DTCC begins limited onchain Treasury test on Canton Network after SEC greenlight

The Depository Trust & Clearing Corporation (DTCC) will begin a limited pilot to place representations of U.S. Treasury securities held at its depository subsidiary onto a blockchain, marking the first live test of onchain assets directly tied to DTC custody under U.S. regulatory approval.

The project, announced Wednesday in partnership with Digital Asset and the Canton Network, follows a recent Securities and Exchange Commission no-action letter allowing DTC to experiment with tokenizing certain security entitlements within a narrowly defined framework.

Under the pilot, DTC participants will be able to convert entitlements to DTC-held U.S. Treasurys into blockchain-based tokens. The underlying securities will remain on DTCC's centralized ledger, with the tokens serving as representations of ownership rather than standalone securities.

DTCC plans to run an initial trial in the first half of 2026, with the scope expanding if regulatory conditions and client demand permit. The initiative will use DTCC’s ComposerX platform alongside Digital Asset’s Canton Network, a permissioned blockchain designed to support compliance controls and restricted transfers between approved participants.

DTCC executives framed the pilot as a way to explore tokenization without displacing existing market infrastructure.

"Our goal is to enable participants to take advantage of tokenization capabilities while maintaining the legal certainty and safeguards of today’s markets," DTCC President of Clearing & Securities Services Brian Steele said in a statement.

The test also arrives as tokenized U.S. Treasurys have quietly grown into one of the largest segments of the real-world asset market. Roughly $9 billion in tokenized Treasury products are currently outstanding, with demand driven by investors seeking dollar-denominated yield that can move and settle onchain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Bearish Pressure Intensifies: 3 Critical Factors Threatening ETH’s Price

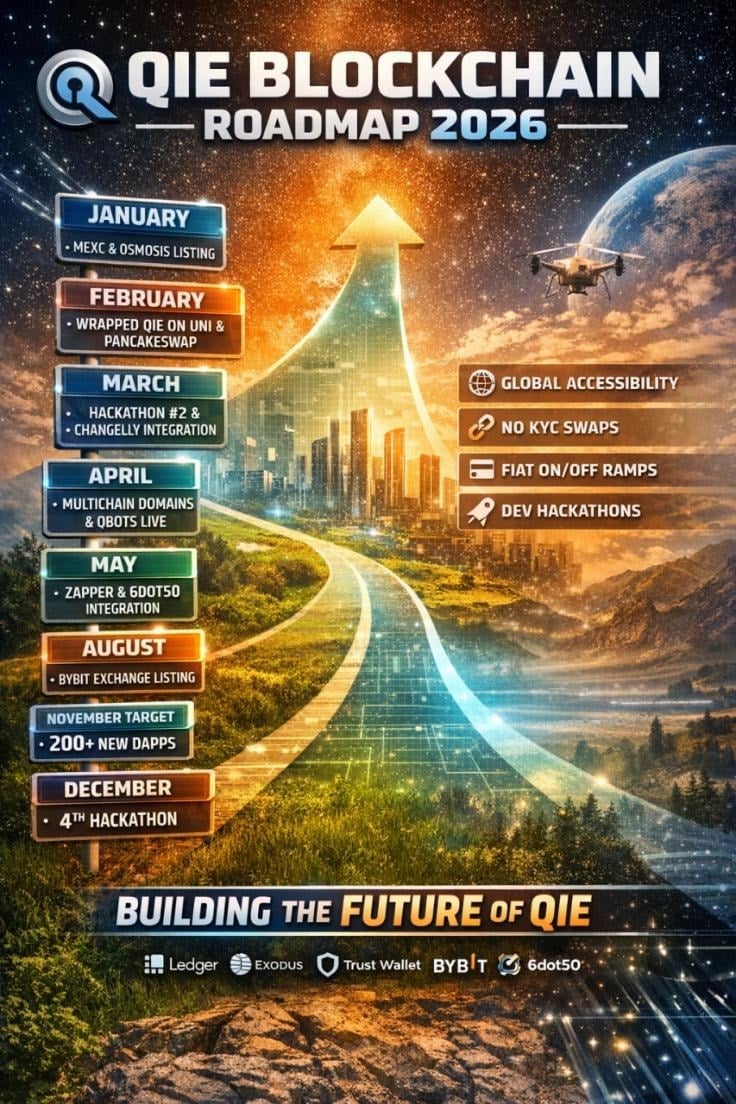

QIE 2026 Roadmap: Building the Infrastructure for Real Web3 Use

Ripple advances protocol safety with new XRP Ledger payment engine specification

Tempo Introduces Crypto-Native Transactions to Scale Stablecoin Payments On-chain