum has made even long-term supporters more cautious, especially as bullish momentum continues to weaken.

Should funds be better allocated elsewhere?

Given SHIB's performance, some analysts believe that reallocating capital may be a more practical approach. Bitcoin is currently trading near $87,000 and has historically rebounded to the $91,000 to $93,000 range after pullbacks, offering potential short-term trading opportunities. Ethereum is also seen as a diversification option for investors looking to reduce exposure to volatility. In contrast, unless overall market conditions improve significantly, SHIB's current risk-reward profile remains unfavorable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

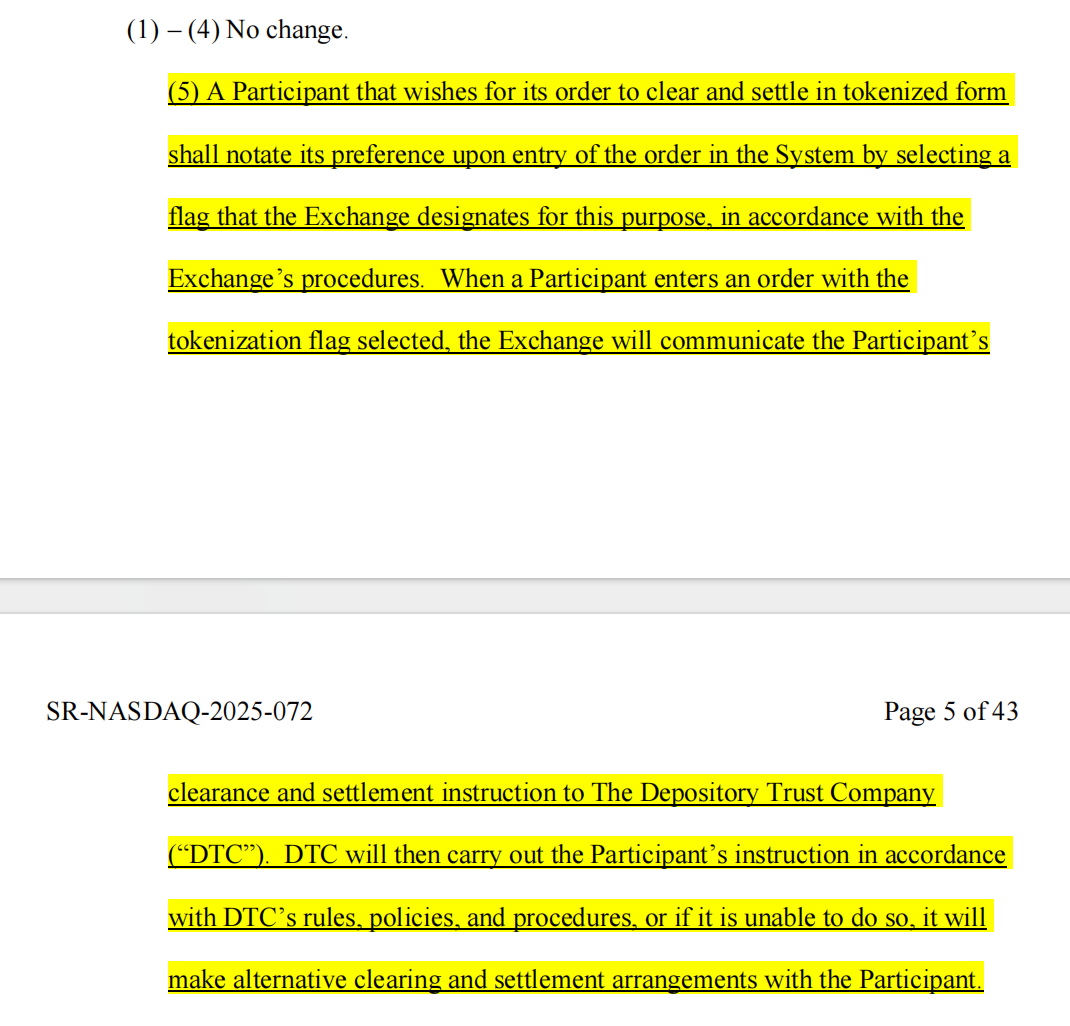

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Why did the "Insider King" fall into his own trap on October 11?

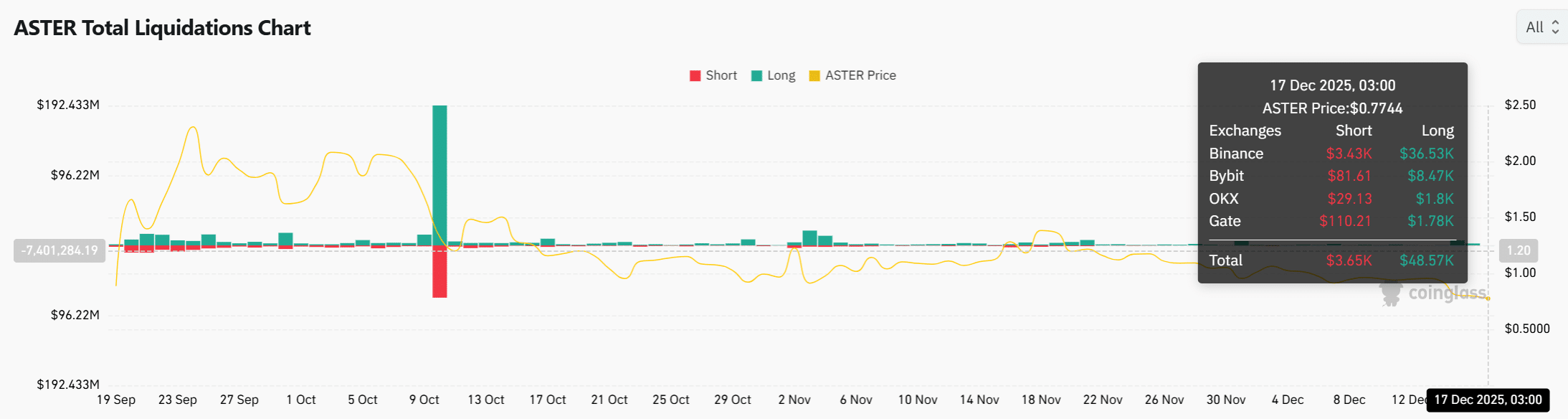

ASTER price sinks as whale losses deepen – Is $0.6 next?