Silently claiming the top spot in the Solana DEX market share, how did HumidiFi achieve this?

You can think of it as the on-chain version of Citadel Securities, a fully blockchain-based and permissionless market maker solution.

Original Article Title: "Solana's 'Invisible Champion': Rising to First in Market Share Quietly, How Did Dark Pool HumidiFi Do It?"

Original Article Authors: TATO, azsui

Original Article Translation: Tim, PANews

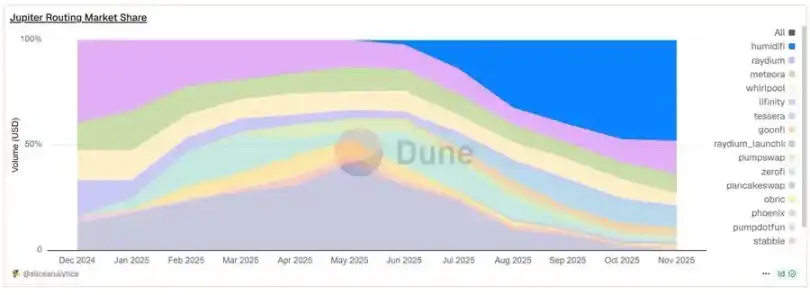

PANews Editor's Note: PANews Flash on November 3 — HumidiFi's 30-day trading volume surpassed Meteora and Raydium, leading the Solana DEX market. Most of the market is unfamiliar with HumidiFi, and the project's official Twitter account has only 12,000 followers. For this "invisible champion," PANews has organized and translated the relevant content of authors TATO and azsui, including an introduction to the HumidiFi project.

Body:

What Is Prop AMM? And What Is HumidiFi?

Traditional Automated Market Maker (AMM):

• Allows any user to provide liquidity→earn trading fees

• Uses a passive pricing mechanism (x*y=k constant product formula)

• Requires TVL to achieve deep liquidity

• Liquidity Providers (LPs) face impermanent loss risk

Professional Market Maker Automated Market Maker (Prop AMM):

• All liquidity provided by professional market makers

• Pricing strategy continuously updated and independent of user trading behavior

• Algorithm actively manages inventory like a centralized exchange market maker

• No public liquidity providers (LPs) = retail users do not bear impermanent loss

Core Features of HumidiFi:

• Rapid quote updates, performing multiple repricings per second

• Private order flow mechanism reduces volatility and front-running risk

• Achieves capital efficiency by precisely concentrating liquidity in the highest-demand areas

• Operates entirely on-chain with an algorithm

• Accessible only through the Jupiter route

This can be understood as the on-chain version of Citadel Securities, a fully blockchain-native and permissionless market maker solution.

HumidiFi Achievements

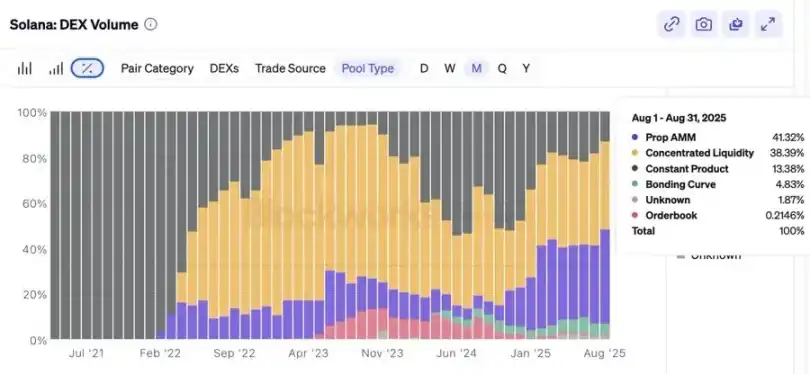

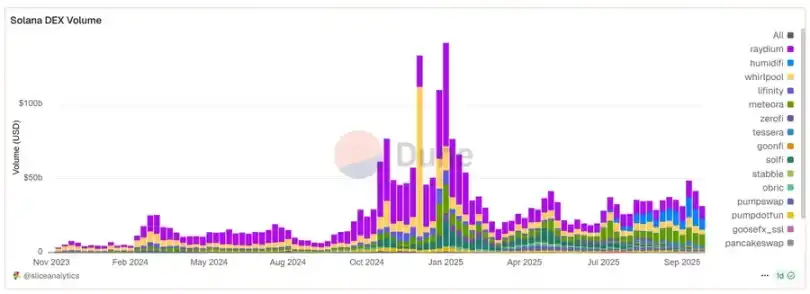

Trading Volume Leadership

• Achieved approximately $1 trillion in total trading volume within 5 months

• Accounted for 35% of the total DEX trading volume on the Solana blockchain

• Daily trading volume consistently ranged from $10 billion to $190 billion

• Last month's trading volume reached $340 billion (surpassing the total of Raydium and Meteora)

Execution Quality

• Narrower spread for SOL/USDC compared to Binance

• More competitive quotes → lower slippage, close to minimal price impact

• 99.7% fill rate (almost zero trade failures)

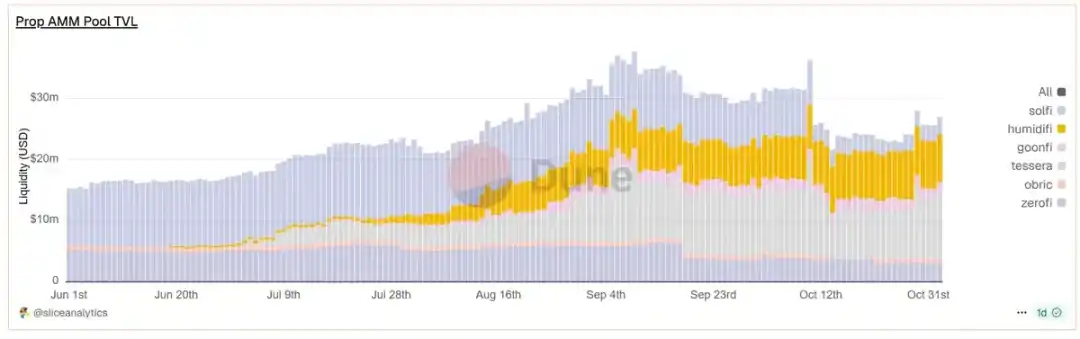

Capital Efficiency Marvel

• Processed $8.19 billion in daily trading volume with only $5.3 million TVL

• Achieved 154x capital efficiency (compared to around 1x for traditional AMMs)

• Oracle updates require only 143 computation units (approximately 1000x lighter than regular swaps)

The result? Users get better prices, without even needing to know that HumidiFi is behind the operation.

Why Choose HumidiFi?

Technological Superiority

• Ultra-lightweight oracle updates require only 143 computation units

• Sub-Millisecond Price Refresh (Competitors take 15-30 seconds)

• Tight liquidity around oracle-based price aggregation = Ultimate capital efficiency

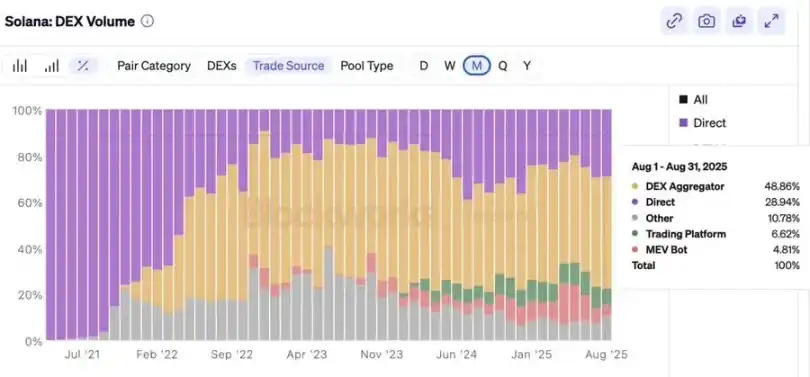

Jupiter Ecosystem Integration Advantage

• Jupiter processes 80%+ of Solana's swap volume

• HumidiFi captures 54.6% of Jupiter's professional market maker route

• Better prices → More routing options → Higher trading volume → Price edge amplification (Flywheel Effect)

Stealth Advantage

• No front-end interface

• Private order flow reduces MEV attack risk

• Anonymous operation = Reduced regulatory target risk

First-Mover Scale Effect

While competitors aim for millions, HumidiFi achieves a billion-asset breakthrough directly. In the DeFi market, liquidity attracts liquidity, and they have seized the initiative.

The Future is Here: HumidiFi Will Lead Solana DeFi Development

In short, it always gives you the best quote. For users, this is our core need.

Conclusion

HumidiFi is a professional AMM protocol, accounting for over 50% of total DEX trading volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Significant Price Decline and the Enduring Insights for Investors Focused on the Long Term

- ChainOpera AI (COAI) collapsed from $44.90 to $0.52 in late 2025 due to market shifts, structural flaws, and regulatory uncertainty. - COAI's 88% supply concentration and 60 manipulative wallets exacerbated liquidity crises amid sector-wide AI token outflows to meme coins. - Regulatory pressures (GENIUS Act, FSB) and algorithmic stablecoin collapses (xUSD, deUSD) deepened distrust in DeFi, compounding COAI's decline. - Long-term investors may find opportunities in COAI's collapse by applying margin of sa

Assessing How the TGE of MMT Token Influences the Cryptocurrency Ecosystem

- Momentum Finance's MMT token TGE on Sui blockchain highlights innovative DeFi tokenomics with 42.72% community allocation and ve(3,3) governance model. - Post-TGE volatility (4,000% surge followed by 70% correction) reflects market dynamics, but technical indicators and buybacks suggest long-term resilience. - MMT's $250-350M FDV target and Sui integration demonstrate strategic benchmarks, offering lessons for balancing innovation, sustainability, and institutional trust in emerging blockchain projects.

Momentum (MMT) and the Rising Popularity Among Retail Investors: Insights from Behavioral Finance

- Momentum (MMT) price surges mirror 2021 GameStop dynamics, driven by social media sentiment and behavioral biases like overconfidence and herd behavior. - Retail-driven speculation distorts market efficiency, with 21% trading volume reflecting emotional decision-making over fundamentals, as shown by Bitget and academic studies. - Institutional investors exploit these anomalies through contrarian strategies, while regulators scrutinize social media's role in destabilizing traditional market models. - The

Timeless Strategies for Investing in Today's World

- McNeel and Buffett's value investing principles remain vital in today's volatile crypto markets. - Crypto surges driven by FOMO and hype, like MMT's 2025 rise, highlight risks of ignoring these strategies. - Buffett's focus on fundamentals and emotional discipline offers a structured approach to avoid speculative traps. - Case studies show adherence to these principles can mitigate losses during market corrections. - Timeless tenets of patience and intrinsic value are essential for long-term success in u