T. Rowe Price Files for Actively Managed Crypto ETF, Surprising Analysts

Quick Breakdown

- T. Rowe Price has filed with the SEC to launch an actively managed crypto ETF holding 5–15 major cryptocurrencies.

- The move marks a significant shift from its mutual fund-dominated portfolio and conservative stance.

- Analysts say the filing shows legacy firms are racing to secure a foothold in the booming digital asset ETF market.

T. Rowe price makes nold entry into Crypto ETF market

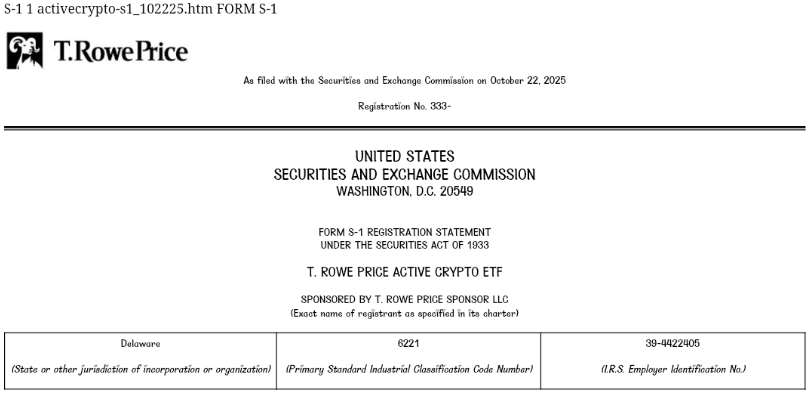

In a surprising twist, trillion-dollar asset manager T. Rowe Price has filed to launch an actively managed cryptocurrency exchange-traded fund (ETF) in the United States. The move marks a dramatic pivot for the 87-year-old investment firm, which has traditionally focused on mutual funds and remained cautious toward digital assets .

Source:

U.S SEC

Source:

U.S SEC

The filing , submitted to the U.S. Securities and Exchange Commission (SEC) on Wednesday, outlines plans for an “Active Crypto ETF” that will invest in five to fifteen cryptocurrencies approved under the SEC’s generic listing standards. Eligible assets include Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP, among others.

The filing has drawn strong reactions from industry observers. Nate Geraci, President of NovaDius Wealth Management, described the move as “completely from left field,” suggesting that traditional investment giants that missed the first wave of crypto ETFs are now racing to establish their positions.

Similarly, Bloomberg ETF analyst Eric Balchunas labeled the filing a “semi-shock,” noting that T. Rowe Price’s $1.8 trillion portfolio has long been centered around mutual funds. “Did not expect it, but I get it. There’s gonna be a land rush for this space too,” he said.

Active management and broader token exposure

Unlike single-asset ETF applications currently awaiting SEC approval, T. Rowe’s proposed fund aims to outperform the FTSE Crypto US Listed Index. Its asset weighting will be determined by fundamentals, valuation, and momentum rather than purely by market capitalization.

Other cryptocurrencies considered for inclusion include Cardano (ADA), Avalanche (AVAX), Litecoin (LTC), Dogecoin (DOGE), Hedera (HBAR), Bitcoin Cash (BCH), Chainlink (LINK), Stellar (XLM), and Shiba Inu (SHIB).

The fund’s diversified approach could give investors broader exposure to the crypto market without concentrating risk in a single token.

Notably, The U.S. SEC) is set to rule on 16 cryptocurrency exchange-traded fund (ETF) applications in October. The pending decisions cover major tokens such as Solana (SOL), XRP, Litecoin (LTC), Cardano (ADA), Hedera (HBAR), and Dogecoin (DOGE), with final deadlines staggered across the month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chicago Tribune files lawsuit against Perplexity

All the major highlights from AWS’s flagship tech event re:Invent 2025

DASH Gains 5.78% Following DoorDash’s Expansion of Delivery Network and New Partnerships

- DoorDash's DASH stock surged 5.78% in 24 hours amid Q3 2025 results showing $3.4B revenue and $244M profit, driven by 27% YoY growth. - Strategic expansions include grocery delivery partnerships with Kroger/Family Dollar and robot delivery via Serve Robotics , enhancing its 68% U.S. food delivery market share. - Long-term investments in automation (Waymo, Dot robot) and $1.2B SevenRooms acquisition aim to boost efficiency but caused a 20% post-earnings stock pullback. - Favorable regulatory shifts (Prop

BCH sees a 32.36% increase over the past year as the network undergoes upgrades and mining adjustments

- Bitcoin Cash (BCH) surged 32.36% in a year due to network upgrades, mining shifts, and positive market sentiment. - Price hit $574.7 on Dec 5, 2025, with 6.34% 30-day and 0.03% 24-hour gains. - 2024 protocol upgrade boosted transaction throughput, fees, and real-world payment adoption. - Mining pools shifted hashrate to BCH, enhancing security and decentralization. - Institutional support and fixed supply model drive BCH’s appeal as a scalable payment alternative.