- XRP fell to $2.07 in 24 hours as market cap slipped to $125.33B, marking a 4.25% decline.

- Liquidity maps showed dense activity between $2.10 and $2.20, shaping frequent intraday reactions.

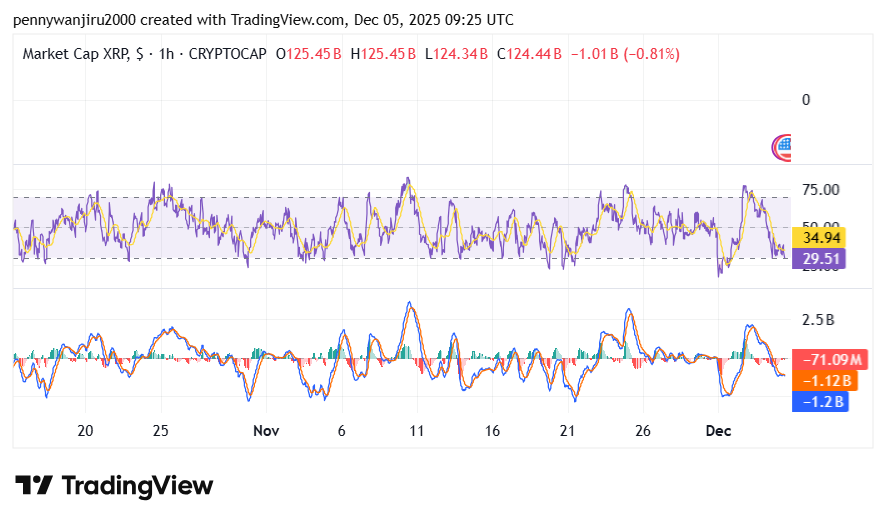

- Hourly indicators showed continued volatility, with RSI near 35.14 and 32.36, reflecting unstable momentum.

XRP’s market performance weakened over the past 24 hours as the asset recorded a fresh drop to $2.07. The fall was accompanied by a significant decrease in market capitalization, which dropped to the level of 125.33 billion following a decrease of 4.25%.

This change took place as trading data indicated more volatility over shorter periods, and liquidity maps were showing activity that was shifting around the area of $2.10. These flows preconditioned the new session, and they also influenced the short-term expectations on the market in general. Having these readings in place, traders were still monitoring price action keenly, particularly as the asset retested previous levels.

XRP Pullback Deepens as Mid-Range Indicators Crosses Limit Directional Strength

The contraction in XRP’s market cap aligned with the confirmed 4.24% intraday price decline. This decline moved the asset away from earlier levels near $2.20, which remained visible on the volume heatmap. The pullback also followed a broader cooldown that developed throughout the previous trading day.

Source: TradingView

Source: TradingView

Moving to the momentum readings, hour-by-hour oscillators showed frequent shifts. RSI hovered within a middle range, with levels near 35.14 and 32.36 during the latest update. These readings indicated steady fluctuations, and they helped explain the limited directional pushes seen during the session.

Momentum indicators reinforced this pattern. Hourly MACD lines crossed several times, and each cross coincided with small shifts in volume bars. These signals highlighted unstable intraday behavior, especially as market participants adjusted positions during the decline.

Short-Term Trading Range Shows Increased Volatility

The chart also showed frequent swings within a narrow trading band. These swings became visible as XRP failed to hold earlier intraday recoveries. Price repeatedly revisited the lower region near $2.05, which aligned with several liquidity pockets on the heatmap.

However, liquidity distribution added additional context. The heatmap displayed dense activity between $2.10 and $2.20, and this band showed frequent order clustering. This clustering influenced short-term moves and shaped intraday reactions when price approached those levels.

Moreover, repeated tests of nearby price levels continued to define the latest sessions. Notably, these movements followed a sequence of rapid adjustments recorded across the market cap chart, which reflected steady pressure through the early morning hours

Liquidity Patterns Highlight Key Near-Term Levels

Liquidity distribution offered additional insight into potential near-term behavior. Several bright clusters appeared slightly above the current price, especially around the $2.10 to $2.15 zone. These clusters suggested increased activity in that region, and they shaped the immediate trading landscape.

This landscape remained important because each cluster marked areas where price stalled several times earlier. Market participants monitored these areas closely as XRP hovered near $2.07. Furthermore, the market cap decline placed more attention on how liquidity concentrated at these levels. As the next sessions unfold, these concentrations and the repeated intraday reactions will likely guide short-term movements.