Key Market Information Discrepancy on December 8th - A Must-See! | Alpha Morning Report

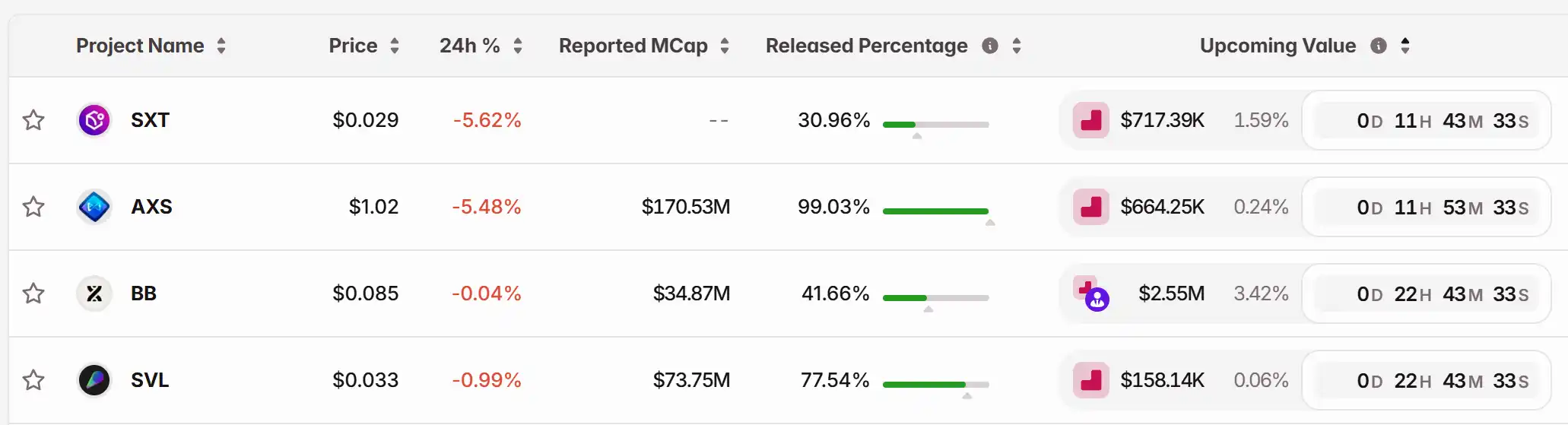

1. Top News: This week APT, CHEEL, LINEA, and other tokens will undergo a one-time large unlock 2. Token Unlock: $SXT, $AXS, $BB, $SVL

Featured News

1.This Week APT, CHEEL, LINEA, and Other Tokens Will See Large One-Time Unlock

2.MOODENG Surges Over 43% in 24 Hours, Market Cap Reaches $1.04 Billion

3.Strategy's Bitcoin Holding Currently Has Unrealized Profits of 19.3%, About $9.35 Billion

4.Paradigm Co-founder Says This Is the Cryptocurrency's 'Netscape or iPhone Moment'

5.Solana Foundation President Urges Kamino and Jupiter to Stop Infighting and Focus on Market Expansion

Articles & Threads

1.《The World Beyond SWIFT: Russia and the Cryptocurrency's Secret Economy》

Moscow's winter mornings always arrive slowly. The subway glides from the gray residential areas into the city center, with the advertising screens in the carriages rolling the usual ruble loan offers, online shopping promotions, and a seemingly normal banner: "Settling Overseas Income? USDT Accepted." It's hard to imagine that in a country surrounded by the Western financial system, the term "stablecoin," originally found only in Silicon Valley whitepapers, has quietly become the infrastructure upon which ordinary people and businesses rely.

2.《The Future of Cryptocurrency: From Speculative Asset to the Internet's Foundation》

Cryptocurrency is heading towards mainstream adoption, but the path may be entirely different from what you imagine. It won't come in the form of Bitcoin, Ethereum, or Solana, nor will it be dominated by NFT art or meme coins. Instead, it will quietly integrate into the underlying infrastructure of digital finance and the internet, becoming a secure communication layer between applications, much like the transition from HTTP to HTTPS.

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

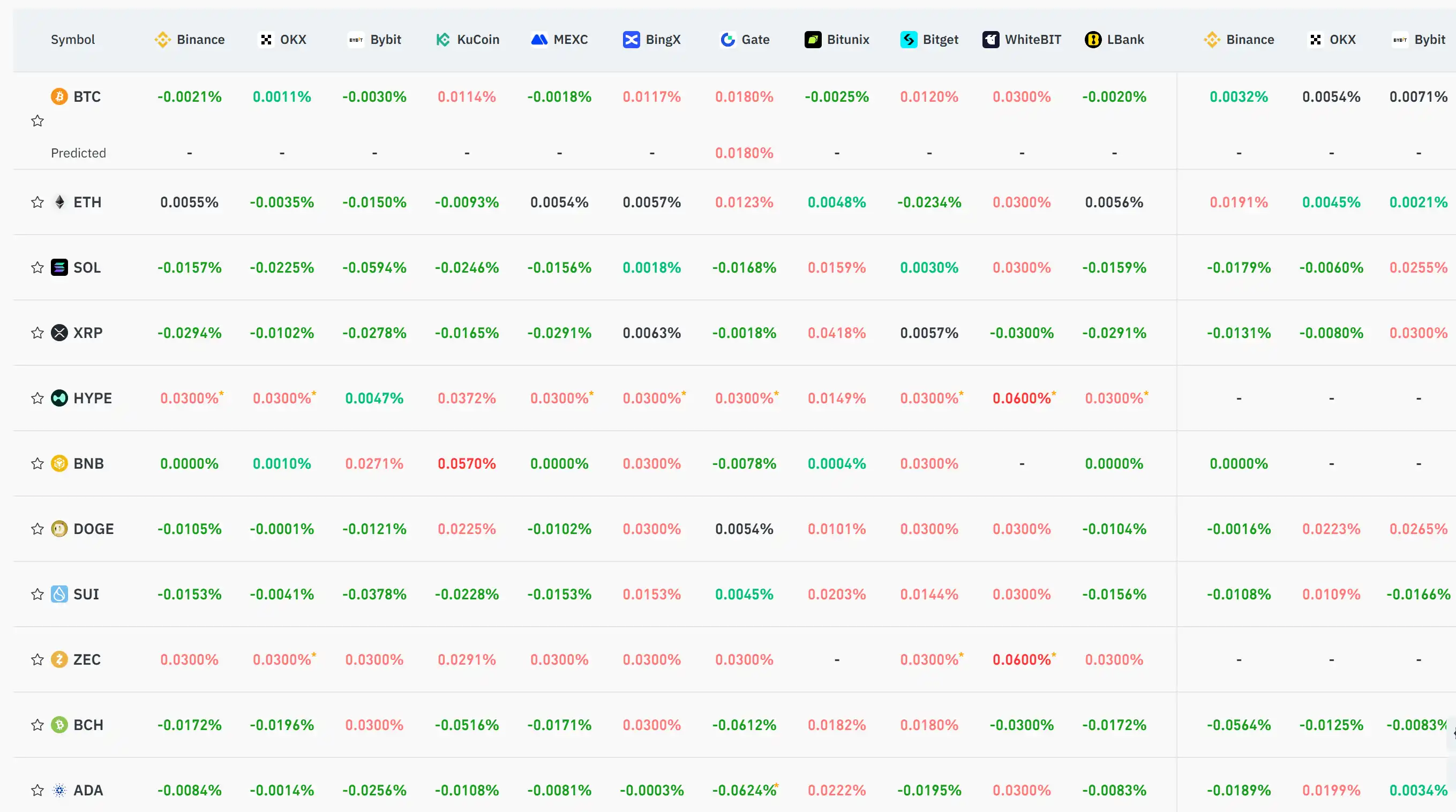

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bears take over below $90K? 5 things to know in Bitcoin this week

How CFTC-regulated platforms such as CleanTrade are transforming clean energy into a new category of tradable assets

- CFTC-approved CleanTrade transforms clean energy derivatives into standardized, liquid assets via its SEF platform, unlocking $16B in trading volume within two months. - By standardizing VPPAs/RECs and offering real-time analytics, CleanTrade bridges sustainability and profitability for institutional investors seeking ESG-aligned opportunities. - Early adopters like Cargill leverage CleanTrade to hedge energy costs while addressing fragmented markets, accelerating a $125T global clean energy derivatives

The Emergence of a Vibrant Clean Energy Market: How REsurety's CleanTrade Platform is Transforming Institutional Investments and ESG Approaches

- REsurety's CleanTrade platform, CFTC-approved for clean energy swaps, is transforming the market by enabling institutional trading of renewable assets with liquidity and transparency. - It addresses historical illiquidity in VPPAs/RECs through standardized contracts and real-time pricing, reducing transaction times and enabling $16B in notional value within two months. - The platform integrates ESG metrics with financial analysis, supporting 84% of institutional investors' growing demand for decarbonizat

COAI's Significant Recent Drop: Should Investors See This as a Chance to Buy or a Cautionary Signal?

- COAI's sharp stock decline sparks debate over short-term volatility vs. structural risks in South Africa's coal sector. - Weak domestic coal supply chains, US tariffs, and governance gaps amplify operational risks for export-dependent COAI. - Unclear AI policy implementation and media credibility issues deepen investor skepticism about COAI's transparency and adaptability. - Structural challenges including infrastructure bottlenecks and low AI adoption rates suggest the decline may reflect systemic indus