US is Seizing $12 Billion in Bitcoin, But What Will They Do With It?

The US Treasury’s effort to seize $12 billion in Bitcoin from Cambodia’s Prince Group marks a turning point in crypto crime enforcement. If successful, these assets could significantly strengthen Trump’s Strategic Reserve—unless victims reclaim their stolen funds.

The US is moving to seize around $12 billion in Bitcoin from Prince Group, a Cambodian-based pig butchering operation. It’s also applying massive sanctions to the Huione Group for facilitating money laundering.

If Treasury can acquire and gain ownership of these assets, it could substantially boost Trump’s Strategic Reserve. However, many defrauded Americans may attempt to reclaim their stolen money.

More Bitcoin For The US Government

Pig butchering scams were already a huge problem before 2025’s unprecedented crypto crime wave, but escalating fraud is making all these problems much larger.

One recent incident shows the scale of these incidents, as the Treasury is moving to seize $12 billion in Bitcoin from a long-running scheme:

The Treasury also released a statement on this pig butchering operation, although it does not directly address the effort to seize these bitcoins.

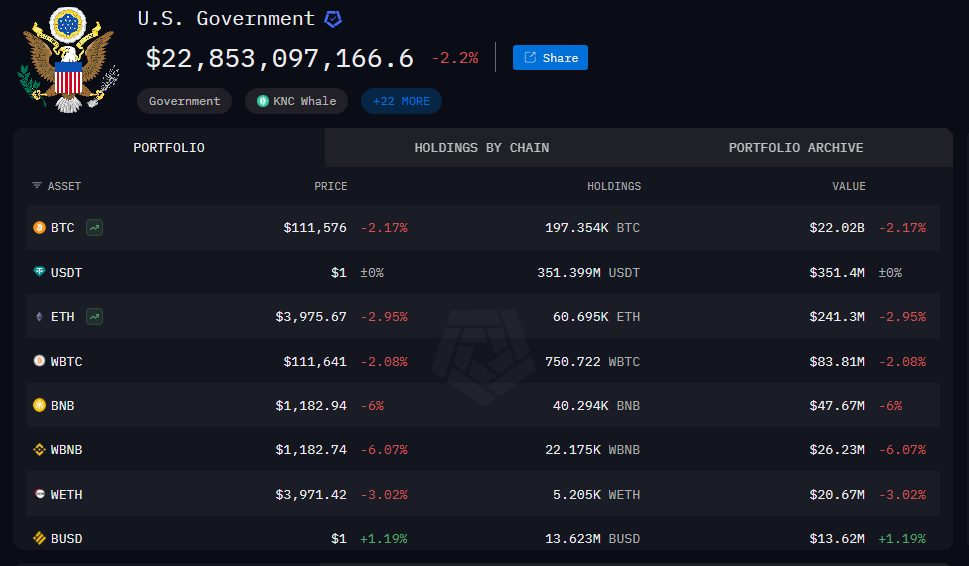

US Government Bitcoin Portfolio Till Now. Source:

US Government Bitcoin Portfolio Till Now. Source:

It claimed that a multinational investigation targeted the Prince Group, a Cambodian-based crime ring. By 2024, this group apparently stole at least $10 billion from US citizens.

Additionally, the Treasury finalized its efforts to sever the Huione Group from the US financial system, due to its history of facilitating money laundering.

Private crypto firms have levied restrictions upon the Cambodian financial conglomerate, but the US government is making a major escalation here.

