Pi Coin Price Rises 10% As Capital Inflows Jump to 6-Week High

Pi Coin rallies 10% as inflows spike sharply, RSI rises, and investors push the asset toward a potential breakout above key support.

Pi Coin is gaining strong traction after a sharp 10% price increase that lifted the token to a weekly high. The recent rise reflects renewed investor confidence and improving market conditions.

Strengthening demand and accelerating inflows continue to support Pi Coin’s upward movement, signaling momentum that could extend in the near term.

Pi Coin Is Picking Up Capital

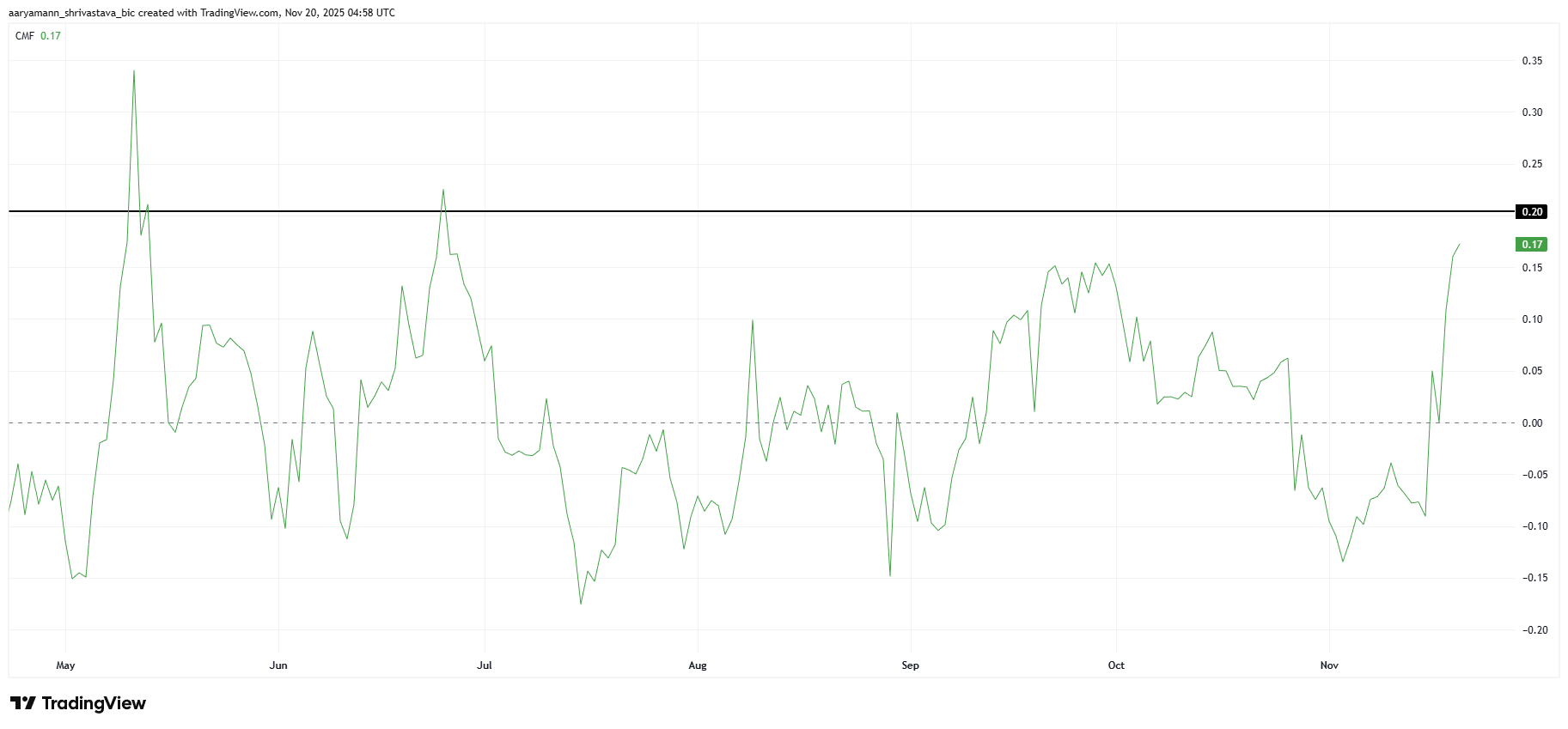

Market sentiment has strengthened notably, with the Chaikin Money Flow showing a sharp rise over the past few days. CMF measures capital flows, and a move into positive territory signals increasing inflows. Pi Coin’s CMF is climbing quickly, suggesting that investors are actively adding liquidity to the asset.

This uptick reflects growing confidence in Pi Coin’s short-term outlook. As inflows increase, the buying pressure strengthens. Investors appear motivated by improving conditions and are positioning themselves for continued gains.

Pi Coin CMF. Source:

TradingView

Pi Coin CMF. Source:

TradingView

Macro momentum indicators are also aligning with Pi Coin’s bullish trend. The Relative Strength Index is observing a steady uptick, showing rising demand and stronger upward momentum. A rising RSI often suggests that buyers are gaining control and driving sustained appreciation.

This strengthening momentum is crucial for supporting ongoing growth. As broader market sentiment improves, Pi Coin may continue benefiting from increased risk appetite across altcoins.

Pi Coin RSI. Source:

TradingView

Pi Coin RSI. Source:

TradingView

PI Price Could See Continued Rise

Pi Coin trades at $0.250 after rising 9.5% in the past 24 hours. The altcoin is preparing to flip $0.246 into a confirmed support level. Holding this range will be essential for maintaining upward momentum and preventing short-term pullbacks.

If Pi Coin secures the support, it could rise toward $0.260 and higher, recovering losses from late October. Such movement may attract new investors looking for momentum-driven opportunities, further sustaining the ongoing rally. Strengthening fundamentals and improving sentiment add to the bullish outlook.

Pi Coin Price Analysis. Source:

TradingView

Pi Coin Price Analysis. Source:

TradingView

However, if Pi Coin faces selling pressure, the price could slip below $0.246 and weaken current support. A decline may push the altcoin toward $0.234 or even $0.224, signaling a deeper retracement. This scenario would invalidate the bullish thesis and reflect fading confidence among traders.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Price Forecast Post-Listing: Understanding Institutional Attitudes and Market Fluctuations

- KITE's post-IPO price fell 63% by Nov 2025 amid divergent institutional strategies and retail sector uncertainty. - Analysts split between "Buy" ($30 target) and "Hold" ratings, citing operational gains vs. macro risks like the $3.4T deficit bill. - Q3 net loss (-$0.07 EPS) and 5,400% payout ratio highlight structural risks despite industrial real estate pivots and 7.4% dividend hike. - Institutional trading directly impacted price swings, with COHEN & STEERS' stake increase briefly stabilizing shares be

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook