November Was Bitcoin’s Second Worst Month In 2025

Bitcoin decline was driven by heavy ETF outflows, macroeconomic pressure from tariffs and the US government shutdown, and a spike in short-term holder losses.

Bitcoin is on track to post its second-worst monthly performance of the year after falling 17.28% in November. According to CoinGlass data, that places it just behind February’s 17.39% decline.

Notably, the drop also marks Bitcoin’s steepest November slide since 2022, when it lost 16.23% of its value.

Why Bitcoin Price Struggled This November

According to BeInCrypto data, Bitcoin opened November near $110,000 after a volatile October that delivered a record high of $126,000 but also erased about $20 billion in market value.

The selloff had begun after Donald Trump expanded tariffs on China on October 10, prompting a broad reassessment of risk across global markets.

The choppiness persisted into November, and the record US government shutdown further exacerbated it by tightening liquidity across traditional markets.

Apart from the macroeconomic conditions, BTC was also affected by weakening institutional flows.

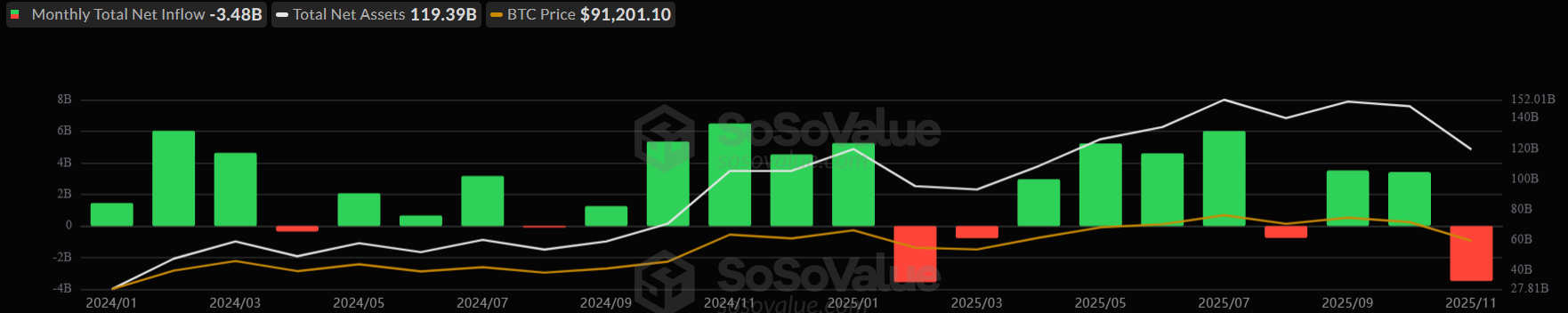

According to SoSo Value data, Bitcoin ETFs recorded $3.48 billion in outflows in November. This marks the second-largest monthly outflow since the products launched in 2024.

US Bitcoin ETFs Monthly Flows Since Launch. Source:

SoSo Value

US Bitcoin ETFs Monthly Flows Since Launch. Source:

SoSo Value

This outflow trend began quietly in the second half of October. However, it accelerated in November as global markets digested the broader macroeconomic conditions, reducing one of the asset’s most reliable sources of demand.

At the same time, the market stress was amplified by short-term investor capitulation.

According to Glassnode, the realized loss of short-term holders surged, with the 7-day EMA rising to $427 million per day. That level is the highest recorded since November 2022.

The realized loss of short-term holders has surged, with the 7D-EMA reaching $427M/day, the highest level since Nov 2022.Panic selling is elevated & clearly rising, now exceeding the loss levels seen at the last two major lows of this cycle.📉

— glassnode (@glassnode) November 18, 2025

At the time, BTC panic selling was rife, resulting in losses similar to those observed at the previous two major lows of this cycle.

The data suggests that reactive selling, rather than long-term distribution, was the defining pressure point for Bitcoin’s recent decline.

Due to the convergence of these points, BTC’s price briefly fell to a seven-month low of under $80,000 during the month, before rebounding to $90,773 at press time.

This price performance reflected both external pressures and the accumulation of structural stress in the crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Rise of a Governed Clean Energy Marketplace: REsurety's CleanTrade and the Next Chapter in Sustainable Finance

- CFTC's 2025 approval of REsurety's CleanTrade platform establishes the first regulated market for financially-settled clean energy contracts. - The platform addresses market fragmentation by standardizing VPPAs and RECs, enabling institutional-grade trading with real-time pricing and risk analytics. - Rapid adoption ($16B notional value in two months) demonstrates demand for scalable, transparent green finance solutions that reduce counterparty risks. - By converting complex VPPAs into tradable assets, C

Solana’s Uptake Among Institutions and Recent Market Fluctuations: Reasons to Trust in Its Long-Term Potential

- Solana secures institutional validation via JPMorgan's $50M Solana-based commercial paper and Bhutan's gold-backed TER token, signaling cross-sector adoption. - Technical upgrades like Firedancer and consensus algorithm enhancements boost scalability, outpacing Ethereum while maintaining cost efficiency and sustainability. - Q2 2025 revenue ($271M) and $7.14B trading volume post-Bhutan deal highlight Solana's market dominance despite $130–$145 short-term volatility amid macroeconomic uncertainty. - JPMor

BrightView’s Approach to Growth in the Changing Landscaping Industry: Harnessing Infrastructure and Sustainable Practices

- BrightView leverages infrastructure and sustainability to lead the evolving landscaping sector. - Its 2025 initiatives include smart irrigation (30% water savings) and 17% electric fleet expansion, aligning with UN SDGs and SASB standards. - IoT/AI tools boost efficiency, while 2025 EBITDA rose 8.5% to $352. 3M , supporting $300M fleet upgrades and $150M share buybacks. - Client diversification (83% retention) and niche markets (e.g., solar-powered senior living) strengthen market reach and client loyalt

Retirement Preparation and Portfolio Longevity for Wealthy Individuals: Harmonizing Emotional Preparedness with Financial Stability

- High-net-worth individuals (HNWIs) face a critical gap between financial preparedness (92% with advisors) and emotional readiness (11% deemed ready by advisors) for retirement. - Studies reveal 74% of HNWIs work with advisors, yet 49% admit their financial planning needs improvement, highlighting misaligned confidence and actual preparedness. - Portfolio sustainability strategies like diversified alternative assets (10% CAGR) and tax-efficient tools (Roth conversions, annuities) address inflation risks w