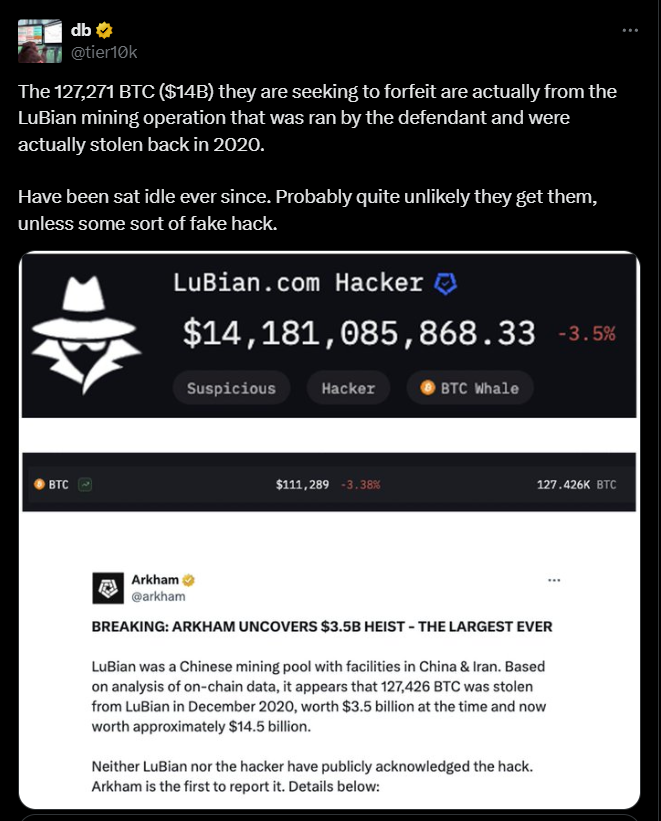

Some reports suggest these funds could actually be linked to the biggest crypto hack till date involving LuBian mining pool.

Source:

Source:

Strategic Reserve Implications?

The Prince Group’s operations were truly frightening, including human trafficking, torture, sexual exploitation, and more. Treasury’s report details all these unseemly aspects, which may be too lurid for our coverage.

However, as far as the crypto community is concerned, there’s one crucial point to realize. If the Treasury can successfully seize this Bitcoin, it could be a huge windfall for Trump’s planned Strategic Reserve.

Specifically, the administration has run into a major problem: it custodies huge quantities of seized bitcoins, but it doesn’t have legal ownership. It can’t exactly put these assets into a Strategic Reserve if it’s legally obligated to return them to the actual fraud victims.

There may be an opportunity here, depending on a few things. If the Treasury can acquire these assets, $12 billion is a huge windfall. If even a tiny fraction of initial theft victims fail to pursue reimbursement, this Bitcoin may be up for grabs.

In short, there are many factors in the air right now. The US may fail to seize these bitcoins, or a huge chunk may simply return to their initial owners. If, however, it can retain a few billion dollars’ worth, this could make a Bitcoin Reserve truly formidable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Evaluating the Influence of MMT on Market Fluctuations in 2025

- Modern Monetary Theory (MMT) drives 2025 fiscal expansion, reshaping global markets through deficit-financed AI and infrastructure investments. - U.S. equity markets benefit from MMT-aligned stimulus, while emerging markets show resilience via fiscal reforms and commodity-linked growth. - Commodity volatility rises as MMT-fueled demand clashes with supply constraints, amplified by dollar strength and climate disruptions. - IMF advocates "credible frameworks" to balance MMT's growth potential with inflati

COAI Experiences Sharp Decline in Share Value: Regulatory Oversight and Changing Investor Attitudes Impact India's Cryptocurrency Industry

- India's 2025 crypto crackdown triggered COAI's sharp share price drop as FIU-IND targeted 25 offshore exchanges for AML violations. - SEBI banned finfluencer Avadhut Sathe for ₹601 crore in unregistered investment advice, exposing systemic risks in influencer-driven trading. - Regulatory uncertainty and 30% crypto tax dampened investor confidence, with COAI's decline linked to both enforcement actions and $5.6B forex reserve losses. - Experts warn India's punitive approach risks stifling innovation despi

The Impact of New Technologies on Improving Educational Programs and Boosting Institutional Effectiveness

- Global EdTech and STEM markets are transforming via AI, cybersecurity, and VR/AR integration, driving curricular innovation and institutional scalability. - Farmingdale State College exemplifies this shift, boosting enrollment 40% through AI/cybersecurity programs and securing $75M for a new tech-focused campus center. - AI-in-education market alone is projected to grow from $5.88B in 2024 to $32.27B by 2030, with EdTech overall expected to reach $738.6B by 2029 at 14.13% CAGR. - Government funding and i

Navigating the Fluctuations of the Cryptocurrency Market: Smart Entry Strategies for Individual Investors

- KITE token's 2025 price surge highlights retail-driven volatility, with 72% trading volume from individual investors. - FDV ($929M) far exceeding initial market cap ($167M) fueled FOMO and panic selling amid rapid 38.75% gains followed by 16% corrections. - Strategic approaches like DCA and stop-loss orders are critical for managing risks in speculative crypto markets dominated by emotional trading behavior.