Date: Thu, Nov 20, 2025 | 09:30 AM GMT

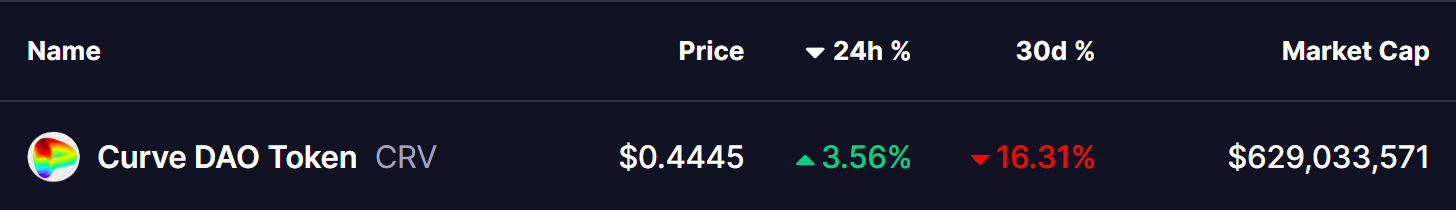

The broader altcoin market continues to face strong headwinds as Ethereum (ETH) extends its 30-day decline past 22%. This ongoing weakness has put pressure on several major assets , including Curve DAO Token (CRV), which has fallen nearly 16% during the same period.

Even so, today’s mild recovery has brought a fresh development onto the chart — a harmonic structure that could potentially shift sentiment in favour of buyers. A possible trend-reversal formation is now emerging, hinting that CRV may be preparing for a notable rebound if key levels continue to hold.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Signals More Upside

On the daily timeframe, CRV is developing a Bearish Butterfly harmonic pattern — a setup known for pushing the price higher during the movement toward its final D-point. While the major reversal often takes place at the PRZ, the climb leading into this zone typically offers bullish momentum and recovery phases.

The structure began forming at Point X around $0.5968, followed by a sharp dip into Point A, a bounce into Point B near the 0.763 Fibonacci retracement, and finally a drop to Point C at $0.3991. This C-zone has now emerged as the anchor of the entire formation, holding price steady even during broader market weakness.

Curve DAO Token (CRV) Daily Chart /Coinsprobe (Source: Tradingview)

Curve DAO Token (CRV) Daily Chart /Coinsprobe (Source: Tradingview)

From this support, CRV has shown its first signs of stabilization. The token is currently trading near $0.4447, indicating early movement in the potential CD-leg — though more confirmation is still required for a strong upside continuation.

What’s Next for CRV?

The most critical factor in the short term is the continued defense of the C-support region around $0.3991. As long as CRV stays above this level, the harmonic structure remains valid, and the probability of a bullish CD-leg increases.

If buyers maintain momentum from this zone, the next key test arrives at the 40-day moving average near $0.4975. Reclaiming this dynamic resistance would provide the chart with a far stronger bullish signal, suggesting that the reversal structure is gaining traction.

Should CRV extend its upward leg, the path leads toward the Potential Reversal Zone between $0.6537 (1.272 Fibonacci extension) and $0.7260 (1.618 extension). This is the region where the Butterfly pattern typically completes and where price often faces significant resistance or trend exhaustion.

However, if CRV fails to hold above $0.3991, the pattern risks invalidation. Such a breakdown could trigger deeper downside exploration before any meaningful recovery attempt emerges.