Bitcoin pumped and dumped following a “mixed” U.S Jobs report for November.

The crypto asset initially rallied by over 3%, rising to $88K from $85K. However, it retraced the gains afterwards and traded at $86.6k at press time.

The Jobs report came in stronger at 64K than the expected 51K, indicating a resilient labor market. Since the Fed uses the labor data to make rate decisions, this meant reduced odds of another interest cut in January 2026.

As a result, the chance of keeping rates unchanged at current levels (3.50-3.75%) surged by 3% to 78%. This dented the risk-on sentiment and triggered a retracement in Bitcoin [BTC].

Still, the “strong” jobs report showed that the number of quality full-time roles declined, while part-time gigs increased.

In a statement to AMBCrypto, David Hernandez, Crypto Investment Specialist at asset manager 21Shares, said,

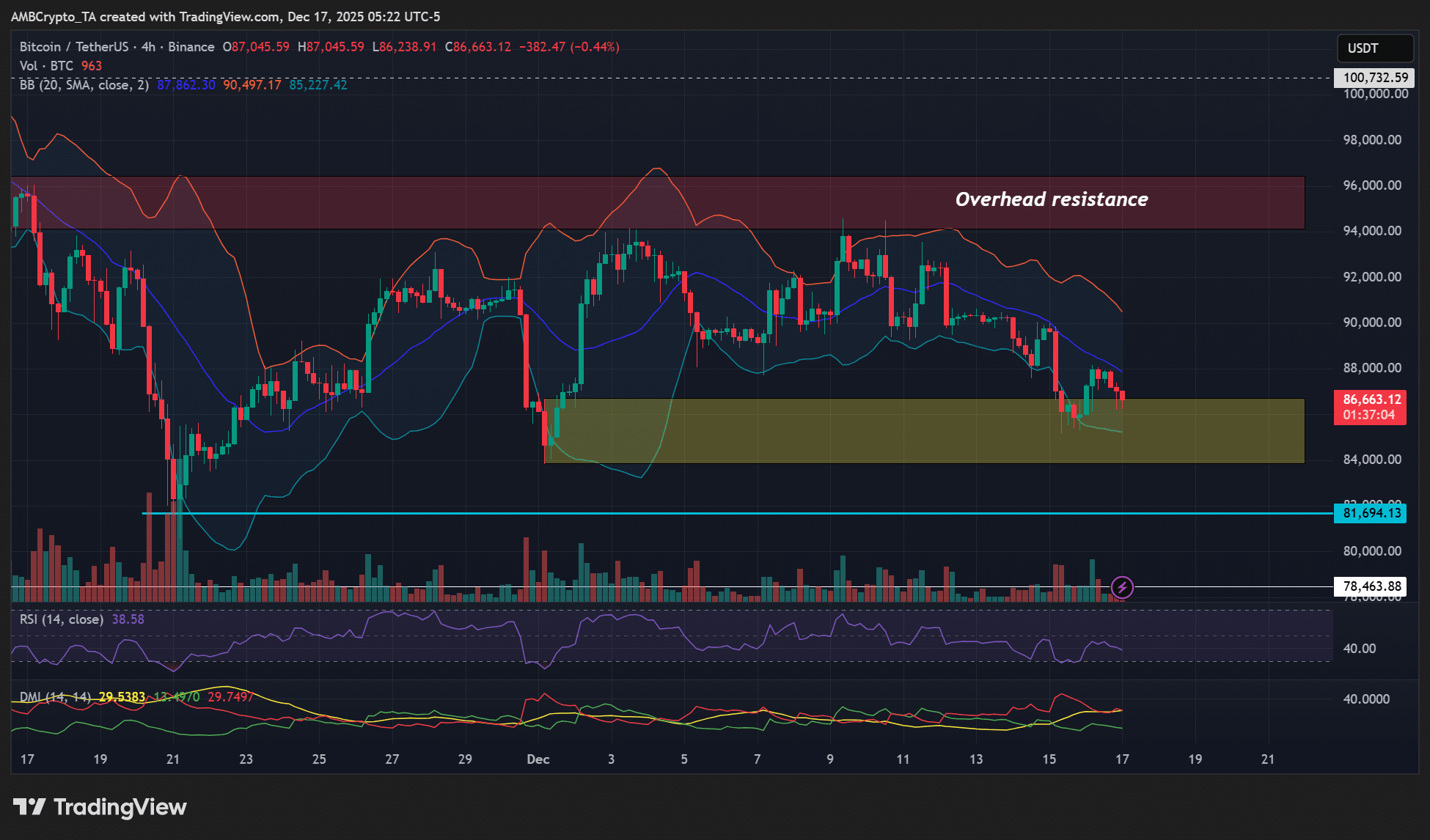

“Immediate selling pressure may emerge as traders re-evaluate the risk landscape, forcing BTC to defend key support zone”

Volatile week ahead for BTC

Meanwhile, U.S. inflation data is scheduled for release on the 18th of December, and the BoJ’s rate decision is set for the 19th of December, exposing BTC to a likely volatile week ahead.

Hotter inflation data would further push the Fed to avoid aggressive rate cuts and drag the BTC price lower. On the contrary, a cooler inflation print and repricing in labor markets could boost the odds of another rate cut and BTC momentum.

That being said, the Bank of Japan’s (BoJ) rate decision is most anticipated, especially with market consensus leaning towards a 25-basis-point hike.

Past hikes led to further BTC sell-off, hence the overall market jitters.

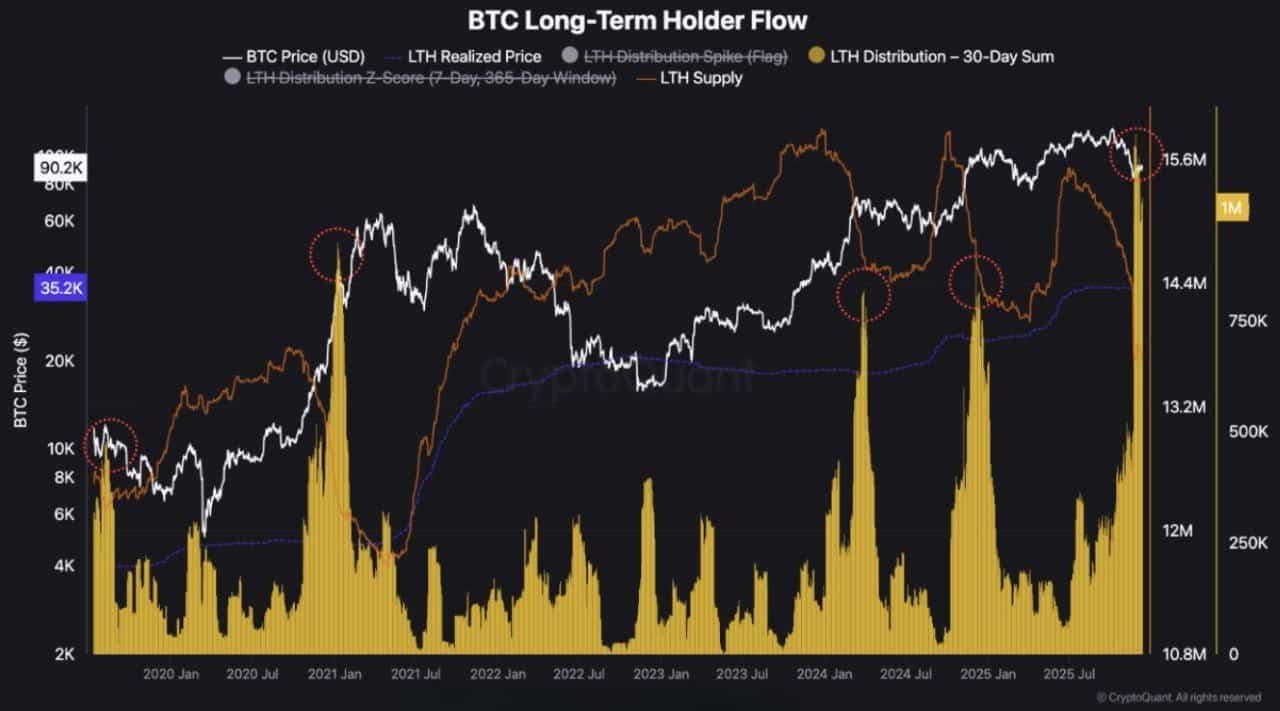

And long-term holders (LTH) were making the situation any better. This cohort that has held BTC for more than five months has been offloading nonstop since July.

In fact, the LTH dump reached a five-year high, a