3 Altcoins Whales Are Selling Fast as October Ends

Altcoin whales are exiting fast as October ends. This analysis tracks three major tokens seeing heavy sell pressure — SHIBA INU (SHIB), CARDANO (ADA), and ZORA (ZORA). From SHIB’s stalled triangle breakout to ADA’s fading momentum and ZORA’s profit-taking drop, these coins show how whale exits are reshaping the altcoin market.

Whales are selling several major altcoins fast as October draws to a close. Since October 13, the total altcoin market cap (excluding Bitcoin) has dropped by over 11%, slipping from $1.62 trillion to $1.45 trillion.

The decline isn’t only due to falling prices — large holders have been steadily reducing exposure. While some projects still attract quiet accumulation, there are three altcoins that whales are selling fast. The selling spree comes amid delayed breakouts, profit-taking, and fading confidence.

Shiba Inu (SHIB)

Whales appear to be losing interest in Shiba Inu, steadily offloading their holdings since October 18.

Data shows that wallets dropped their combined stash from 697.88 trillion to 694.26 trillion, a reduction of roughly 3.62 trillion SHIB, worth about $355,000 at the current price of $0.0000098.

SHIB Whales:

SHIB Whales:

This selling aligns with Shiba Inu’s chart setup. The token has been stuck inside a symmetrical triangle pattern since October 10, signaling indecision. Between October 14 and 20, the price formed lower highs while the Relative Strength Index (RSI), which measures price momentum, made higher highs.

This pattern is known as hidden bearish divergence, often signaling that a downtrend will continue.

SHIB Price Analysis:

SHIB Price Analysis:

The broader picture supports that view. SHIBA INU is down 27.2% over the past three months, confirming the ongoing downtrend.

A daily close below $0.0000097 could send it to $0.0000092, while a breakout above $0.000010 might open the door toward $0.000011. For now, however, whales seem unconvinced that such a SHIB price rebound is near.

Cardano (ADA)

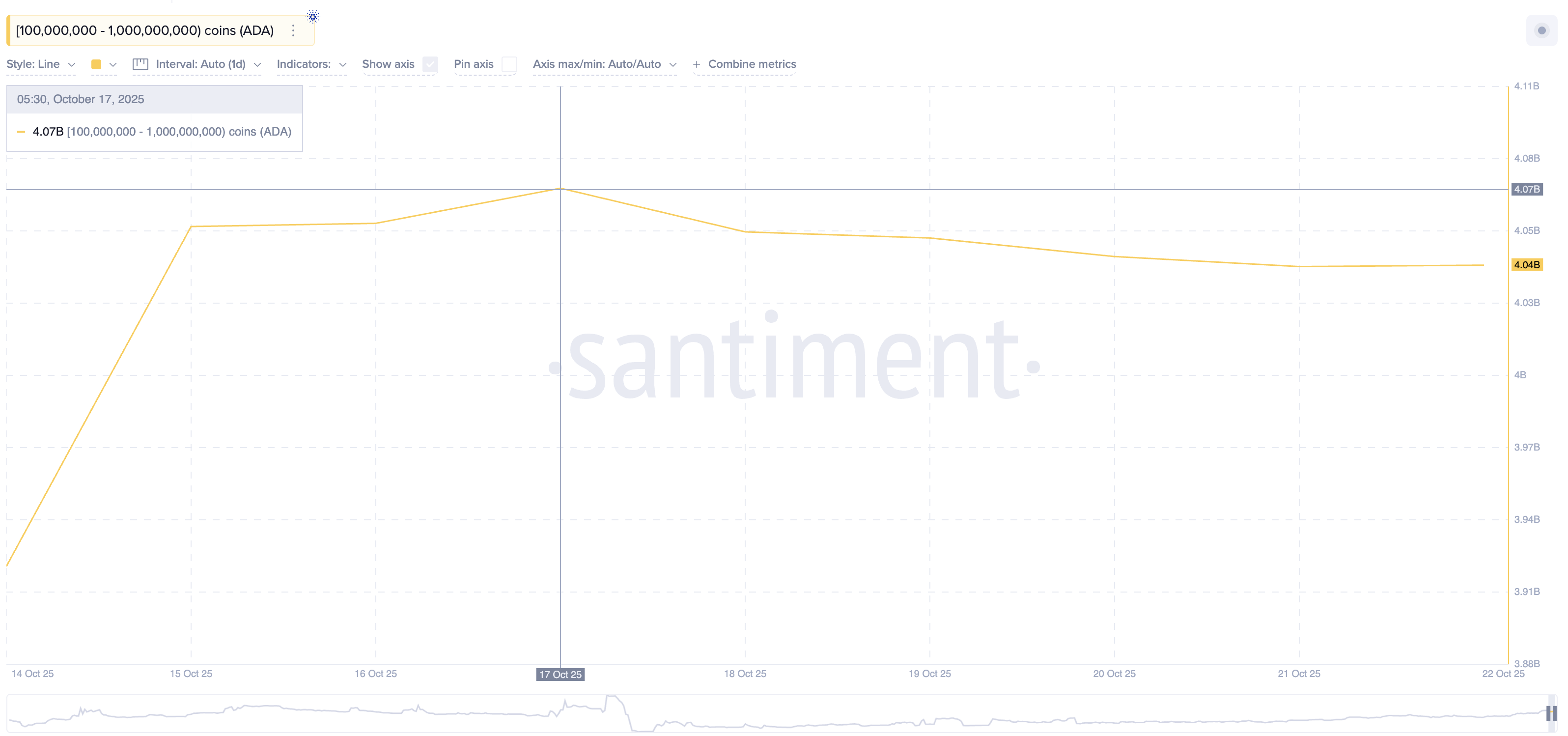

Crypto whales holding ADA between 100 million and 1 billion tokens have started trimming their positions since October 17. Their combined holdings fell from 4.07 billion ADA to 4.04 billion ADA, a reduction of about 30 million ADA, worth nearly $19 million at the current price of $0.63.

Cardano Whales Offloading:

Cardano Whales Offloading:

The timing of this sell-off is important. On October 17, ADA briefly broke below the ascending channel’s lower trendline, which has only two touchpoints and is structurally weak. The breakdown seems to have triggered mild panic among whales.

Although ADA prices recovered later, selling hasn’t stopped, suggesting confidence remains low.

Between October 13 and 20, the price made a lower high while the Relative Strength Index (RSI) formed a slightly higher high, indicating a hidden bearish divergence. This pattern usually points to trend continuation (21% down over the past three months) rather than reversal. If ADA fails to hold $0.61, it could slide toward $0.59 or even $0.50.

Cardano Price Analysis:

Cardano Price Analysis:

To invalidate this bearish outlook, ADA must clear $0.86, a resistance level, 36% higher than the current level. This level has capped multiple Cardano rallies before. Until then, the upside target near $1.12 (channel breakout point) remains unlikely — at least for now.

Zora (ZORA)

