Ethereum Holds Support As Smart Money Steps In – What This Means For Price

Ethereum is holding firm above key support as smart money steps in, hinting at growing confidence beneath the surface. With bullish signals and steady inflows aligning, the market now watches whether this stability can spark a meaningful upside move.

ETH Coils Below $3,200 Ahead Of A Decisive Move

AltCoin Việt Nam, in a recent post, highlighted that ETH is positioned at an extremely tense moment on its chart, signaling that the asset is preparing for a major directional move. This immediate pressure is being fueled by a significant bullish divergence that has just appeared on the chart, marking the first time the signal has materialized in over a month.

The analyst reinforced the expectation of high volatility by referencing historical data. Their research shows a consistent history of 9–16% price volatility whenever ETH falls below the $3,200 level. Given that the price is currently fluctuating tightly around the $3,100 mark, this historical context provides a clear signal that a sharp volatility explosion may be imminent.

Adding overwhelming conviction to the bullish case is the recent action of market movers. AltCoin Việt Nam reported that a single super large whale just opened a leveraged long position totaling a massive $392 million (equivalent to 120,094 ETH). This colossal bet on the upside demonstrates a firm, high-conviction among institutional players.

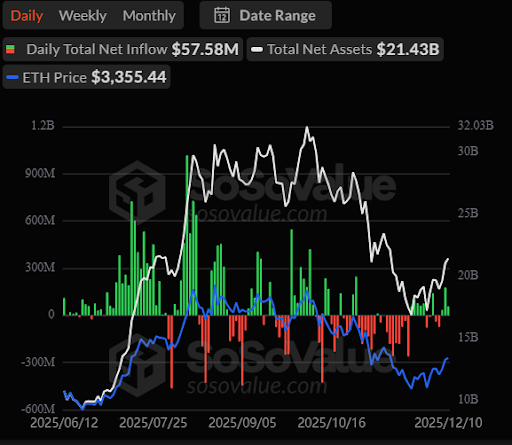

Furthermore, the institutional framework continues to provide a reliable underlying demand. The Spot Ethereum ETF market is still actively attracting substantial capital inflows, totaling over $250 million this week. BitMine Technologies also purchased an additional 33,504 ETH (valued at $112 million) today, highlighting persistent institutional accumulation.

Considering the confluence of technical divergence, historical volatility context, and massive whale and institutional purchasing, the market faces a critical juncture. AltCoin Việt Nam posed the final question: Can ETH break out strongly and immediately confirm the uptrend, or will it need to retest lower support levels before initiating the expected explosive rally?

Buyers Step In As Ethereum Defends Key Support

According to crypto analyst The Boss, ETH has shown a highly encouraging response from a key technical area. Ethereum has reacted positively with the $3,091 support zone, and is currently holding firmly above this level, which is a strong signal that short-term buying pressure remains resilient and active in the market.

As long as the price stays above the green line, the analyst confirms that the primary focus remains the upside, validating the potential for a move toward the resistance zone marked by the blue line. The Boss emphasized the importance of these structural defense moves, concluding that such strong reactions from established support levels are vital signals for confirming the validity of the current structure and providing clear direction of the prevailing trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The HYPE Token Crypto Rally: Unveiling the Driving Force Behind Its Week-Long Surge

- HYPE Token's 7-day surge in late 2025, reaching $35.08, was driven by protocol upgrades, institutional backing, and retail FOMO. - Institutional investments like Paradigm’s $581M stake and retail-driven momentum mirrored the 2021 Dogecoin rally. - However, looming token unlocks and bearish indicators, including a $11B unlock of 237M tokens, raised sustainability concerns. - Technical analysis showed mixed signals, with consolidation near support levels and short-term volatility risks, while broader trend

How CFTC-Recognized Platforms Such as CleanTrade Are Transforming the Landscape of Clean Energy Investments

- CFTC-approved CleanTrade introduces a regulated SEF for clean energy derivatives, addressing market fragmentation and liquidity gaps. - The platform enables institutional-scale trading of vPPAs/RECs, achieving $16B notional volume in two months by aggregating demand/supply. - Integrated risk analytics (e.g., CleanSight) enhance transparency, allowing investors to hedge project-specific risks like grid congestion and curtailment. - Dual investment pathways attract hedge funds/pension funds through direct

The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

The Increasing Overlap Between Health and Financial Wellbeing in Managing Personal Finances

- Global wellness economy to hit $9 trillion by 2028, driven by holistic well-being trends. - Millennials/Gen Z prioritize wellness as lifestyle, with 55% spending over $100/month on health. - Employers integrate financial wellness into health programs to reduce burnout and boost productivity. - Investors target wellness-driven SaaS, healthcare tech , and financial literacy platforms for holistic solutions.