Wall Street Braces as Bitcoin Goes Public for the First Time | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead. Grab a coffee and brace for Wall Street’s latest twist: a Bitcoin-native company is about to hit the NYSE. Shareholders have approved a major merger, putting billions in Bitcoin under one roof and signaling

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and brace for Wall Street’s latest twist: a Bitcoin-native company is about to hit the NYSE. Shareholders have approved a major merger, putting billions in Bitcoin under one roof and signaling a shift in how crypto meets traditional markets.

Crypto News of the Day: Twenty One Capital Gains NYSE Approval

Cantor Equity Partners (CEP) shareholders voted to approve the merger with Twenty One Capital, clearing the final major hurdle for the business combination.

The deal, subject to standard closing conditions, is expected to finalize on December 8, 2025. Following the completion, the merged entity will operate under the Twenty One Capital name and begin trading the next day (December 9).

Strike CEO Jack Mallers will lead the company, which Tether and Bitfinex hold as majority owners. The firm markets itself as the first Bitcoin-native company preparing for a public listing, offering investors a regulated pathway to gain exposure to the cryptocurrency.

“Following the consummation of such transactions, the combined company will operate as Twenty One Capital, Inc., and its shares of Class A common stock are expected to trade on the New York Stock Exchange (“NYSE”) beginning on December 9, 2025, under the symbol XXI,” read an excerpt in the announcement.

Public Equity Exposure to Bitcoin Amid Crypto and Banking Frictions

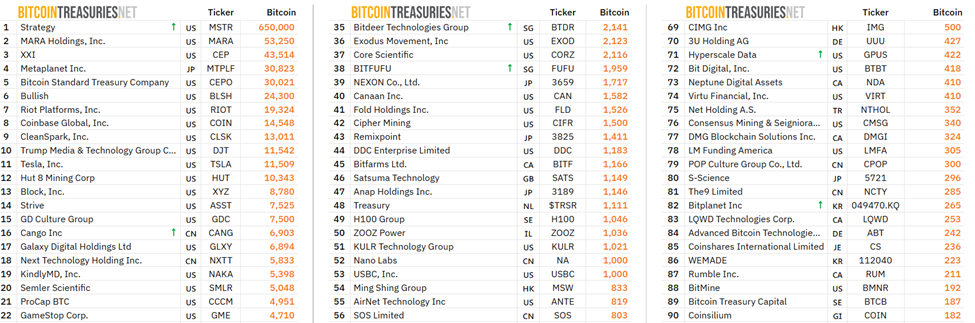

Twenty One Capital currently holds 43,514 BTC, valued at approximately $4 billion, making it the third-largest Bitcoin holder among publicly traded companies, after Strategy and MARA Holdings.

Top 22 Public BTC Treasury Companies. Source:

Bitcoin Treasuries

Top 22 Public BTC Treasury Companies. Source:

Bitcoin Treasuries

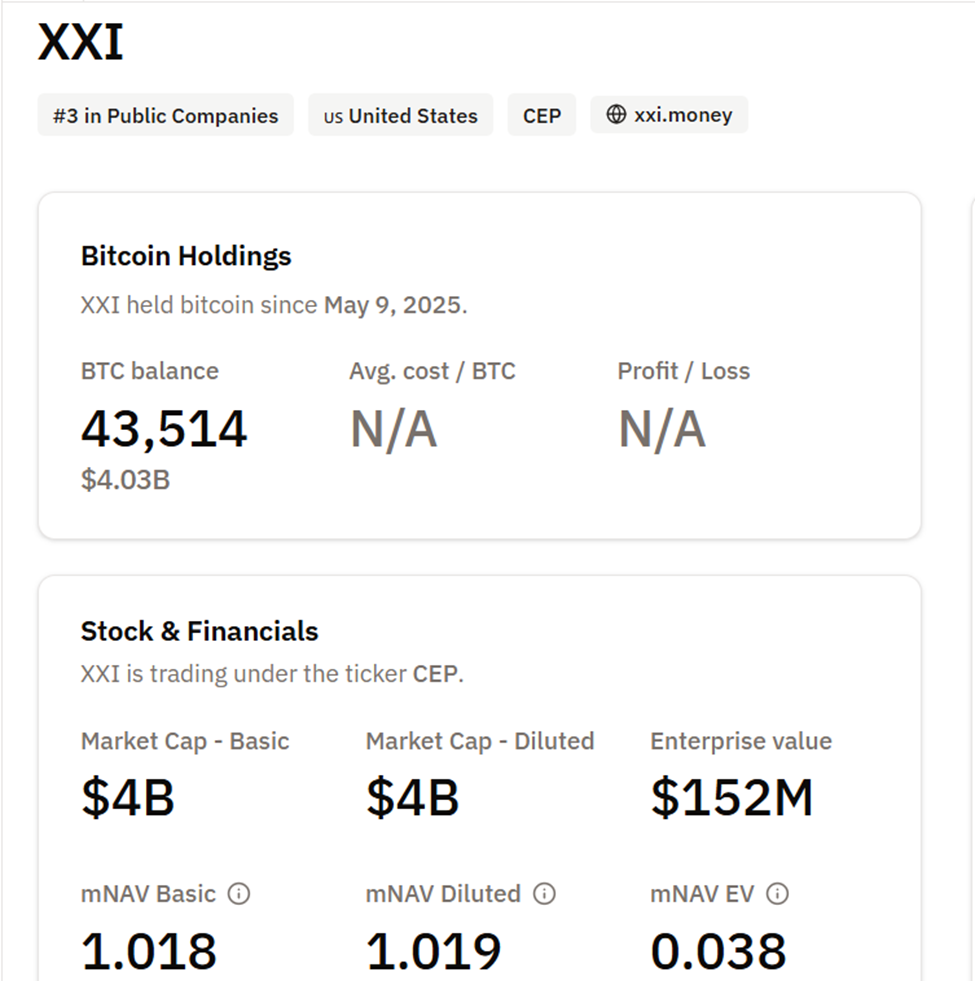

The firm emphasizes “capital-efficient Bitcoin accumulation” and plans to introduce a “Bitcoin Per Share” metric. This metric would enable shareholders to track Bitcoin holdings in real time with auditable on-chain proof-of-reserves.

