Critical Ethereum Investors Begin Selling As Price Struggles Under $4,000

Ethereum’s price remains under $4,000 amid rising sell-offs from long-term holders. Weak RSI and fading momentum suggest bearish pressure, though a break above $4,000 could reverse the trend.

Ethereum (ETH) continues to trade sideways after multiple failed attempts to break above the $4,000 mark. The lack of investor support has stalled its recovery momentum, keeping the second-largest cryptocurrency under pressure.

Market uncertainty is worsening as long-term holders (LTHs) appear to be moving toward selling their positions.

Ethereum Holders Move To Sell

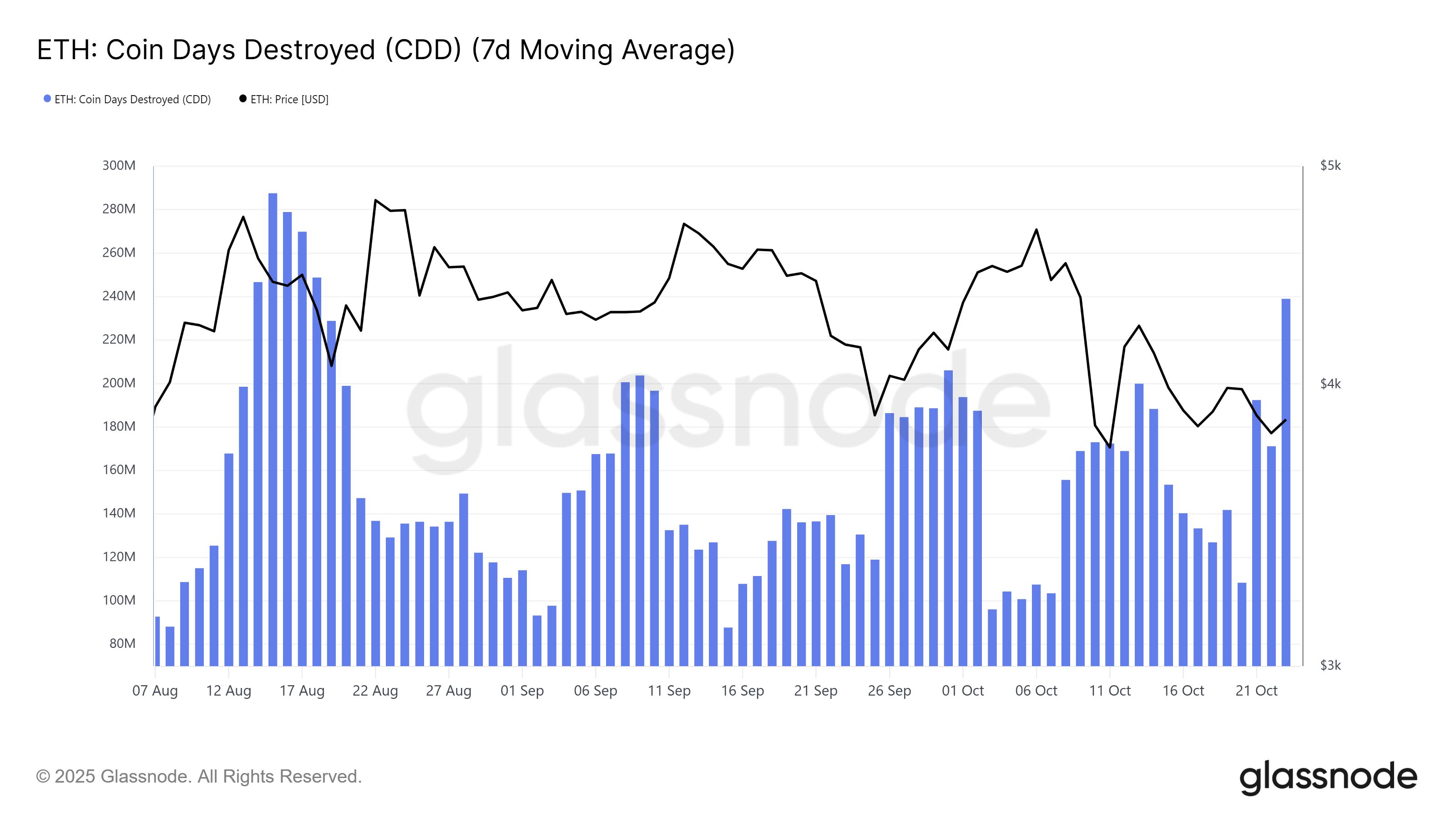

On-chain data shows a sharp spike in Ethereum’s Coin Days Destroyed (CDD) metric over the last 24 hours. This indicates that long-term holders, or LTHs, have started to liquidate their holdings. The recent surge marks the largest increase in over two months, reflecting a decisive shift in investor sentiment.

