Analyst Forecasts Major Solana Breakout in 2026, Updates Outlook on Bitcoin, Ethereum and BONK

A widely followed trader believes Solana ( SOL ) may be gearing up for massive rallies after retesting the $120 level.

The pseudonymous analyst Inmortal tells his 235,200 followers on X that Solana may experience a parabolic rally similar to what Ethereum ( ETH ) did earlier this year.

“Different structure, similar vibes.”

Source: Inmortal/X

Source: Inmortal/X

ETH went from about $1,550 in April to about $4,900 in September, a more than 216% gain.

The analyst also says that Solana’s $120 level has consistently acted as a support level during market corrections.

“This level has provided support for more than 600 days.”

Source: Inmorta/X

Source: Inmorta/X

Solana is trading for $138 at time of writing, up 1.2% on the day.

Next up, the trader says that Bitcoin ( BTC ) may chop around for months before having an explosive move to new all-time highs around $150,000.

“Imagine.”

Source: Inmortal/X

Source: Inmortal/X

Bitcoin is trading for $88,679 at time of writing, up 1.3% in the last 24 hours.

The trader also says that the meme token Bonk ( BONK ) may be forming a local bottom at a key level around $0.00000900, indicating a potential bullish reversal.

“You only see this type of charts one to two times per year.”

Source: Inmortal/X

Source: Inmortal/X

BONK is trading for $0.000009555 at time of writing, down 1.9% in the last 24 hours.

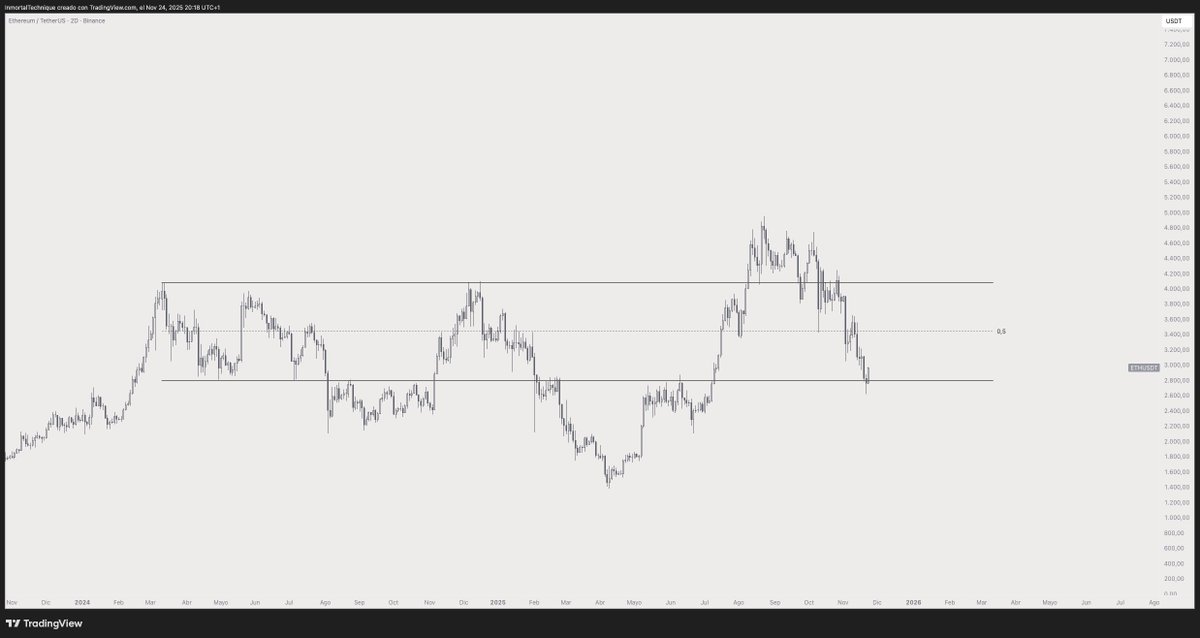

Lastly, the trader predicts that Ethereum ( ETH ) will soon surge more than 18% from its current value, after bouncing off the lower bound of a trading range at around $2,800.

“$3,500: ETH.”

Source: Inmortal/X

Source: Inmortal/X

ETH is trading at $2,963 at time of writing, up about 1% on the day.

Featured Image: Shutterstock/Vink Fan/Natalia Siiatovskaia

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik Buterin's Latest ZK-Focused Statement and What It Means for Layer 2 Scaling

- Vitalik Buterin's ZKsync endorsement triggered a 143% $ZK token surge, redefining Ethereum's Layer 2 scalability with ZK technologies as the cornerstone. - ZKsync's Atlas upgrade achieved 43,000 TPS with sub-second finality, while Kohaku/Lighter frameworks reduced proof costs by 50x, accelerating industry-wide ZK adoption. - Institutional adoption (Deutsche Bank, Sony) and $28B+ TVL growth highlight ZK's market potential, with ZKP market projected to reach $7.59B by 2033 at 22.1% CAGR. - Zcash (ZEC) and

The Influence of ZKsync’s Vitalik-Endorsed Scaling Technology on Ethereum’s Prospective Supremacy

- Vitalik Buterin's 2025 endorsement of ZKsync positions zero-knowledge proofs as Ethereum's scalability solution, enhancing transaction throughput to 15,000 TPS with near-zero fees. - Institutional partnerships, including Deutsche Bank's DAMA 2 and Sony's supply chain solutions, demonstrate ZKsync's enterprise-grade scalability and RWA integration. - ZKsync's 43,000 TPS (post-Atlas) and $15B institutional capital outpace Arbitrum's 45% TVL, signaling a shift toward privacy-centric, enterprise-focused bloc

The Influence of Institutional Strategists on the Evolution of Long-Term Investment Patterns

- Thomas Sowell's analysis of market signals and decentralized systems shapes institutional investors' strategies to avoid policy-distorted markets. - His critiques of rent control and centralized interventions inform avoidance of regulated real estate and subsidy-dependent sectors like renewables. - The Hoover Institution amplifies Sowellian principles through data-driven policy advocacy, aligning with conservative investment frameworks prioritizing market-tested solutions. - While direct case studies are

ASTER Trades at $0.9562 After Trend Line Break Signals Stronger Momentum