Ethereum Faces Mixed Signals at This Critical Price

Ethereum price is attempting once again to break free from the long-standing $3,000 barrier, but the effort has stalled. After briefly moving higher, ETH slipped back toward this support range, signaling that the market remains divided. While bullish momentum is slowly returning, investor impatience could weigh on recovery if a clear direction fails to emerge

Ethereum price is attempting once again to break free from the long-standing $3,000 barrier, but the effort has stalled. After briefly moving higher, ETH slipped back toward this support range, signaling that the market remains divided.

While bullish momentum is slowly returning, investor impatience could weigh on recovery if a clear direction fails to emerge soon.

Ethereum Investors Could Sell Their ETH

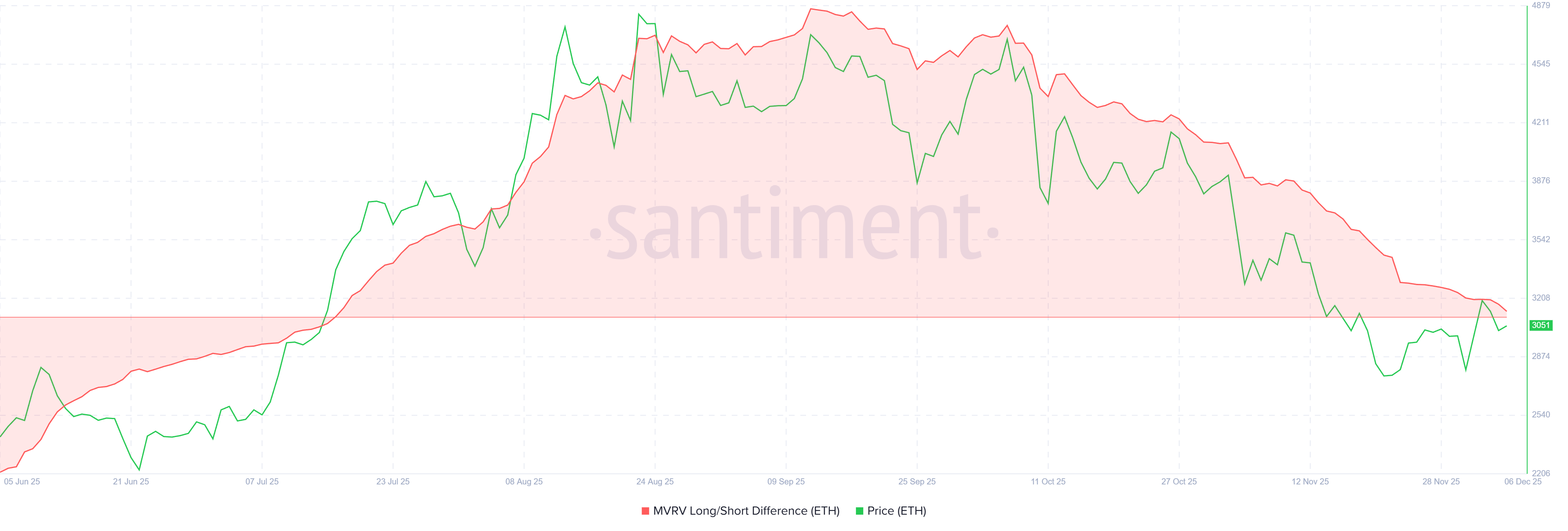

The MVRV Long/Short Difference is nearing the neutral line, signaling a potential shift in profit dominance between long-term and short-term holders. This metric tracks whether long-term holders (LTHs) or short-term holders (STHs) are realizing more gains. For Ethereum, a drop below the neutral line would mean STHs hold the majority of unrealized profits.

This shift is important because STHs historically sell quickly at the first sign of weakness. If they begin taking profits near $3,000, ETH could face renewed selling pressure. This behavior has often stalled previous recovery attempts, making sentiment fragile despite broader bullish signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum MVRV Long/Short Difference. Source:

Ethereum MVRV Long/Short Difference. Source:

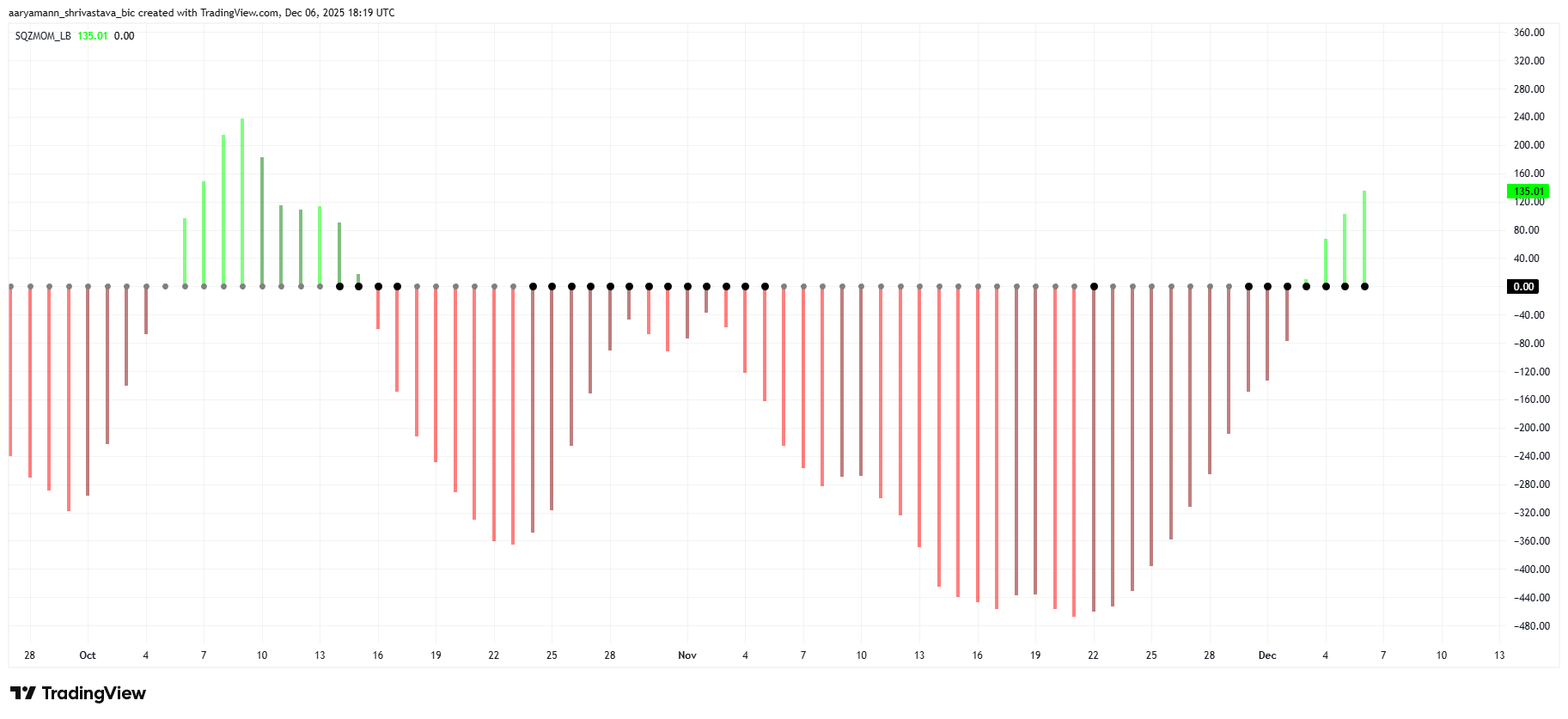

The squeeze momentum indicator adds another layer of complexity. ETH is currently experiencing a squeeze build-up, which occurs when volatility tightens and momentum compresses.

This usually precedes a strong directional move. The histogram indicates that bullish momentum is strengthening, suggesting that once the squeeze is released, price acceleration may follow.

If bullish momentum continues to grow during this period, ETH may benefit from a volatility expansion to the upside. This setup has preceded rallies in earlier cycles, though confirmation depends on market participation and whether buyers step in at $3,000.

ETH Squeeze Momentum Indicator. Source:

ETH Squeeze Momentum Indicator. Source:

ETH Price Might End Up Falling Again

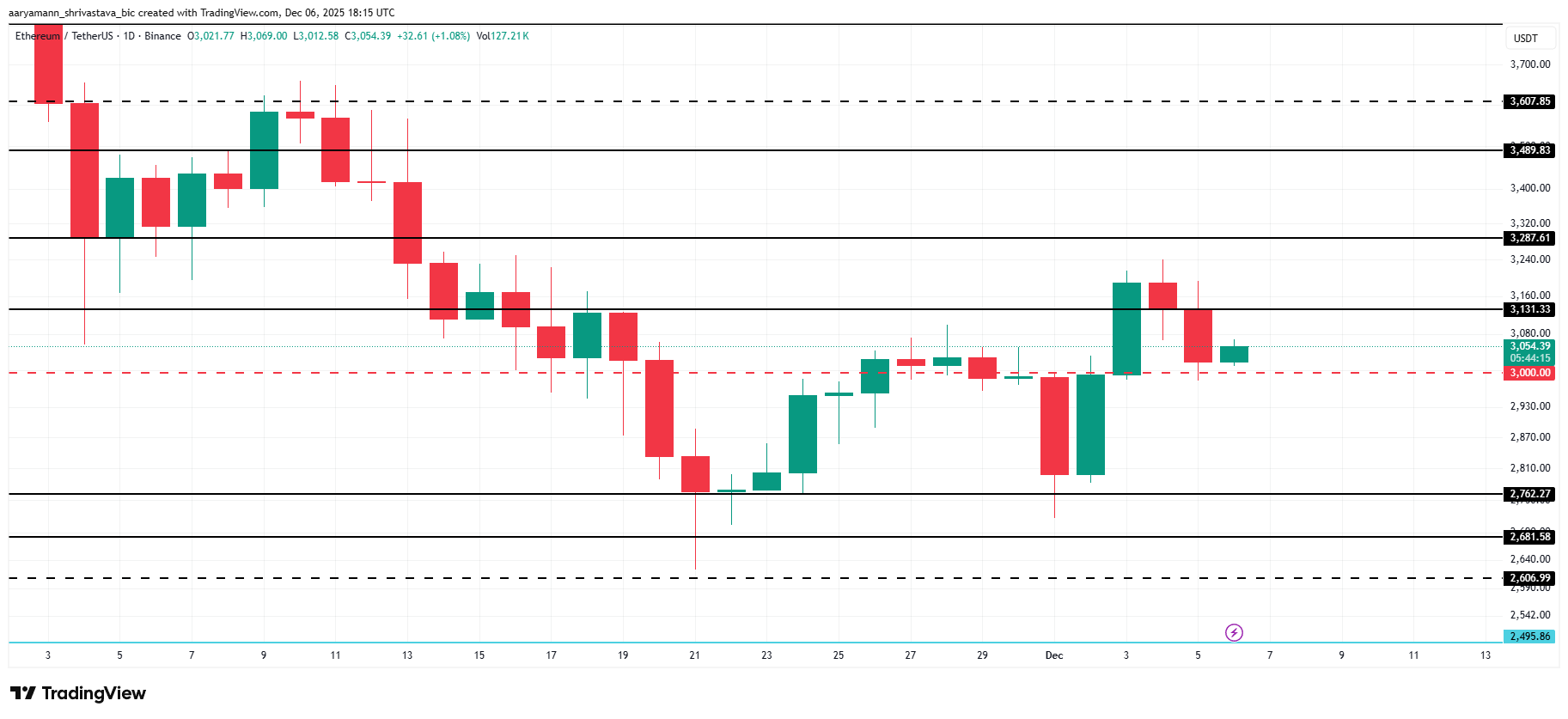

Ethereum is trading at $3,045 and remains above the critical $3,000 support level. Over the last several days, ETH has hovered tightly around this zone, signaling indecision among traders as market cues shift.

The mixed signals suggest that ETH may continue to move sideways near $3,000 in the short term. A breakdown triggered by STH profit-taking or broader market skepticism could push Ethereum toward $2,762 before stabilizing.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

However, if bullish momentum strengthens alongside favorable macro conditions, ETH could climb past $3,131 and target $3,287. A clean break above these levels would invalidate the bearish outlook and set the stage for a broader recovery phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Stock Performance After Listing: Understanding Investor Reactions and Institutional Ambiguity in Initial Tech IPO Phases

- KITE's stock plummeted 63% post-IPO despite strong retail occupancy and NOI growth, highlighting market uncertainty in early-stage tech. - Analyst ratings diverged (Buy at $30 vs. Neutral at $24), reflecting skepticism about KITE's ability to compete with AI-driven disruptors. - Institutional positions split sharply, with COHEN & STEERS boosting stakes while JPMorgan/Vanguard cut holdings, revealing sector risk fragmentation. - KITE trades at a 35.17 P/E (vs. 27.1x retail REIT average) but lags high-grow

BCH Drops 1.87% Over 24 Hours as Network Upgrades and Mining Changes Occur

- Bitcoin Cash (BCH) fell 1.87% in 24 hours to $560.60 but rose 29.32% annually amid network upgrades and mining shifts. - A block size limit proposal and hashrate reallocation from Bitcoin to BCH highlight efforts to boost scalability and security. - Developers announced a 2026 wallet interface upgrade to improve retail usability, aiming to expand BCH's real-world adoption. - Analysts note BCH's technical roadmap and low-cost transaction focus could differentiate it in emerging markets despite short-term

TWT's Updated Tokenomics Framework: Transforming DeFi Rewards and Enhancing Capital Utilization

- Trust Wallet Token (TWT) redefines DeFi tokenomics in 2025 with utility-driven incentives, deflationary mechanisms, and cross-chain functionality. - TWT enables gas fee payments, premium service access, and staking rewards, linking token value directly to ecosystem engagement. - A 40% supply burn in 2020 and organic token locking create scarcity, while interoperability reduces multi-asset dependency for users. - Unlike speculative models, TWT's demand grows through usage rather than trading, positioning

Top 4 Memecoins Set for a 1000X Weekend Push as Market Volume Spikes 40% Overnight