XRP ETFs Record $643 Million in Net Inflows in First Month as Demand Surges

XRP ETFs recorded $643.92 million in net inflows during their first month, marking a strong debut for the new products. Trading remained active as institutional demand continued to build across major issuers.

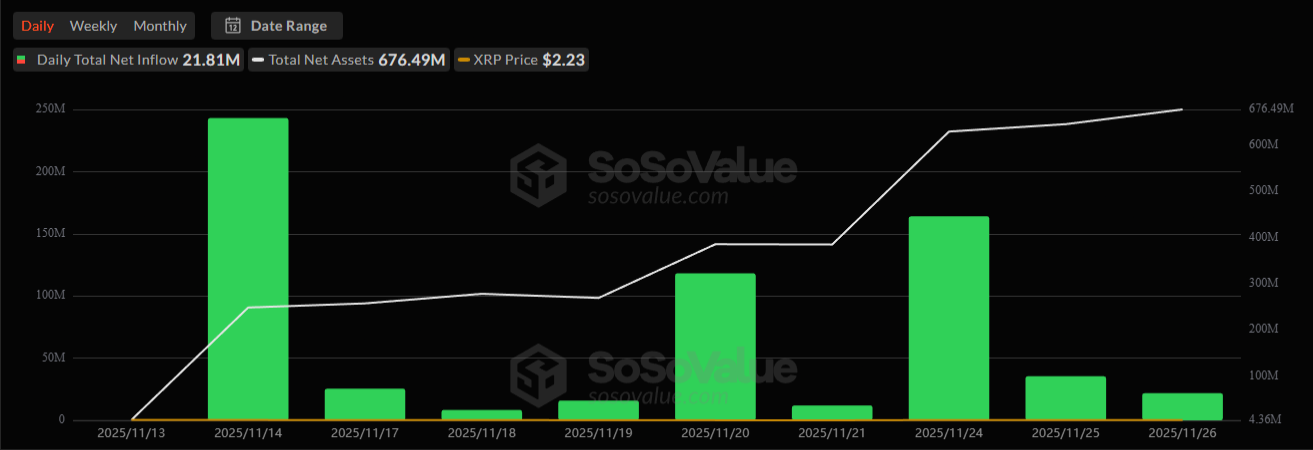

XRP spot ETFs recorded $643.92 million in cumulative net inflows during their first month of trading, according to SoSoValue data. The products also reached $676.49 million in total net assets, capturing 0.50% of XRP’s market capitalization.

Daily inflows remained positive for most of the month. The strongest sessions included $243.05 million on November 14 and $164.04 million on November 24.

Trading Volume Resilient Despite XRP Price Volatility

The leading issuers—Grayscale, Franklin Templeton, Bitwise, and Canary—collectively drove steady inflows across US exchanges.

Together, the four funds brought ETF-held XRP above 0.5% of total circulating supply, indicating early institutional interest.

XRP ETFs Total Net Assets. Source:

SoSoValue

XRP ETFs Total Net Assets. Source:

SoSoValue

The ETFs generated a total value of $38.12 million in trading on November 26 alone. Trading volumes earlier in the month were higher, coinciding with large inflow spikes.

However, XRP’s market price remained volatile. The token traded around $2.23 as ETF demand offset wider crypto-market weakness.

Meanwhile, other major asset managers are looking to enter the XRP ETF race. 21Shares is expected to launch its spot ETF on Monday as WisdomTree’s application remains under review.

Early Signs Point to Sustained Institutional Demand

ETF inflows increased on nine of the past ten sessions. The most recent daily total showed $21.81 million entering XRP ETFs on November 26.

This inflow streak suggests institutions are still building exposure. It also reduces liquid supply on exchanges, as ETF custodians move XRP into regulated storage.

XRP ETFs Daily Inflows. Source: SoSoValue

XRP ETFs Daily Inflows. Source: SoSoValue

Franklin Templeton disclosed 32.04 million XRP held in its ETF by November 25, signalling continued accumulation.

This steady inflow pattern in the first month is positive for new crypto ETFs and reflects improved regulatory clarity for XRP products.Meanwhile, XRP wasn’t the only altcoin to receive an ETF greenlight over the past week. Dogecoin, HBAR, and Litecoin spot ETFs also started trading earlier this month.However, these funds did not receive any notable interest from institutional investors. Bitwise and Grayscale’s DogeCoin ETF only attracted around $2 million in inflows in their first 48 hours of trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Price Forecast Post-Listing: Understanding Institutional Attitudes and Market Fluctuations

- KITE's post-IPO price fell 63% by Nov 2025 amid divergent institutional strategies and retail sector uncertainty. - Analysts split between "Buy" ($30 target) and "Hold" ratings, citing operational gains vs. macro risks like the $3.4T deficit bill. - Q3 net loss (-$0.07 EPS) and 5,400% payout ratio highlight structural risks despite industrial real estate pivots and 7.4% dividend hike. - Institutional trading directly impacted price swings, with COHEN & STEERS' stake increase briefly stabilizing shares be

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook