One Bullish XRP Metric Hits a 3-Month High — So Why Can’t the Price Break Out?

The XRP price has failed to join Bitcoin and Ethereum in their weekly gains and is still trading inside the tight band it has held since mid-November. Meanwhile, one bullish on-chain signal has reached a three-month high, which is normally a strong setup for a recovery. Yet the XRP price has barely moved. Let’s understand

The XRP price has failed to join Bitcoin and Ethereum in their weekly gains and is still trading inside the tight band it has held since mid-November.

Meanwhile, one bullish on-chain signal has reached a three-month high, which is normally a strong setup for a recovery. Yet the XRP price has barely moved. Let’s understand why.

Dormancy Hits a 3-Month High, but Long-Term Holders Keep Selling

The story begins with spent coins. Spent coins measure how many older XRP tokens move each day, and the metric has collapsed from 186.36 million XRP on November 15 to just 16.32 million XRP now. This is a dramatic 91% drop and the lowest level in three months.

When the older supply stops moving, selling pressure falls sharply. That is why dormancy , which increases when spent coins go down, has now hit its strongest level in three months. Under normal market conditions, this shift alone would support a stronger XRP price.

XRP Dormancy Peaks:

XRP Dormancy Peaks:

But the XRP price has not reacted because the conviction groups are moving the other way.

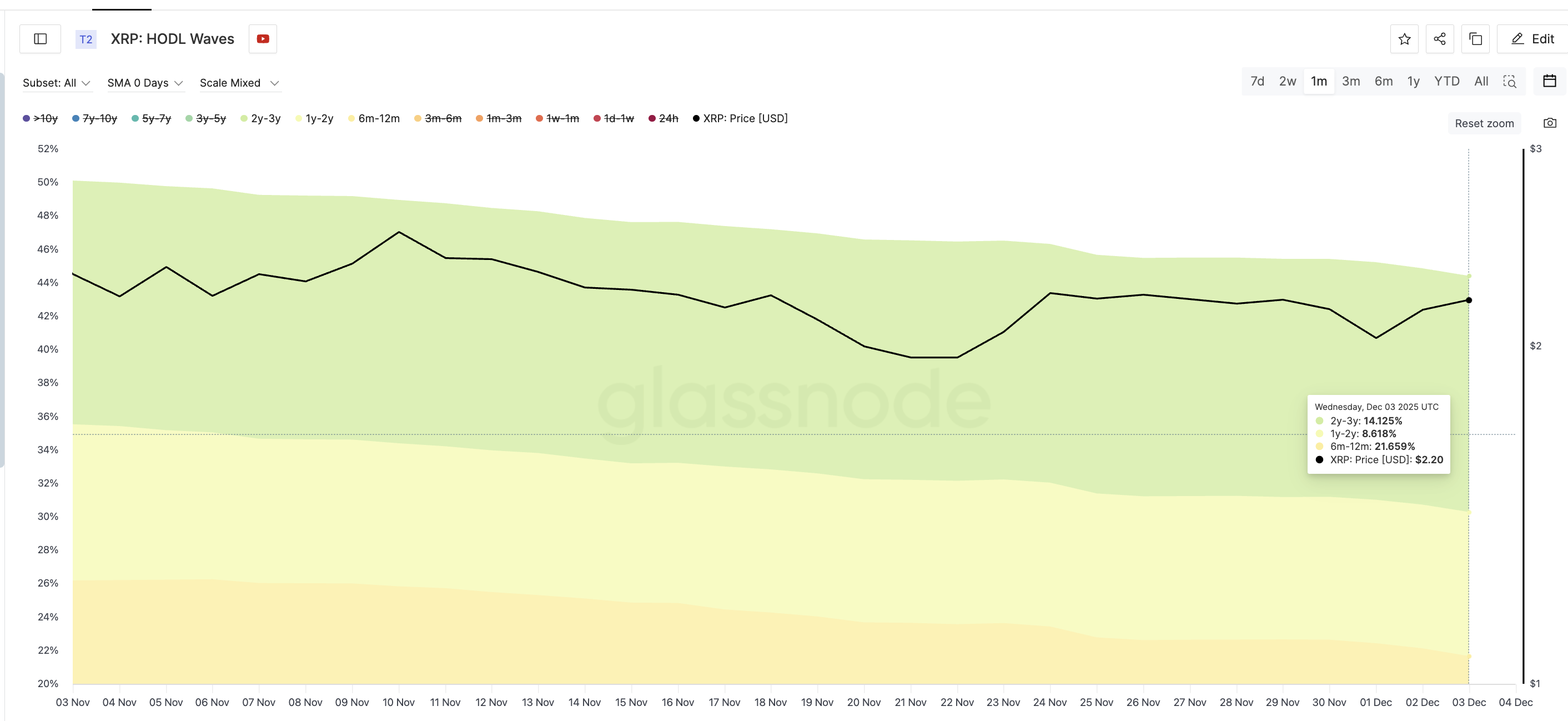

HODL Waves, which track supply held by each age band, show a clear distribution from older holders across the past month. The 6–12 month cohort has dropped from 26.18% of supply to 21.65%. The 1–2 year group has fallen from 9.34% to 8.61%. Even the 2–3 year cohort has eased from 14.58% to 14.12%.

Long-Term Holders Keep Selling:

Long-Term Holders Keep Selling:

These groups form the backbone of trend strength because they control the supply that rarely moves. When they reduce their share, upside attempts lose power.

This also explains why even recent whale buying, which we covered earlier, has not been enough to lift the XRP price. Whales have increased exposure, but persistent outflows from older holders are still overpowering that demand. Until long-term supply stops leaving these cohorts, dormancy alone cannot drive a breakout.

XRP Price Must Close Above $2.28 to Escape Its Range

The chart reflects the same tug-of-war. The XRP price has been stuck between $2.28 and $1.81 since November 15 and has not produced a single daily close above $2.28. This remains the key line that must break for momentum to build. A successful move above $2.28 would open the next targets at $2.56 and $2.69, areas where XRP has reacted strongly before.

A close below $1.98, however, would weaken the current structure and increase the chance of a return to $1.81.

XRP Price Analysis:

XRP Price Analysis:

For now, the message is clear. Dormancy is at a three-month high as spent coins are at a three-month low, but long-term holders are still distributing. Until these conviction groups stabilize and a daily candle closes above $2.28, the XRP price will stay inside its range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rep. Marjorie Taylor Greene increases Bitcoin exposure during market dip

Kalshi Tops Prediction Markets with $1.21B in Volume

Kalshi leads November prediction markets with $1.21B volume, surpassing Polymarket and Opinion as user interest spikes.Why Kalshi Pulled AheadGrowing Interest in Predictive Trading

Kalshi and CNBC Strike Multi-Year Prediction Market Deal

CNBC teams up with Kalshi to bring real-time prediction market data across its platforms starting in 2026.What Kalshi Brings to CNBCWhy This Partnership Matters

Bitcoin vs Gold: CZ Outsmarts Schiff in Debate

CZ defends Bitcoin’s utility as Schiff fumbles with a gold bar during a live debate.Schiff’s Awkward Gold Bar MomentThe Future of Money?