These Three Metrics Show Bitcoin Found Strong Support Near $80,000

Bitcoin BTC$90,174.13 has so far bounced above $90,000, 15% higher from its Nov. 21 low of around $80,000, with price finding confluence support across three important cost basis metrics: the 2024 yearly volume weighted cost basis, the True Market Mean, and the average U.S. spot exchange-traded fund (ETF) cost basis.

These metrics help to identify where investors are most likely to defend positions during drawdowns. The area of support proved vital, as it aligned closely with the average acquisition prices of multiple investor cohorts.

First, the True Market Mean, represents the average onchain purchase price of bitcoin held by active market participants. It focuses on coins that have moved recently, filtering out long dormant supply, and therefore reflects the cost basis of investors who are most likely to trade.

During this pullback, the True Market Mean sat near $81,000 and acted as clear support. Notably, bitcoin first moved above this level in October 2023 and had not traded below it since, reinforcing its importance as a structural bull market threshold.

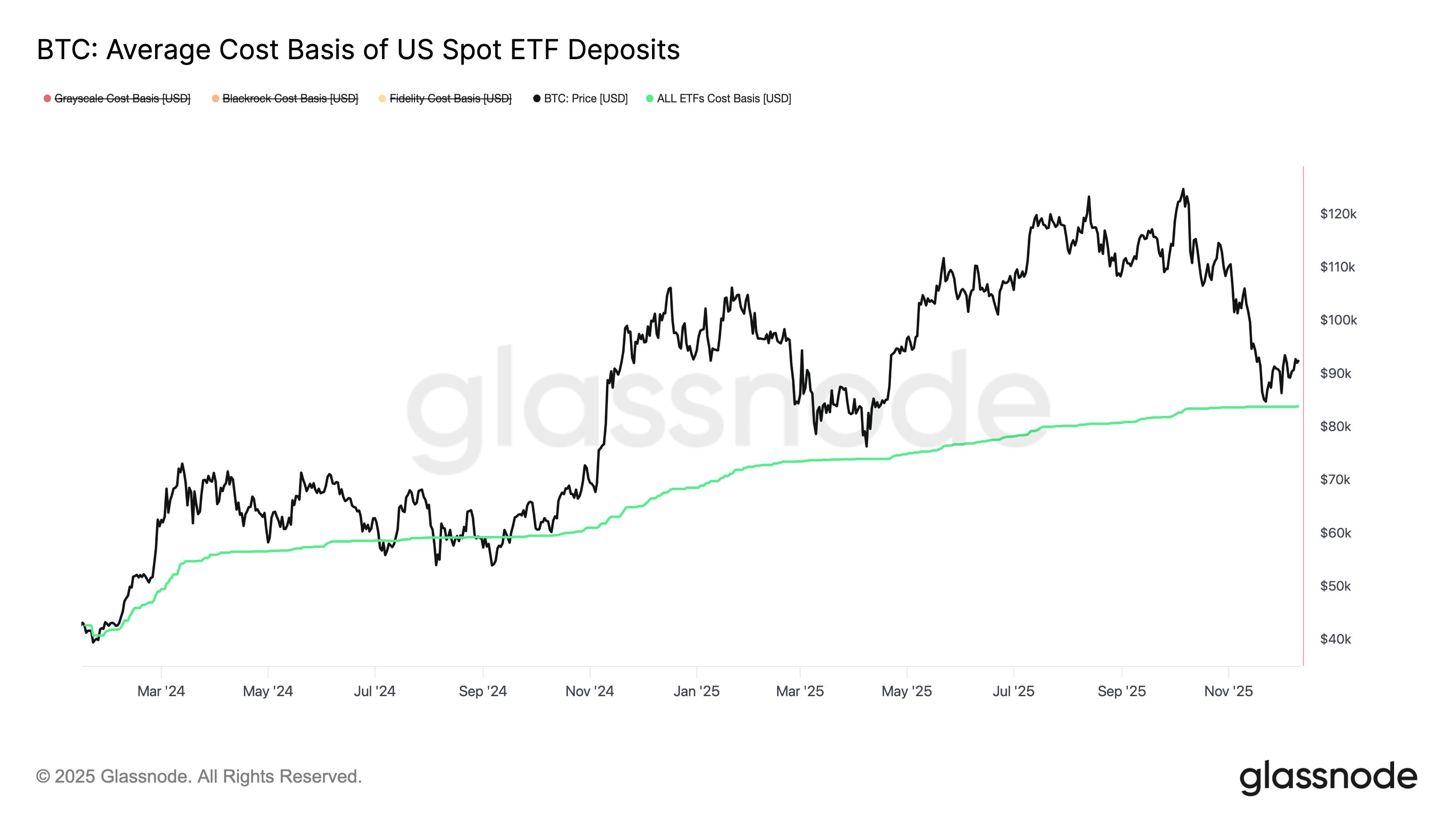

Second, the U.S. spot ETF cost basis reflects the weighted average price at which bitcoin has flowed into U.S. listed spot ETFs. This is calculated by Glassnode using the combined daily ETF inflows with the market price.

The average cost basis currently sits around $83,844, according to Glassnode, and bitcoin once again bounced off this level, which it similarly did during the April tariff-driven selloff.

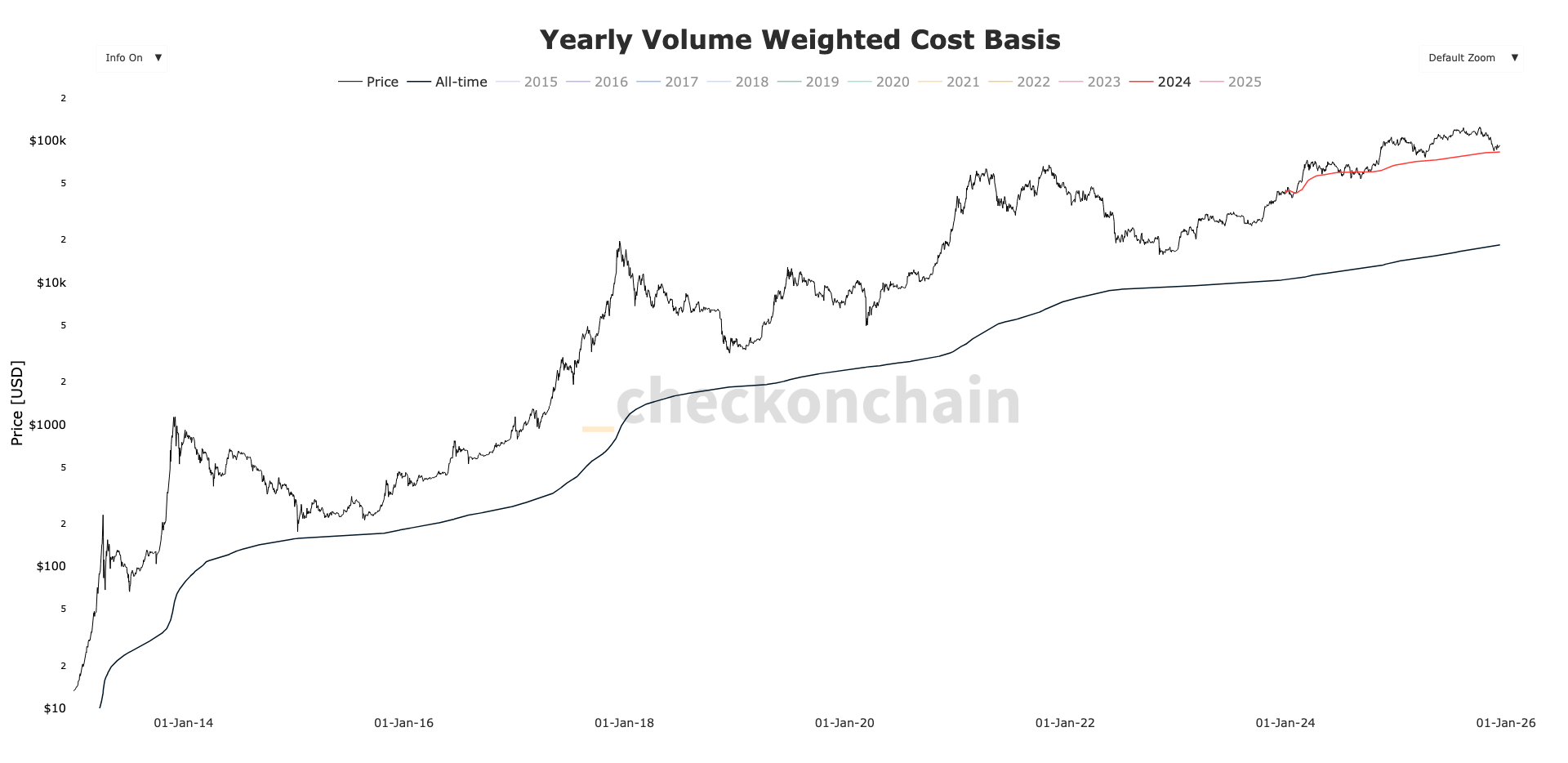

The third metric, the 2024 yearly cost basis, tracks the average price at which coins acquired in 2024 were withdrawn from exchanges. CoinDesk Research has shown a pattern that yearly cohort cost bases tend to act support during bull markets.

In this case, the 2024 cost basis near $83,000, according to checkonchain, provided additional confirmation of demand, again was also seen as support during the April correction.

These metrics highlight the depth of demand of support in the $80,000 region.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

India’s Spinny set to secure $160 million in funding for GoMechanic acquisition, sources report

PENGU Price Forecast: Managing Immediate Market Fluctuations and Exploring Future AI Opportunities

- PENGU token's price fell to $0.01114 in Nov 2025, far below its 2024 peak of $0.068, amid regulatory and macroeconomic risks. - Short-term volatility is amplified by SEC ETF delays, $7.68M short positions, and susceptibility to broader crypto market downturns. - Long-term potential emerges through AI-driven features like dynamic staking and cross-chain interoperability, plus Schleich's physical collectible partnerships. - Pudgy Penguins' hybrid digital-physical model, including Walmart retail presence, d

The Rise of Dynamic Clean Energy Markets

- CleanTrade, CFTC-approved as a Swap Execution Facility (SEF), transformed clean energy markets into institutional-grade assets by standardizing VPPAs, PPAs, and RECs. - The platform addressed fragmented pricing and opaque risks, enabling $16B in transactions within two months and bridging renewable assets with institutional capital. - Institutional investors now use CleanTrade’s tools to hedge fossil fuel volatility and lock in renewable energy prices, mirroring traditional energy strategies. - Global cl

COAI Token Fraud: Insights for Cryptocurrency Investors During Times of Regulatory Ambiguity

- COAI token's 88% collapse in late 2025 exposed systemic risks in AI-driven DeFi ecosystems, with $116.8M investor losses. - Governance flaws included 87.9% token concentration in ten wallets, untested AI stablecoins, and lack of open-source audits. - Panic selling accelerated by AI-generated misinformation and CEO resignation, amid conflicting global crypto regulations. - Lessons emphasize scrutinizing token distribution, demanding transparent audits, and avoiding jurisdictions with regulatory ambiguity.