Sony’s stablecoin is redefining the boundaries between traditional banking and commercial sectors

- Sony Bank plans to launch a USD-pegged stablecoin by 2026 to streamline payments in its gaming/anime ecosystem, reducing credit card fees and expanding Web3 presence. - The stablecoin, issued via Connectia Trust's U.S. banking charter and Bastion's blockchain, targets U.S. customers (30% of Sony's sales) for digital content transactions. - Regulatory challenges persist as ICBA criticizes the model for blurring banking-commerce lines, while Sony's Japan Web3 initiatives, including yen-pegged stablecoin pr

Sony Bank Plans U.S. Dollar Stablecoin Launch

Sony Bank, the financial division of Sony Group, is preparing to introduce a stablecoin tied to the U.S. dollar in the American market, with a potential rollout as soon as fiscal year 2026. This new digital currency is designed to simplify transactions within Sony’s gaming and anime platforms, aiming to lower the fees typically incurred through credit card payments and to strengthen Sony’s presence in the Web3 space.

The stablecoin will be issued through Connectia Trust, a Sony subsidiary that applied for a U.S. banking charter in October. Bastion, a blockchain infrastructure provider, will support the project’s technical foundation.

Enhancing Payments for U.S. Customers

This stablecoin is intended to streamline purchases for PlayStation titles, anime streaming services, and other digital offerings, specifically targeting Sony’s U.S. user base, which represents about 30% of the company’s international sales. By adopting blockchain-based payments, Sony aims to avoid the high costs of traditional card networks, especially for cross-border transactions. The initiative is part of Sony Bank’s broader exploration of blockchain, including the upcoming launch of its own Ethereum Layer 2 network, Soneium, scheduled for January 2025.

Regulatory Challenges and Industry Response

Despite its ambitions, the project faces scrutiny from regulators. The Independent Community Bankers of America (ICBA) has voiced concerns over Sony’s application for a national crypto bank charter, arguing that Connectia Trust’s approach could blur the lines between commerce and banking, potentially disadvantaging community banks. Nevertheless, Sony Bank’s collaboration with Bastion—a company backed by Coinbase Ventures—demonstrates its commitment to building a compliant and scalable stablecoin solution.

Expanding Stablecoin Market

The U.S. stablecoin sector, already exceeding $306 billion in value, is experiencing rapid growth, with established names like Tether (USDT) and Circle (USDC) leading the market. Sony’s planned entry coincides with a global surge in demand for dollar-backed stablecoins, with projections indicating that inflows from emerging market banks could surpass $1 trillion by 2028. This move positions Sony to meet the increasing need for reliable and affordable digital payment options, especially in entertainment and gaming.

Web3 Initiatives in Japan

Sony Bank’s Web3 strategy extends beyond the United States. In June 2025, the company launched BlockBloom, a subsidiary dedicated to integrating blockchain technology into fan communities, including NFT projects and hybrid digital currencies. This aligns with Japan’s broader efforts to foster a yen-backed stablecoin ecosystem, with regulators recently approving initiatives like JPYC and encouraging partnerships among leading banks.

Looking Ahead

The ultimate success of Sony’s stablecoin will depend on regulatory clearance, user acceptance, and the company’s ability to compete with established stablecoin providers. If successful, this initiative could play a pivotal role in connecting traditional finance with the Web3 world, particularly in sectors such as gaming and entertainment where efficient, low-cost transactions are essential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin: Bad News from ETFs

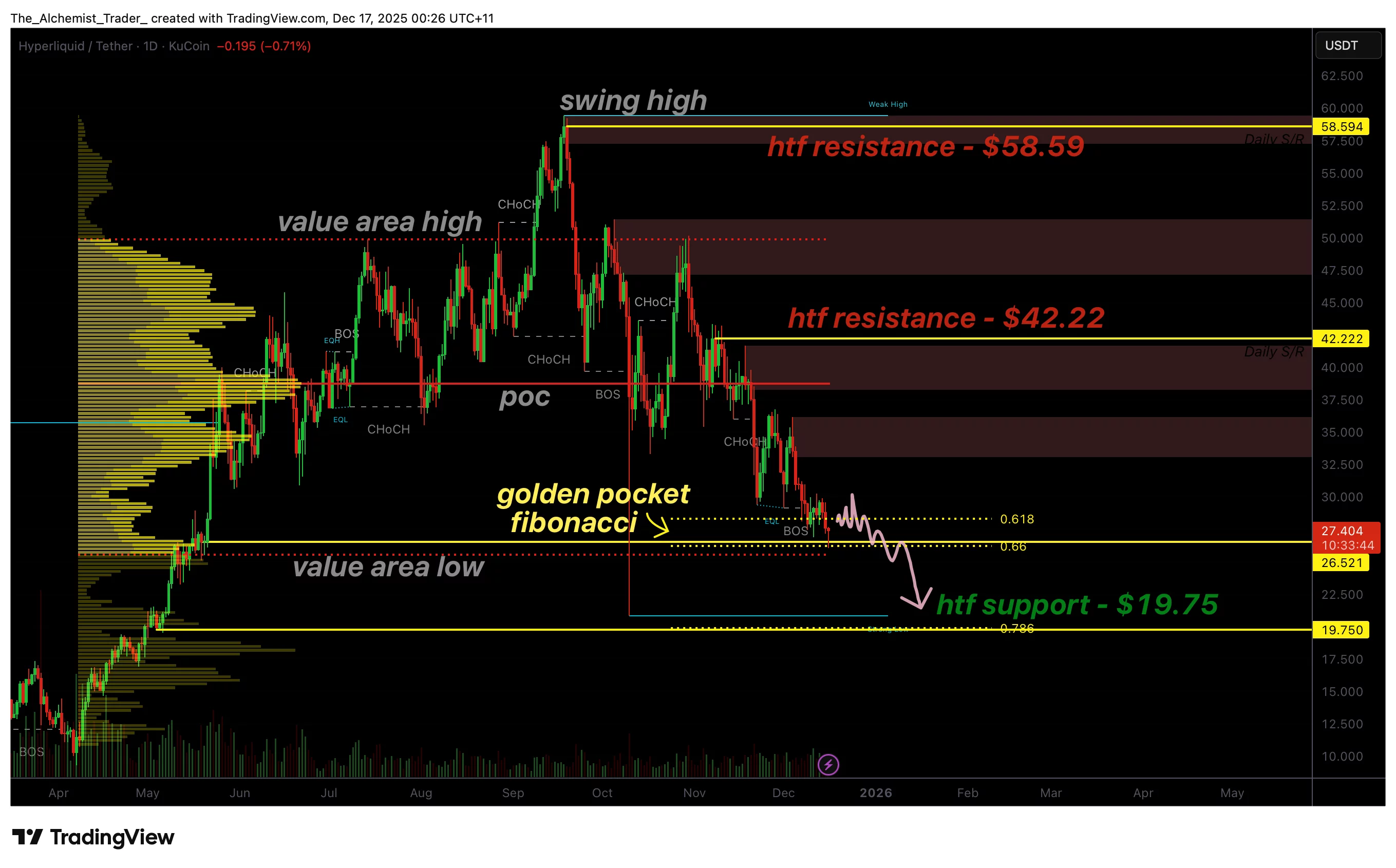

HyperLiquid price bounces at golden pocket, but downside risk remains

DEX users keep full custody as smart contracts replace exchange middlemen