pattern an analyst warned always marks a market top.

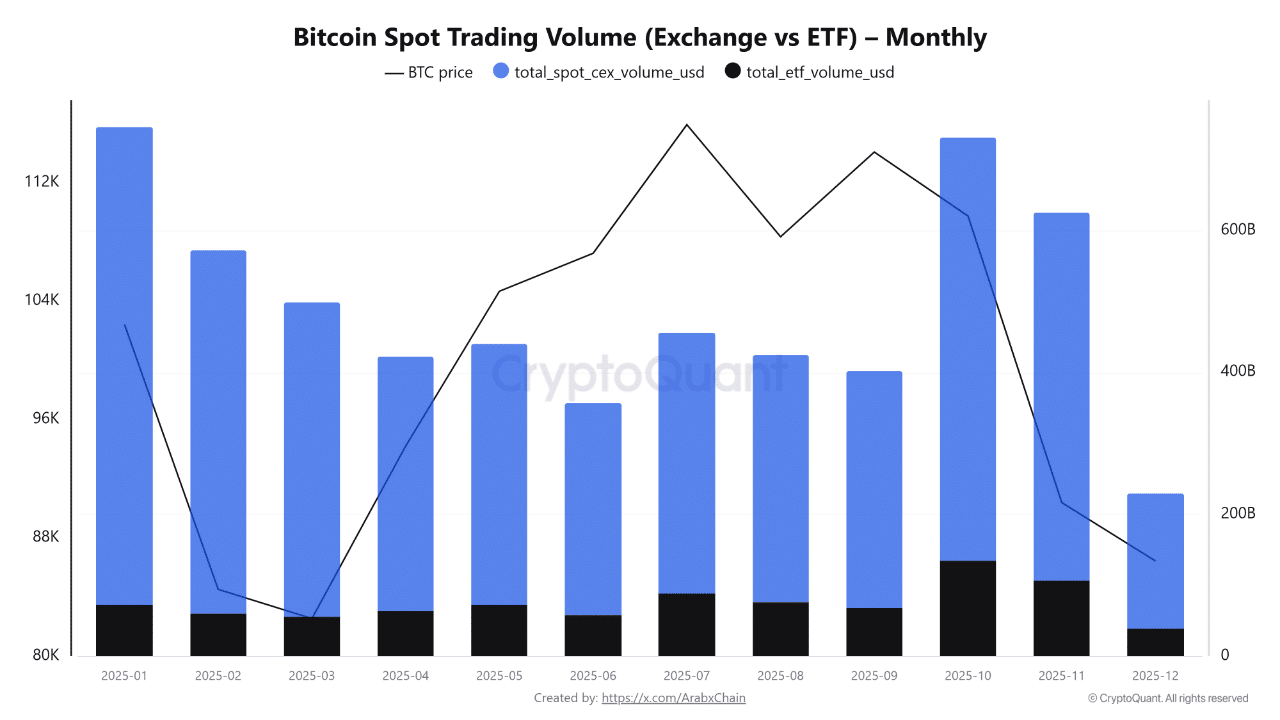

Additionally, U.S. spot BTC ETFs saw $634 million in outflows earlier this week, suggesting a risk-off or cautious approach ahead of the BoJ’s rate decision.

Key levels to watch

So what’s next for BTC’s short-term price action?

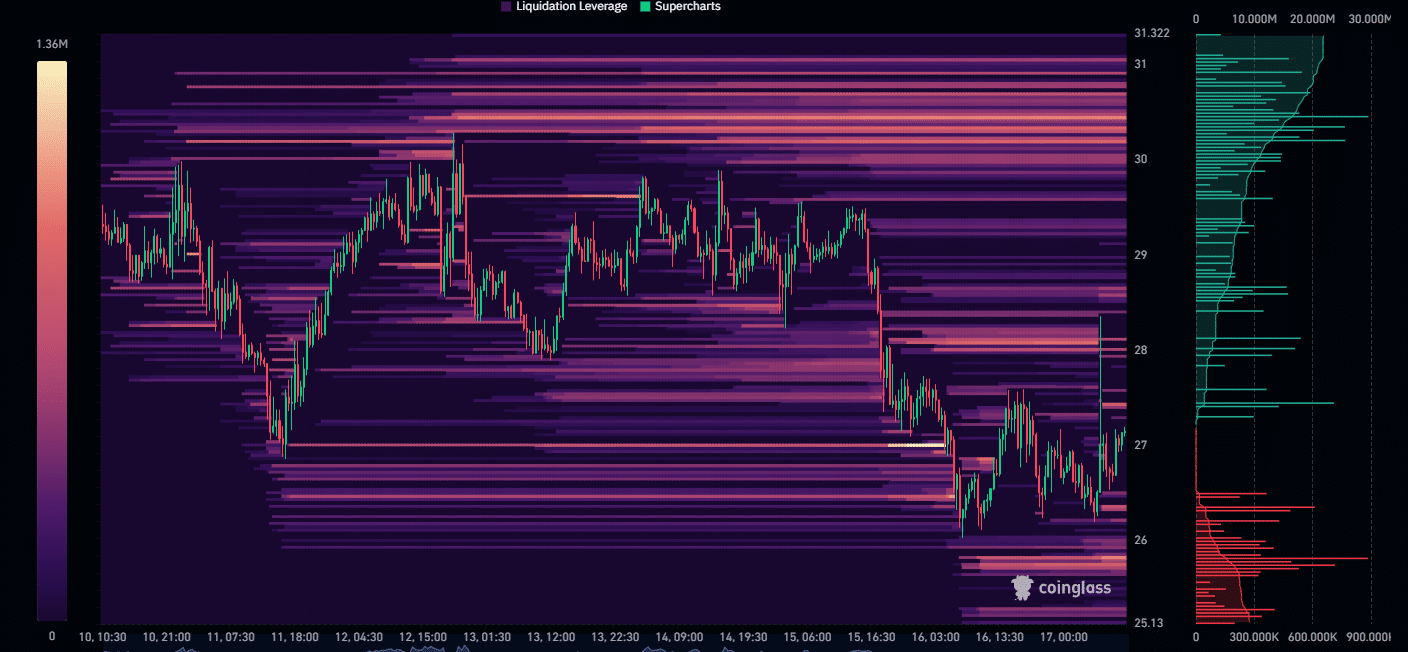

Per the 1-month liquidation heatmap, the immediate liquidity pool was at $83K and could be tagged first.

The upside short-leveraged liquidity was parked at $90K and $95K. These levels could also be hit ahead of incoming volatility. In the mid-term, however, Grayscale projected a new ATH for BTC.

Final Thoughts

- BTC wobbled following the mixed U.S. jobs report, but more price swings are expected ahead of the U.S. inflation data and the BoJ rate decision.

- There was a high chance the $83K level could be hit during a liquidity hunt.