LTHs are often viewed as the most influential group within the market due to their substantial holdings and long-term conviction. When they begin selling, it signals growing doubt about near-term performance. This selling activity can trigger broader market reactions, amplifying bearish momentum and putting additional pressure on Ethereum’s price stability.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum CDD. Source:

Ethereum CDD. Source:

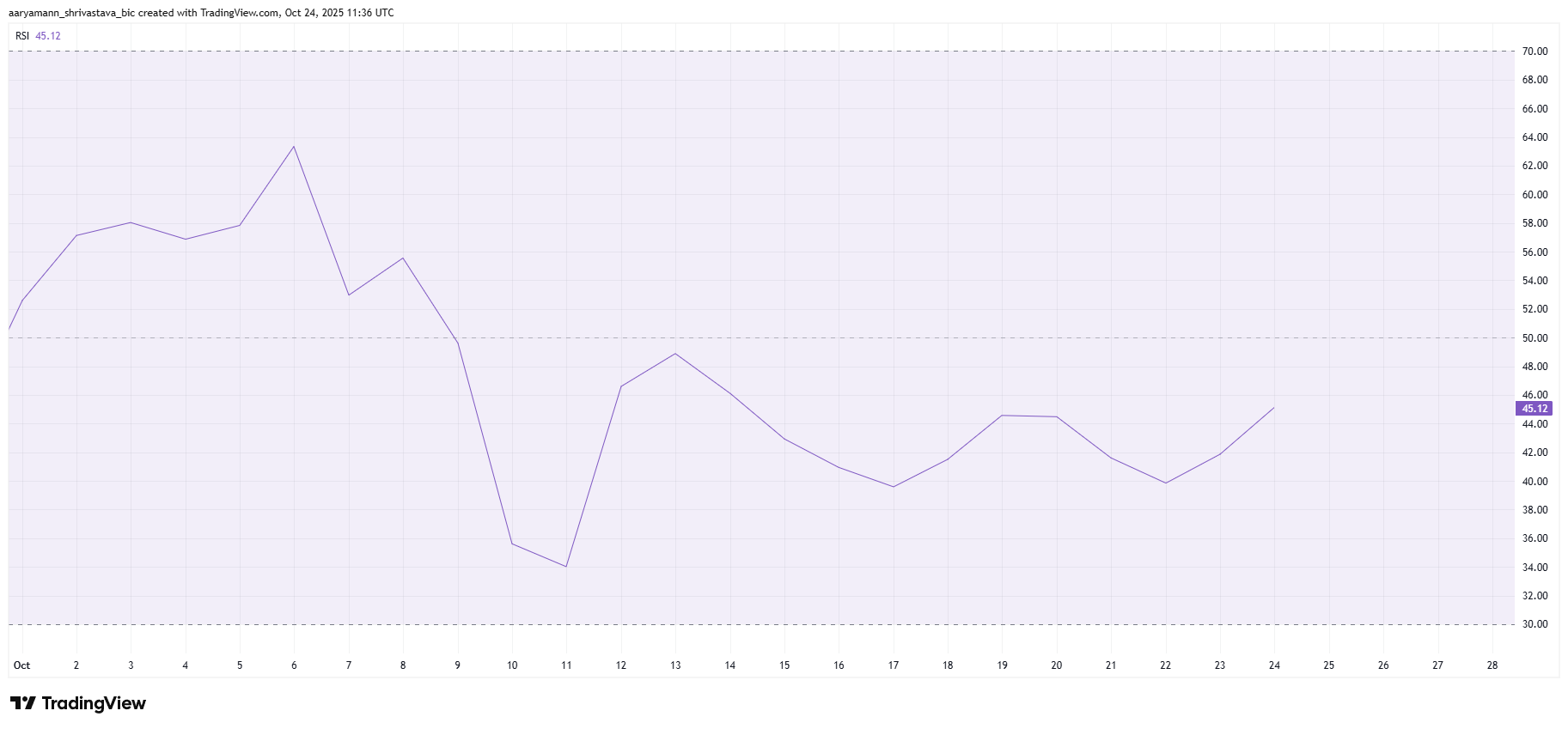

Ethereum’s broader macro momentum appears weak as technical indicators show fading bullish sentiment. The Relative Strength Index (RSI) is hovering below the neutral 50.0 level, indicating that buyers are losing control. This suggests a lack of enthusiasm among investors, even as prices remain near key support levels.

An RSI reading below 50.0 typically signals sustained selling pressure and limited recovery potential. With broader market conditions also showing weakness, Ethereum could struggle to regain traction.

ETH Price RSI. Source:

ETH Price RSI. Source:

ETH Price Is Looking For A Surge

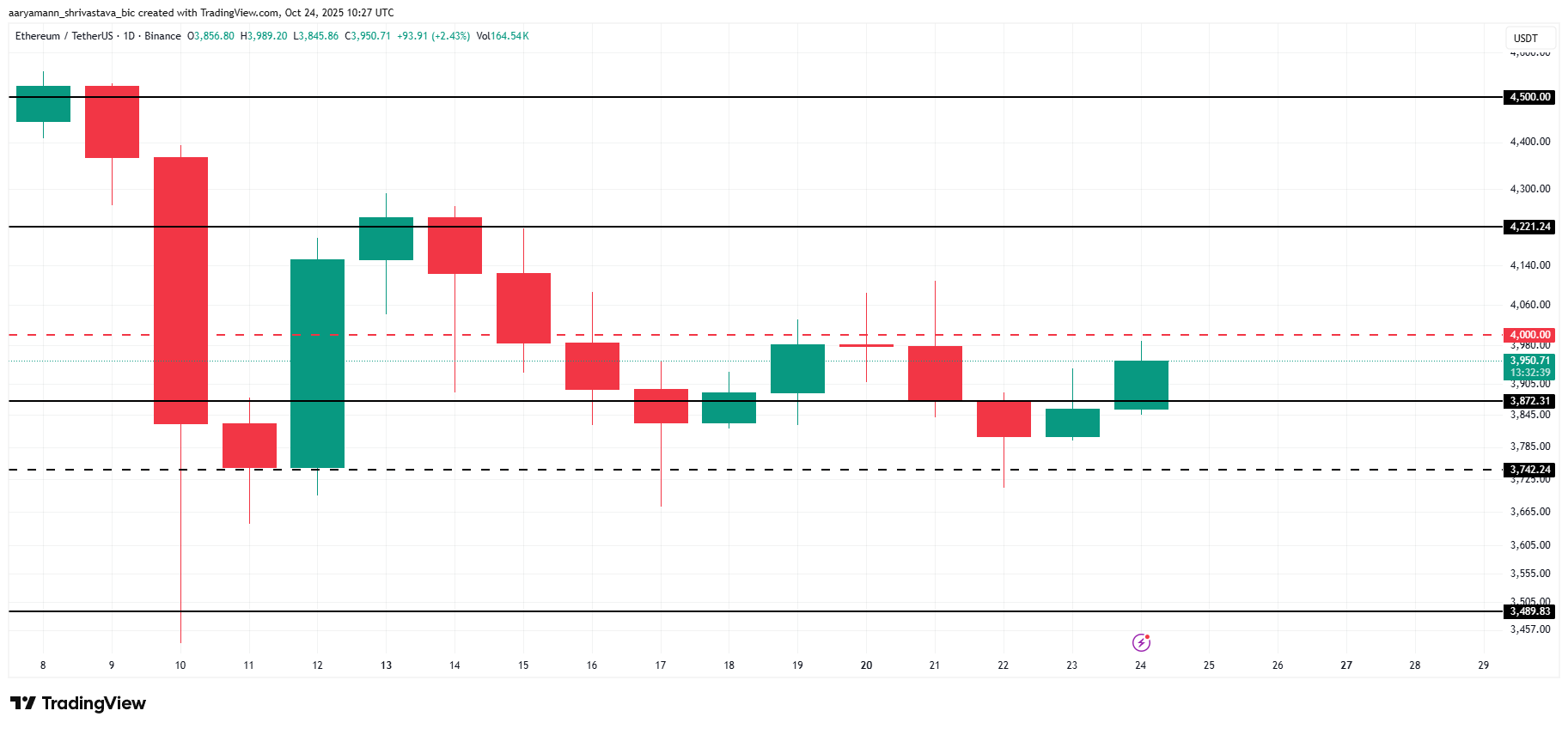

Ethereum’s price sits at $3,950 at the time of writing, stuck below the critical $4,000 resistance. The altcoin has been oscillating near $3,872, showing no clear directional bias.

The current indicators suggest that this consolidation phase above $3,742 support is likely to persist. However, if market conditions worsen and ETH slips below $3,742, a further decline toward $3,489 could follow. Such a move would confirm a bearish continuation pattern.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

Conversely, if buying activity strengthens and overall sentiment improves, Ethereum could breach the $4,000 resistance level. A successful breakout would open the path toward $4,221, invalidating the bearish outlook and signaling renewed investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?