BitMine Stock Pulls Back 7% as Recovery Doubts Grow; Charts Hint at Deeper Weakness

BitMine (BMNR) is trading near $29, down almost 7% after a sharp 15% jump that came around its large Ethereum purchase. The bounce helped stabilise sentiment for a moment, but the latest BitMine price pullback shows the recovery is still fragile. Both big-money flow and trend signals suggest the rally has not earned enough confirmation

BitMine (BMNR) is trading near $29, down almost 7% after a sharp 15% jump that came around its large Ethereum purchase. The bounce helped stabilise sentiment for a moment, but the latest BitMine price pullback shows the recovery is still fragile.

Both big-money flow and trend signals suggest the rally has not earned enough confirmation yet.

Weak Money Flow and Looming Crossovers Limit the Rebound

The Chaikin Money Flow (CMF), which tracks whether large buyers are supporting the price, still trades below zero and under a descending trendline. This means money flowing into BMNR is weak, even though the company continues to buy Ethereum in size.

This is key because every time CMF has approached this trendline and the zero line over the past two months, BMNR has staged a short bounce that later failed. The only time a rally held came in late September, when CMF broke above zero. That move pushed the stock 39% higher.

Big Money Flow Weakens:

TradingView

Big Money Flow Weakens:

TradingView

Right now, CMF is nowhere near repeating that signal. Until it breaks both the trendline and the zero line, recovery hopes remain weak.

Trend pressure is also building. Two bearish crossovers are forming:

- The 50-day EMA is closing in on the 100-day EMA, and

- The 20-day EMA is closing in on the 200-day EMA.

EMA crossovers track average price trends. Similar crossovers on November 3 and November 14 triggered declines of 17% and 29%.

Bearish Crossovers Loom on BMNR:

TradingView

Bearish Crossovers Loom on BMNR:

TradingView

With BMNR also exposed to Ethereum swings due to its heavy ETH holdings, this adds another layer of downside risk. If ETH weakens, it can amplify the impact of these crossovers when they form.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

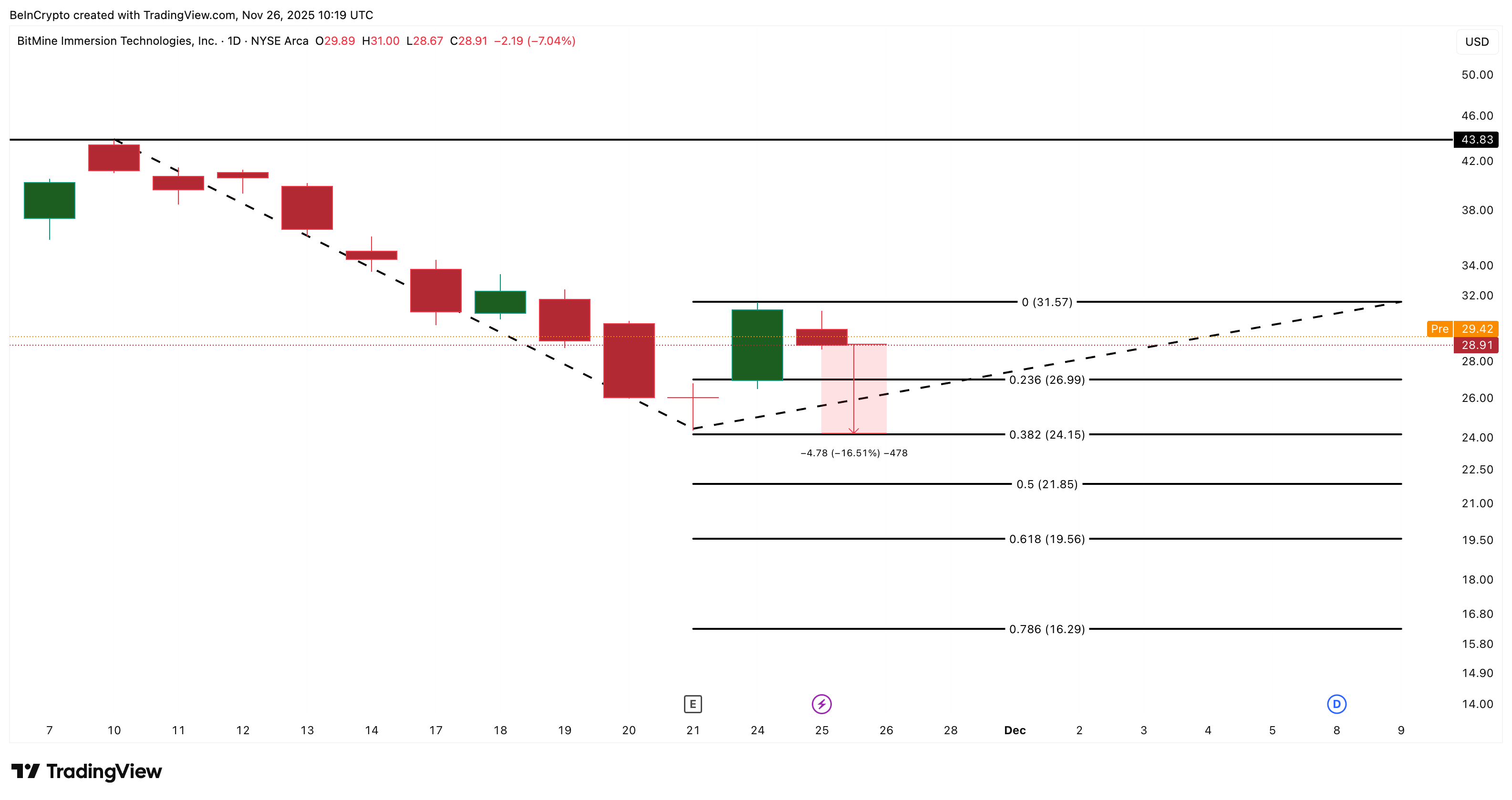

BitMine Price Levels Show Why the Bounce Remains Fragile

On the price chart, the BMNR price failed to reclaim $31.57, a similar level highlighted earlier as the first sign of real strength. The BitMine price moved close but could not close above it, reinforcing that buyers are not in control.

As long as BMNR stays below $31.57, the bearish scenario stays active.

Key downside levels now sit at:

- $26.99 (23.6% Fib)

- $24.15 (38.2% Fib, stronger support)

If both these levels break, the BitMine price might even head towards $16.29.

BitMine Price Analysis:

TradingView

BitMine Price Analysis:

TradingView

These supports show why the recovery remains uncertain. Without a CMF breakout and a close above $31.57, BitMine’s bounce will continue to face resistance, and the charts leave room for a deeper pullback.

However, a clean close above $31.57 can invalidate the bearish case for now and can even push the BitMine price towards $43.83. But that would require Ethereum to show strength as well.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Abrupt 50% Decline in SOL Value: Was This a Market Adjustment or a Total Crash?

- Solana (SOL) faced a 50% price drop in November 2025, sparking debates over whether it signaled a temporary correction or deeper collapse. - Fundamentals showed mixed signals: falling TVL and validator counts, but strong institutional inflows ($101.7M net ETF inflows) and rising DEX activity. - Retail panic ($19B liquidations) and bearish technical indicators (broken $140 support) contrasted with institutional confidence in Solana's infrastructure. - Analysts highlighted the critical $80B market cap supp

Internet Computer's Value Rises: On-Chain Growth and Ecosystem Enhancements Drive Sustainable Gains

The Emergence of a Governed Clean Energy Market and Its Influence on Institutional Investors

- CleanTrade secures CFTC SEF approval, enabling transparent clean energy trading akin to traditional markets. - Platform facilitates $16B in transactions by centralizing VPPAs/PPAs/RECs, reducing counterparty risks for institutional investors. - Global clean energy investment ($2.2T) now outpaces fossil fuels ($1.1T), driven by cost-competitive solar and policy support. - Clean energy markets show growing independence from oil prices while maintaining crisis resilience seen during pandemic recovery. - CFT

Bitcoin Faces Regulatory Turning Point in November 2025: Institutional Integration and Compliance Obstacles

- In November 2025, Bitcoin faces regulatory crossroads as U.S. SEC approves spot ETFs and EU MiCA harmonizes crypto rules, accelerating institutional adoption. - 68% of institutional investors now allocate to Bitcoin ETPs, driven by GENIUS Act clarity and infrastructure advances, signaling strategic asset-class integration. - Compliance challenges persist due to fragmented enforcement, with MiCA passporting inconsistencies and U.S. stablecoin audit requirements complicating cross-border operations. - Futu