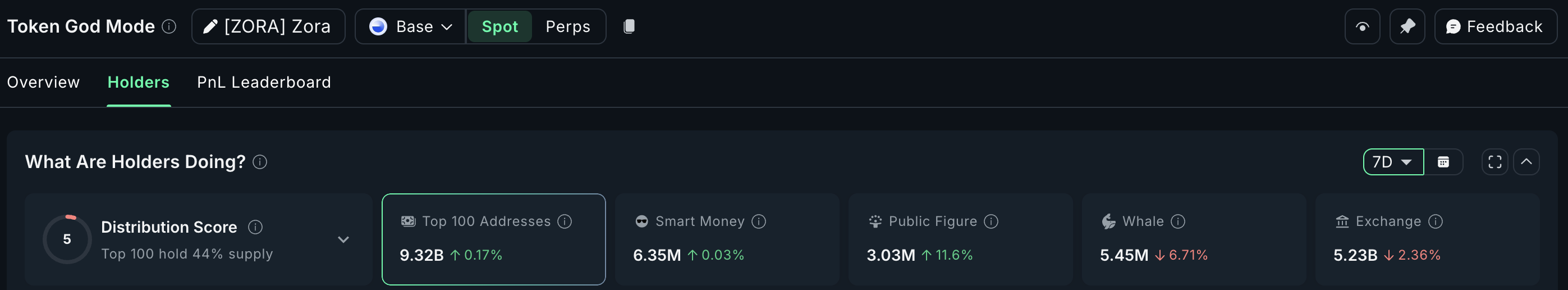

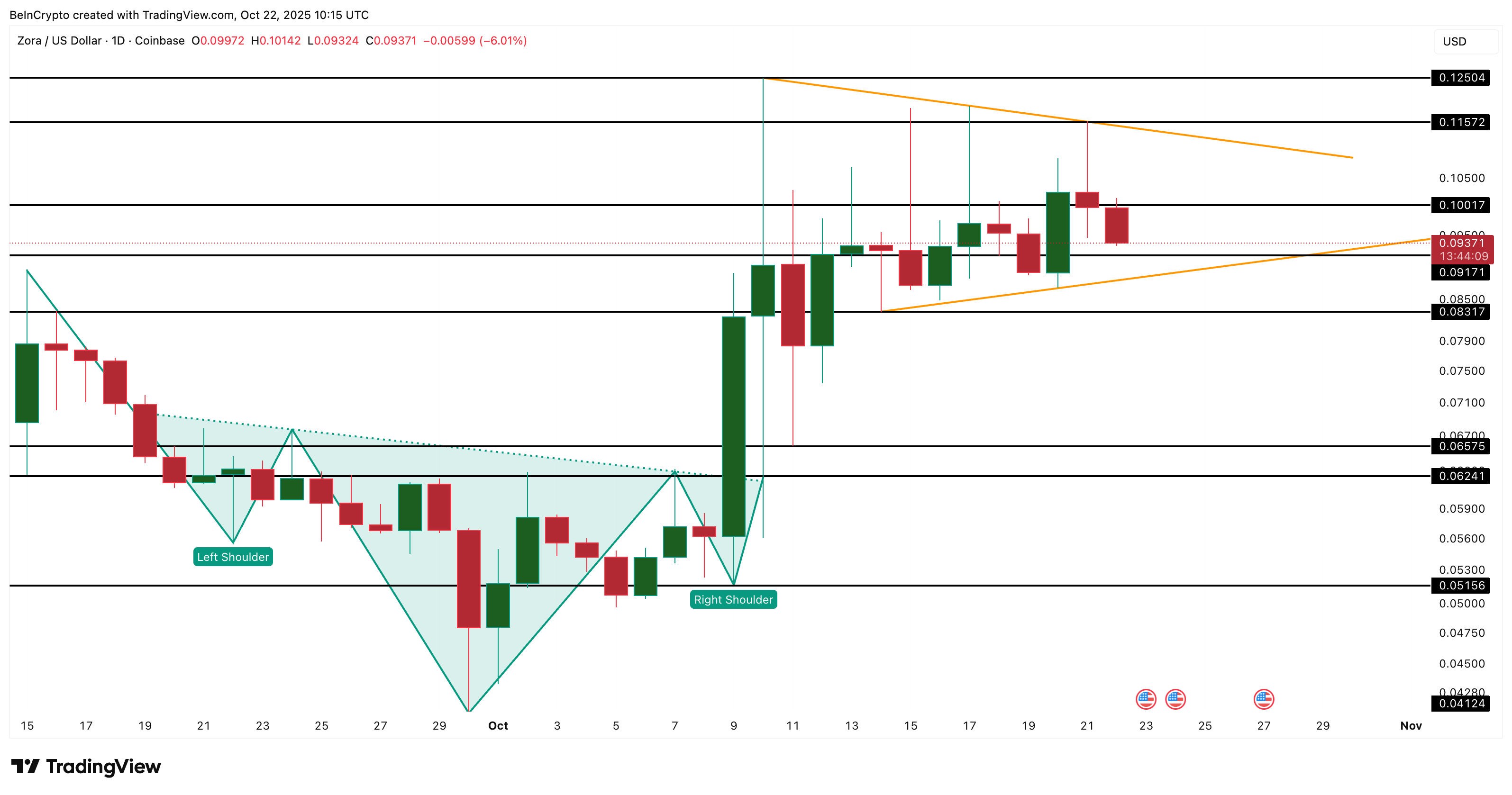

ZORA whales are cashing out. They are likely taking profits after their strong monthly rally. The token has gained over 61% in the past 30 days but has slipped 15.6% in the last week as large holders started selling.

Whale wallets have reduced their holdings by 6.71%, cutting their collective stash to 5.45 million ZORA. That means roughly 390,000 ZORA tokens have been sold in the past seven days.

ZORA Whales:

ZORA Whales:

ZORA’s price action reflects this cooldown. After breaking out of an inverse head-and-shoulders pattern as predicted earlier this month, it’s now consolidating inside a symmetrical triangle, showing a pause in momentum.

If $0.091 fails to hold, a deeper correction toward $0.083 or even $0.065 could follow.

ZORA Price Analysis:

ZORA Price Analysis:

Still, this looks more like a profit-booking phase than a full trend reversal. A daily close above $0.10 and then $0.11 would invalidate the short-term bearish setup, opening room for another push higher — and possibly reviving whale interest.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BCH sees a 32.36% increase over the past year as the network undergoes upgrades and mining adjustments

- Bitcoin Cash (BCH) surged 32.36% in a year due to network upgrades, mining shifts, and positive market sentiment. - Price hit $574.7 on Dec 5, 2025, with 6.34% 30-day and 0.03% 24-hour gains. - 2024 protocol upgrade boosted transaction throughput, fees, and real-world payment adoption. - Mining pools shifted hashrate to BCH, enhancing security and decentralization. - Institutional support and fixed supply model drive BCH’s appeal as a scalable payment alternative.

