Société Générale: The Federal Reserve will cut rates two more times next year, and U.S. Treasury yields still have room to fall

According to ChainCatcher, citing Golden Ten Data, interest rate strategists at Société Générale stated in a report that upcoming economic data will continue to show the resilience of the US economy, sticky inflation, and a slight deterioration in labor market conditions. Nevertheless, they expect the Federal Reserve to cut rates at the December meeting, followed by two more rate cuts next year. By the end of 2026, they anticipate the yield on two-year US Treasury bonds will steadily decline to 3.2%, while the yield on ten-year Treasury bonds will fall to 3.75%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Kobeissi Letter: A new round of liquidity has arrived

SEC Chairman Paul Atkins warns that cryptocurrency could become a financial surveillance tool

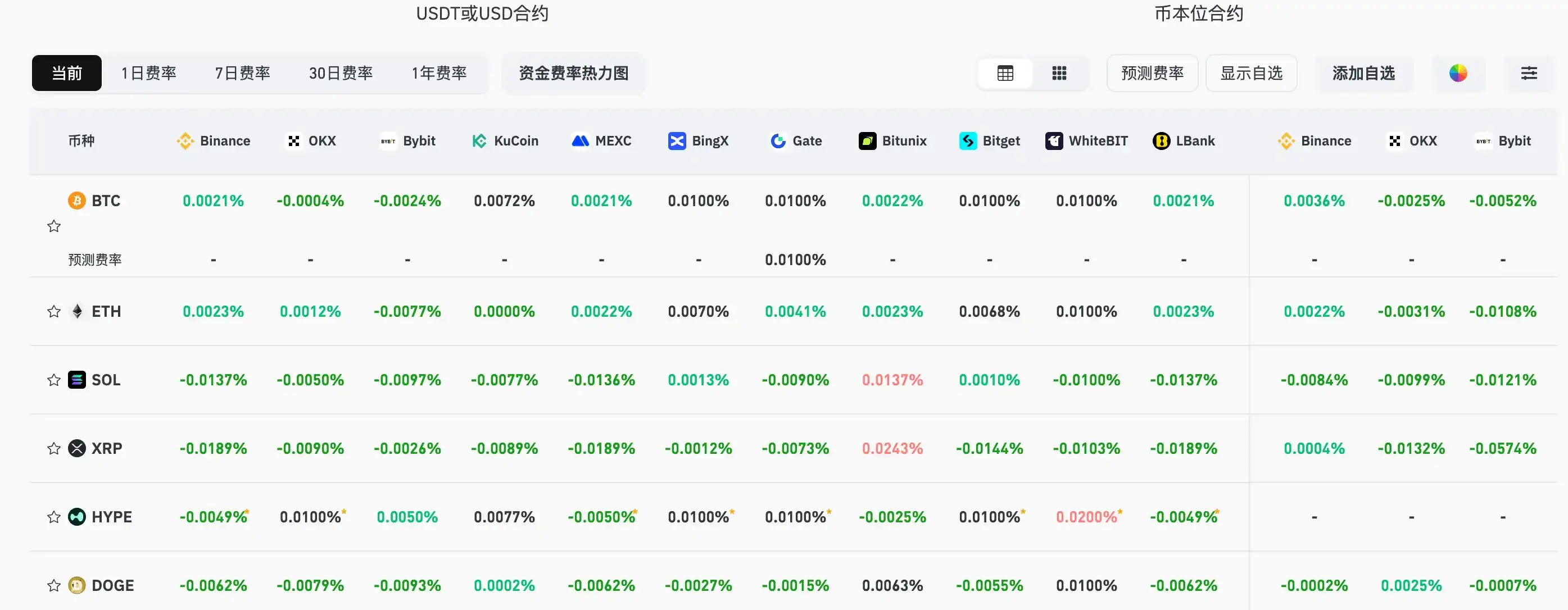

Data: Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish