Five Days, Zero Inflows: Litecoin ETF Struggles to Break $7.44 Million

The only Litecoin ETF (exchange-traded fund) available in the US has seen zero net inflows for five straight trading days, highlighting a stark lack of investor interest since its October 2025 debut. The Canary Litecoin ETF ranks among the weakest performers of newly approved crypto ETFs, lagging well behind funds focused on XRP and Solana.

The only Litecoin ETF (exchange-traded fund) available in the US has seen zero net inflows for five straight trading days, highlighting a stark lack of investor interest since its October 2025 debut.

The Canary Litecoin ETF ranks among the weakest performers of newly approved crypto ETFs, lagging well behind funds focused on XRP and Solana.

Litecoin ETF Fails to Gain Traction

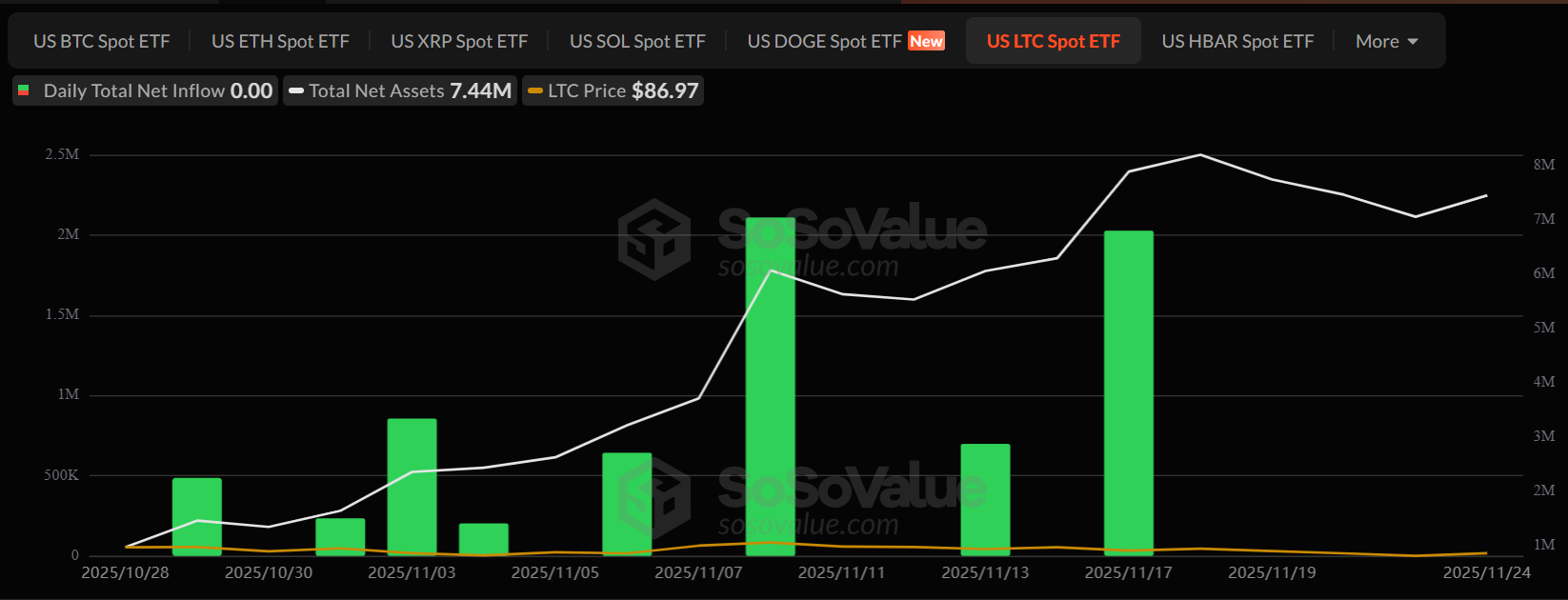

According to data, the Canary Litecoin Spot ETF (LTCC) has posted $0.00 in daily net inflows over the last five trading days as of November 25, 2025.

Its net assets stand at just $7.44 million, while cumulative net inflows since its October 28, 2025, launch reach only $7.26 million.

Canary Litecoin ETF. Source:

Canary Litecoin ETF. Source:

The ETF’s total traded value remains low at $747,600, showing very limited market activity. This stagnation occurs as Litecoin trades at $84.94, down sharply from earlier in the year.

Litecoin (LTC) Price Performance. Source:

Litecoin (LTC) Price Performance. Source:

The lack of interest raises questions about whether institutional and retail investors see Litecoin as a compelling investment right now.

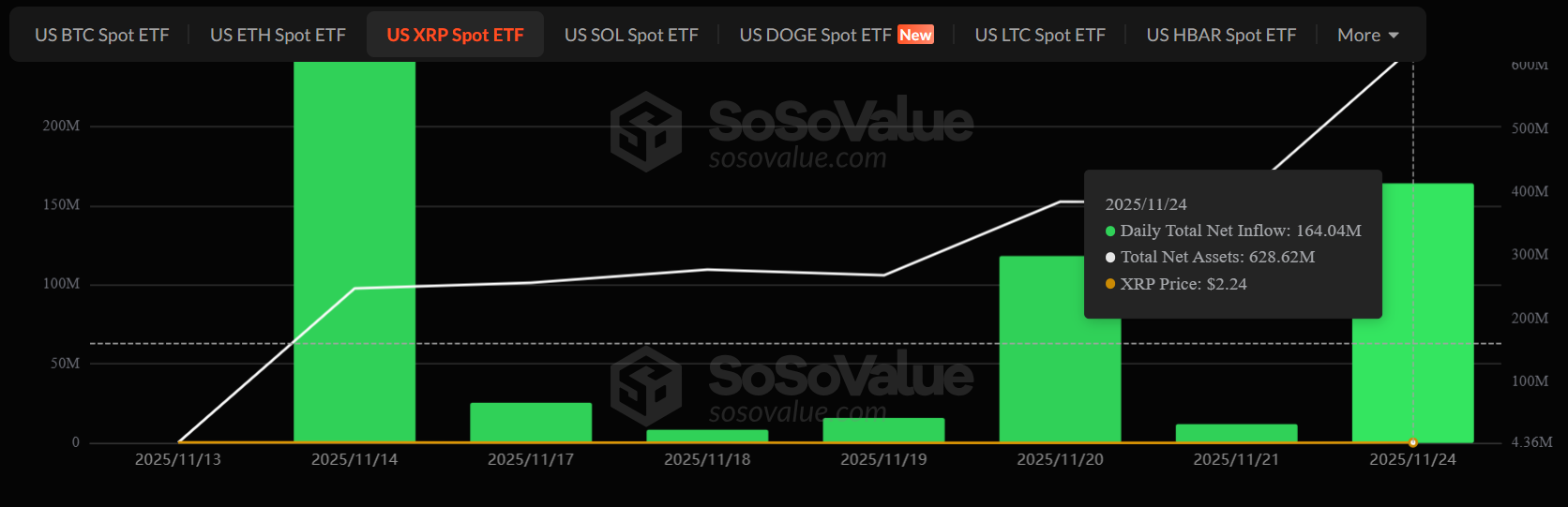

In contrast, other crypto ETFs have attracted far more attention. XRP ETFs saw single-day net inflows of $164 million, as noted by SoSoValue.

XRP ETF. Source:

XRP ETF. Source:

Meanwhile, Solana ETFs have garnered almost $570 million in net inflows since launch, while XRP ETFs have accumulated $586 million. Notably, neither fund has recorded a single day of outflows since its debut.

This disparity reveals a growing gap in investor sentiment across digital asset products. While new ETFs show strong institutional demand, the Litecoin ETF remains mostly ignored.

Corporate Holder Sees Major Unrealized Loss

While the ETF’s performance is disappointing, Litecoin’s largest public corporate holder is also experiencing heavy unrealized losses.

Lite Strategy (LITS), previously known as MEI Pharma, holds 929,548 LTC worth $79.33 million or 1.214% of the total Litecoin supply.

The company purchased these tokens for $100 million, an average of $108 each, resulting in a $20.67 million unrealized loss, or 20.7%.

Lite Strategy shifted its focus from pharmaceuticals to cryptocurrency, making Litecoin its primary reserve asset. Charlie Lee, Litecoin’s creator, now serves as a non-executive director on the company’s board.

Despite this high-profile association, Lite Strategy’s declining holdings reflect ongoing challenges in broader Litecoin adoption.

The company’s current market cap is $67.33 million and its stock price stands at $1.83. Its corporate bet on Litecoin has yet to yield results, mirroring the low enthusiasm seen in ETF activity.

Upcoming ETFs Could Shift the Market

Investors hope that new Litecoin ETF launches might revive interest. Three additional funds are awaiting regulatory approval and trading:

- Grayscale Litecoin ETF,

- CoinShares Litecoin ETF, and

- REX-Osprey Litecoin ETF.

Grayscale filed in January 2025 to convert its Litecoin Trust, now managing $163.88 million, into a spot ETF. CoinShares also filed for Nasdaq spot exposure that month.

The arrival of these established managers could add competition, benefiting the asset class. Grayscale is the largest crypto-focused asset manager by assets under management as of October 2025, and its involvement adds significant credibility. More ETF options may also improve liquidity and price efficiency.

However, it remains unclear whether these new products can lift demand. The Canary ETF’s stretch of zero inflows suggests persistent investor skepticism about Litecoin’s role compared with other digital assets.

The cryptocurrency faces strong competition from Bitcoin as a store of value, Ethereum’s smart contracts, and newer blockchains offering unique features.

Investor Views: Room for Optimism?

Despite weak ETF activity and corporate losses, some investors remain hopeful for Litecoin’s future. Market analysts have predicted ambitious targets, suggesting prices could hit four-digit levels this cycle.

For example, one technical analyst has laid out a bullish long-term outlook, citing $1,000 to $2,000 as feasible goals.

These projections are based on historical patterns and Elliott Wave theory but differ greatly from current conditions in ETF flows and major institutional holdings.

The ongoing divide between optimistic retail traders and cautious institutions remains a challenge for Litecoin.

The next few months may be telling, as future ETF decisions and possible technical breakouts could converge. For now, the Canary ETF’s stagnation reflects today’s investor priorities within the cryptocurrency sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Price Forecast Post-Listing: Understanding Institutional Attitudes and Market Fluctuations

- KITE's post-IPO price fell 63% by Nov 2025 amid divergent institutional strategies and retail sector uncertainty. - Analysts split between "Buy" ($30 target) and "Hold" ratings, citing operational gains vs. macro risks like the $3.4T deficit bill. - Q3 net loss (-$0.07 EPS) and 5,400% payout ratio highlight structural risks despite industrial real estate pivots and 7.4% dividend hike. - Institutional trading directly impacted price swings, with COHEN & STEERS' stake increase briefly stabilizing shares be

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook