The latest drop in the Bitcoin price has surprised the traders, as they were expecting a rise above $95,000 after a brief consolidation. The token broke down below the psychological barrier at $86,800, forming an intraday low at $84,756. The recent drop has also sparked a big question across the market: Are whales buying this dip or stepping back?

Fresh on-chain data shows that while whales are not panic-selling, they are being highly selective about where they accumulate. Let’s break it down.

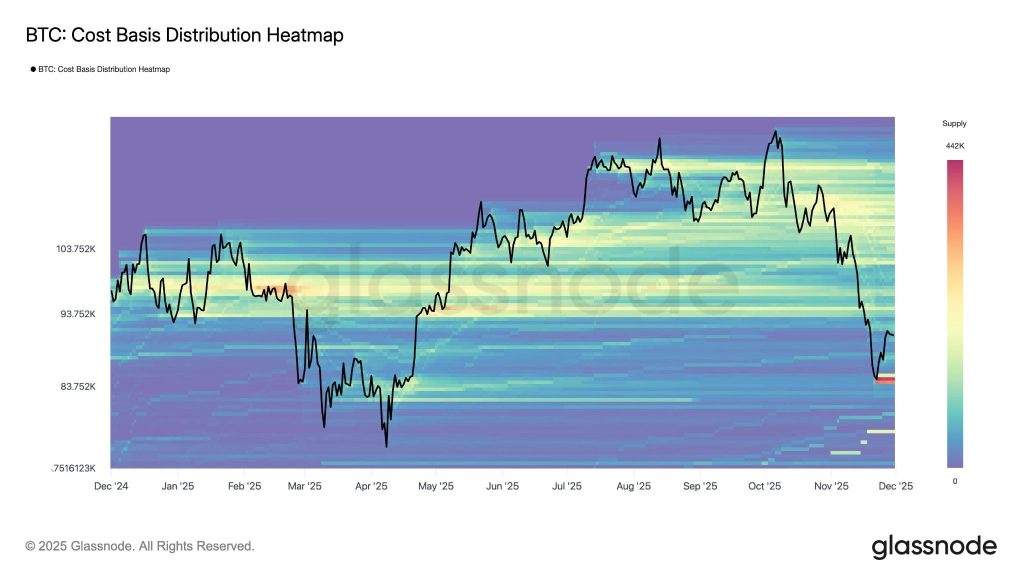

One of the strongest indicators of whale behavior during the corrections is where their cost basis clusters sit. The data below shows that the large BTC holders have not dumped their coins during the latest correction, instead waiting for the price to fall into their preferred buying zones. The Bitcoin Cost Basis Distribution Heatmap shows the star token has dropped into a major whale accumulation zone.

The Glassnode data highlights where a large amount of supply last moved. According to the chart, heavy whale cost-basis clusters sit between $83,000 and $88,000, meaning whales are likely preparing to accumulate again if the price stays in this region. The most compelling signal isn’t where whales bought before, but it’s what they are doing now. The latest part of the heatmap shows a new cluster forming near the recent lows, suggesting the whales could begin to accumulate again.

This behavior aligns with previous accumulation cycles, where whales steadily buy into weakness while retail holds back.

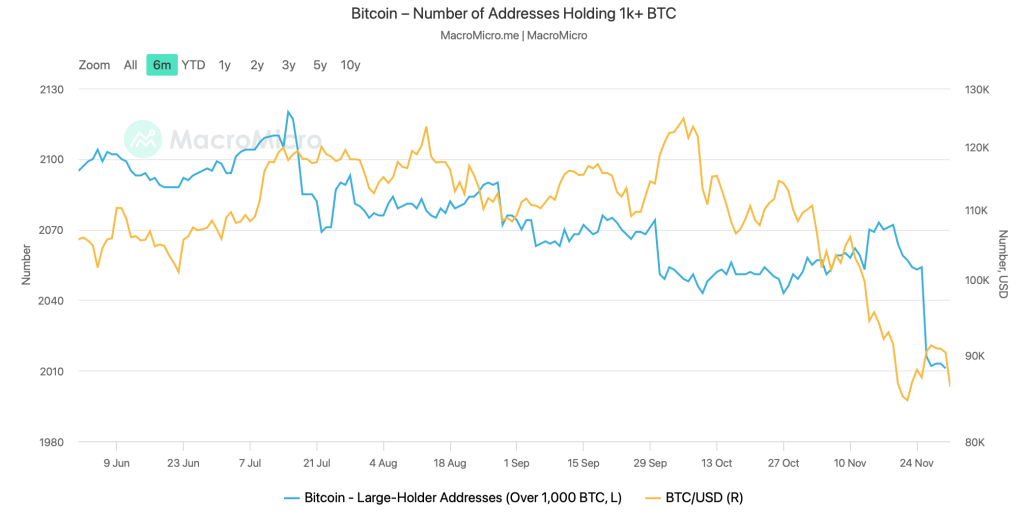

The above chart suggests the whales may have begun to accumulate again, but the whale address indicates the action is yet to start. The addresses holding more than 1000 Bitcoin faced a significant downfall just before the current pullback. Presently, the levels have stabilized, but a rise in the total BTC held by large wallets may trigger a strong recovery in the Bitcoin price.

If accumulation continues in this zone, Bitcoin may be forming a structural bottom. Historically, whale cost-basis layers act as springboards once the market stabilizes and liquidity returns. A resumption of buying in this band typically precedes:

- a reduction in selling pressure,

- a gradual reclaim of resistance levels, and

- a medium-term trend reversal.

If this chart begins to trend upward again, it means whales are actively buying the dip—historically a strong bullish signal.

The current pullback has validated the bearish pressure on the token, as the BTC price has confirmed its third lower high and low following a rejection at the ATH. Despite multiple attempts, the bulls have failed to initiate a recovery above $87,000. This suggests BTC price is prone to more deeper correction in the next few days, which may break the $80,000 support range.

As seen in the above chart, the RSI surged from the overbought zone but is preparing to enter back into the same range. However, the Chaikin Money Flow (CMF) has displayed a bullish divergence, despite being within the negative range, indicating a significant influx of liquidity. Moreover, the Bollinger bands have also begun to squeeze, suggesting the token is preparing for a big move.

Therefore, in the coming days, one can expect the Bitcoin (BTC) price to touch the support at $82,918 that may initiate a recovery. However, a strong whale accumulation and bullish activity may only reinstate the Bitcoin bull run, and until then, the token may continue to form lower highs and lows.