ZEC Rises 11.19% in the Past 24 Hours Amid Increasing Average Short Positions

- Zcash (ZEC) rose 11.19% in 24 hours to $395.27 but fell 4.99% weekly/monthly amid mixed performance. - "Calm Long King" trader increased ZEC short positions to $2.51M, raising average entry price to $360 with 20% unrealized gains. - ZEC shorting reflects cautious optimism as traders adjust exposure amid volatility, with BTC/SOL shorts showing $160k combined losses. - The trader's recent 15-trade winning streak contrasts November setbacks, highlighting shifting market dynamics in altcoin trading.

ZEC Value Rises 5.73% as Short Sellers Adjust Positions During Market Fluctuations

- ZEC surged 5.73% in 24 hours to $385.59, defying 9.19% weekly/monthly declines but rising 590.63% annually amid market turbulence. - "Calm Long King" trader increased ZEC short positions to $2.51M (10x leverage) with a $20K unrealized gain, contrasting losses in BTC and SOL shorts. - The trader's $17.29M ZEC short exposure reflects volatile market dynamics, with leveraged positions showing mixed gains/losses as crypto prices swing sharply. - ZEC's 24-hour rebound highlights risks for short sellers in a m

ZEC Rises 4.77% Amid Increased Short Positions and Market Rebound

- ZEC surged 4.77% in 24 hours to $386.31, with a 584.4% annual gain despite recent declines. - A prominent trader increased ZEC short positions to $17.29M, showing a $20k gain but larger losses in BTC and SOL. - Market recovery and short-position adjustments highlight ZEC’s volatility, with analysts warning of potential downward pressure if prices rise further.