Silver Hits a New All-Time High: What Does It Mean for Bitcoin?

Silver soared to $63 per ounce today, marking a new all-time high for the precious metal. In contrast, the cryptocurrency market slipped 2.74% over the past day, with all top 20 coins, except stablecoins, in the red. This sharp divergence in performance indicates a shift in capital flows. While such moves are often viewed as

Silver soared to $63 per ounce today, marking a new all-time high for the precious metal. In contrast, the cryptocurrency market slipped 2.74% over the past day, with all top 20 coins, except stablecoins, in the red.

This sharp divergence in performance indicates a shift in capital flows. While such moves are often viewed as a classic risk-off signal, some analysts argue that it may indicate the opposite.

Why Are Silver Prices Rising?

Silver extended its broader uptrend today, reaching yet another milestone as it climbed to a fresh record high during early Asian trading hours. Companies Market Cap data shows silver sits sixth among global assets with a $3.5 trillion market cap.

According to recent commentary from The Kobeissi Letter, the metal is now on pace to record its strongest 12-month performance since 1979.

“The current rally in Silver prices makes 2020 and 2008 look like a rounding error. A new era of monetary policy is coming,” the post read.

JUST IN 🚨: Silver soars to $63 for the first time in history 📈📈 pic.twitter.com/FGpabMHg4N

— Barchart (@Barchart) December 11, 2025

As the rally accelerates, people are once again rushing to acquire safe-haven assets. But why is the demand for silver rising? According to trader Michael, the surge is not simply a matter of demand, but “desperation.”

He highlighted physical silver-backed ETFs absorbed more than 15.3 million ounces in four days. This marked the second-largest weekly inflow of 2025.

Moreover, Michael noted that this figure comes quite close to the 15.7 million ounces added throughout the entire month of November.

“Silver ETFs are now on track for their 10th straight monthly inflow, something that has only happened during systemic stress events,” he added.

The world’s largest silver ETF, SLV, reportedly saw almost $1 billion in weekly inflows, surpassing the inflows of major gold funds. In his view, the factors behind silver’s rapid ascent extend far beyond retail enthusiasm or inflation fears. Michael said that,

“The global monetary system is losing trust quietly, quickly, and from the inside out.Silver is the only asset that sits at the crossroads of two crises: 1. A hard-asset scramble as sovereign debt climbs past breaking points. 2. A relentless industrial shortage driven by AI infrastructure, solar expansion, EV adoption, and semiconductor demand.”

The trader stressed that when financial uncertainty meets physical scarcity, silver’s price doesn’t simply rise but “detaches,” signaling what he describes as a deeper rupture rather than a typical market rally.

Silver vs Bitcoin: The Performance Gap Widens in 2025

Meanwhile, the crypto market’s lackluster performance stands in sharp contrast to silver’s surge. BeInCrypto Markets data showed that the largest cryptocurrency fell more than 2% over the past day, extending a broader downward trend.

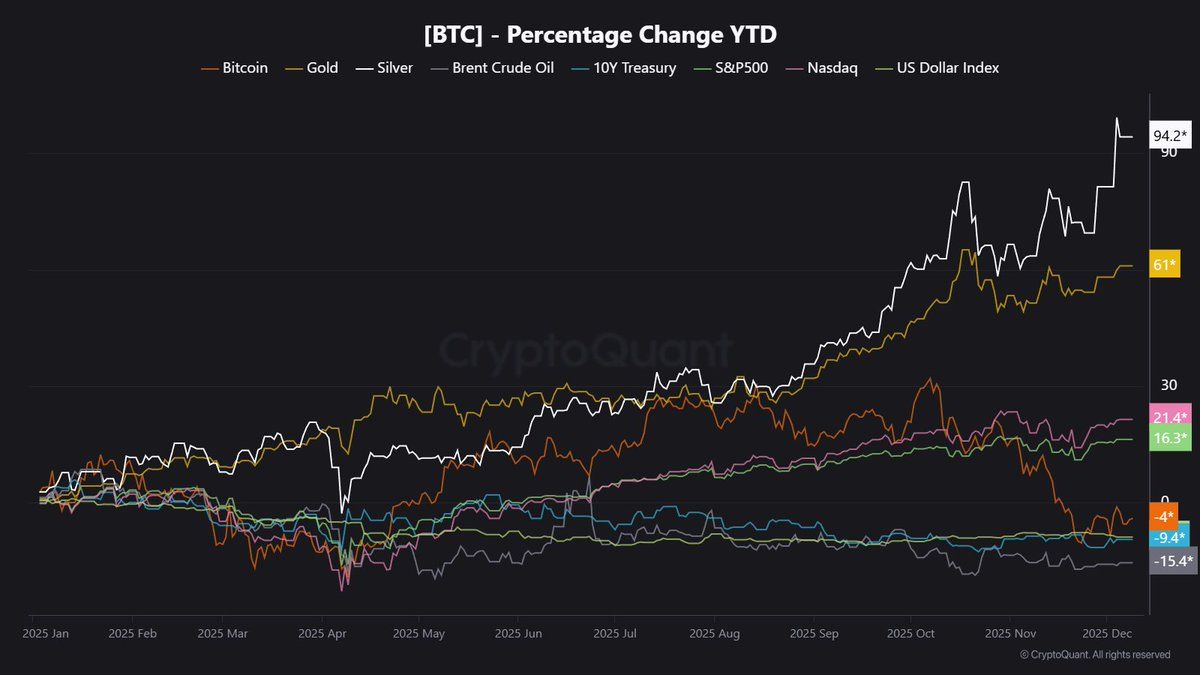

Analyst Maartun noted that in 2025, silver is emerging as the standout performer, even outpacing gold. Bitcoin, on the other hand, is lagging behind these precious metals and even major stock indices, including the S&P 500 and the Nasdaq.

“Over the past four years Bitcoin has been getting killed in terms of silver. It’s lost over half of its value priced in silver,” economist Peter Schiff remarked.

2025 YTD Performance Comparison Showing Silver’s Gain Versus Bitcoin’s Decline. Source:

X/JA Maartun

2025 YTD Performance Comparison Showing Silver’s Gain Versus Bitcoin’s Decline. Source:

X/JA Maartun

This indicates that risk-off sentiment is rising. When uncertainty increases, investors often turn to traditional safe-haven assets. Silver and gold have served this role for centuries.

Nonetheless, some analysts view silver’s rally not as a flight to safety, but as a sign that investors are ready to take on risk. Crypto analyst Ran Neuner offers this contrarian take, saying market conditions now favor risk-on assets. His view challenges traditional perspectives on the surges in precious metals.

“The market is now in FULL risk-on mode and most people aren’t seeing it because Bitcoin isn’t moving! Silver is at all-time highs. It is on a breakout and climbing with acceleration. Silver is the Beta gold and indicates Risk-On!” he stated.

Neuner also pointed to the ETH/BTC ratio climbing above its 50-week simple moving average, indicating renewed interest in cryptocurrencies. He also cited the Russell 2000’s breakout and the Federal Reserve’s latest pivot as additional evidence supporting a broad risk-on environment.

“Soon the sellers in BTC will dry up and the big catch up trade will begin. All the data points in one direction!” Neuner claimed.

Other analysts also expect Bitcoin to see renewed demand. Whether this view prevails will depend on how market trends continue and whether crypto buyers return strongly in the coming time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Emergence of CFTC-Regulated Clean Energy Platforms and Their Influence on Institutional Investment Approaches

- CFTC-approved CleanTrade, the first SEF for VPPAs/RECs, transforms clean energy markets by addressing liquidity, transparency, and regulatory challenges. - Its $16B trading volume and Cargill-Mercuria's first transaction demonstrate institutional adoption of standardized, verifiable renewable energy assets. - CleanTrade enables ESG alignment through project-specific carbon tracking, reducing emissions by 15% for investors while complying with IRA-driven $2.2T global investments. - By bridging financial a

Clean Energy Market Fluidity and the Rise of CleanTrade: Strategic Considerations for Investors in a Regulatory Environment

- CleanTrade, a CFTC-approved SEF, addresses fragmented pricing and low liquidity in clean energy markets by standardizing VPPA, PPA, and REC trading. - The platform’s $16B in two-month transactions demonstrates institutional demand for transparent, ESG-aligned tools to hedge energy risks and track carbon impact. - By centralizing renewable derivatives and aligning with regulations like SFDR, CleanTrade lowers barriers for investors and developers, accelerating decarbonization while boosting market efficie

The Rise of a Dynamic Clean Energy Marketplace

- Global clean energy investment hit $2.1 trillion in 2024, driven by decarbonization trends and institutional demand. - REsurety's CFTC-approved CleanTrade platform addresses liquidity gaps by standardizing VPPA/REC trading with oil-like transparency. - The platform processed $16 billion in two months, enabling risk mitigation and rapid capital reallocation amid policy shifts. - Advanced analytics and structured workflows transform clean energy assets into tradable instruments, attracting diversified inst

The Rise of a Dynamic Clean Energy Market and What It Means for Institutional Investors

- A liquid clean energy marketplace is emerging, enabling institutional investors to trade renewable assets with traditional market efficiency. - E-fuels and platforms like CleanTrade ($16B in notional value) address hard-to-decarbonize sectors while Enel's blockchain-based systems enhance scalability. - Regulatory reforms (e.g., EPA RFS) and industry M&A activity support market growth, though high costs and fragmented standards remain challenges. - 84% of institutional investors plan to increase clean ene