“This listing provides a transparent, regulated way for investors to access Bitcoin without directly holding the asset,” the company added.

The NYSE debut also positions Twenty One Capital as a bridge between crypto-native operations and traditional equity markets, potentially reshaping investor access to digital assets.

“…offers investors a new way to gain BTC exposure via the equity markets,” commented Conor Kenny, a popular user on x (Twitter).

The announcement comes amid wider discussions about the banking sector’s relationship with crypto firms. In late November, Jack Mallers revealed that JPMorgan Chase abruptly closed his personal accounts without explanation, fueling fears of “debanking” in the crypto industry.

Tether CEO Paolo Ardoino described the move as an opportunity for crypto executives to operate independently of centralized financial institutions.

I think it's for the best

— Paolo Ardoino 🤖 (@paoloardoino) November 23, 2025

These tensions coincide with broader market scrutiny. JPMorgan is currently monitoring potential MSCI reclassification rules that could impact companies with significant Bitcoin holdings, such as MicroStrategy.

Analysts estimate that index changes could trigger billions in passive fund outflows, potentially as high as $9 billion for MicroStrategy.

As Twenty One Capital prepares to trade under the “XXI” ticker on December 9, market participants will watch for trading volumes, investor appetite, and the reception of the Bitcoin-per-share metric.

The listing could set a precedent for other crypto-native firms seeking regulated market exposure, potentially broadening institutional and retail participation in the Bitcoin economy.

Chart of the Day

Twenty One Capital (XXI) BTC Holdings. Source:

Bitcoin Treasuries

Twenty One Capital (XXI) BTC Holdings. Source:

Bitcoin Treasuries

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Kevin Hassett sparks a crypto–bond market split as Fed race heats up.

- One bullish XRP metric hits a 3-month high — So why can’t the price break out?

- Peter Schiff to CZ: ‘Bitcoin payments? They’re just liquidated bets.’

- Vienna crypto murder shocks Europe as kidnapping wave escalates.

- Citadel Securities turns against DeFi while pouring $500 million into Ripple.

- Three crypto narratives surge in December 2025—Top picks for 2026?

- Tom Lee’s relentless ETH buying puts BMNR stock on a possible 55% breakout path.

Crypto Equities Pre-Market Overview

| Strategy (MSTR) | $188.39 | $187.82 (-0.30%) |

| Coinbase (COIN) | $276.92 | $275.85 (-0.39%) |

| Galaxy Digital Holdings (GLXY) | $27.05 | $26.93 (-0.44%) |

| MARA Holdings (MARA) | $12.47 | $12.45 (-0.16%) |

| Riot Platforms (RIOT) | $15.64 | $15.57 (-0.45%) |

| Core Scientific (CORZ) | $16.55 | $16.50 (-0.30%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After viewing your Spotify Wrapped 2025, take a look at these similar alternatives

Privacy Coins and Market Fluctuations: Uncovering the Factors Behind ZEC's Latest Price Jump

- Zcash (ZEC) surged 700% in late 2025 driven by institutional backing and network upgrades like the Zashi wallet. - Regulatory pressures and market fragmentation intensified as exchanges delisted privacy coins and liquidity shifted to decentralized platforms. - ZEC's volatility reflects macroeconomic tailwinds and speculative demand, but its long-term viability hinges on balancing privacy with regulatory compliance. - Institutional adoption of privacy coins accelerated in 2025, yet fragmented markets and

Why Dash (DASH) Is Soaring as Institutions Embrace It and Privacy Concerns Fuel Demand

- Dash (DASH) surged 150% in June 2025, driven by institutional adoption and privacy-focused demand. - Institutional ownership reached 90.64% after AGF Management's $7.79M investment and DoorDash's $450M partnership. - Dash Platform 2.0 enhanced scalability while PrivateSend usage grew 25% YoY amid rising privacy needs. - Regulatory challenges persist under EU MiCA and SEC scrutiny, prompting multi-jurisdictional compliance strategies. - DeFi integration and Latin American adoption expanded DASH's utility

ZK Atlas Upgrade: Pioneering the Future of Blockchain Infrastructure for Enhanced DeFi Scalability

- ZKsync's 2025 Atlas Upgrade revolutionizes DeFi scalability via zero-knowledge rollups, boosting transaction throughput to 43,000 TPS and slashing costs to $0.0001 per transfer. - Modular architecture with Atlas Sequencer and Airbender Prover enables real-time execution, while zkSync OS supports EVM/WASM compatibility and cross-chain liquidity unification. - Post-upgrade DeFi metrics show 300% transaction volume growth and $0.28–$1.32 ZK token price projections, positioning ZKsync as a key Layer 2 infras