Why Dogecoin Could Revisit Its 13-Month Low Despite a 5% Recovery

Dogecoin’s short-lived bounce may be losing steam as network activity declines and long-term holders take profits, raising the risk of another dip toward its yearly lows.

Leading meme coin Dogecoin has staged a modest 5% rebound. This comes after the meme coin’s price briefly crashed to a September 2024 low during last week’s Black Friday sell-off.

With the broader crypto market attempting to recover from the sharp downturn, DOGE’s price has trended slightly upward in recent days. Yet, on-chain data suggests that this recovery may lack real conviction. This analysis explains why.

Dogecoin Recovery May Be Short-Lived

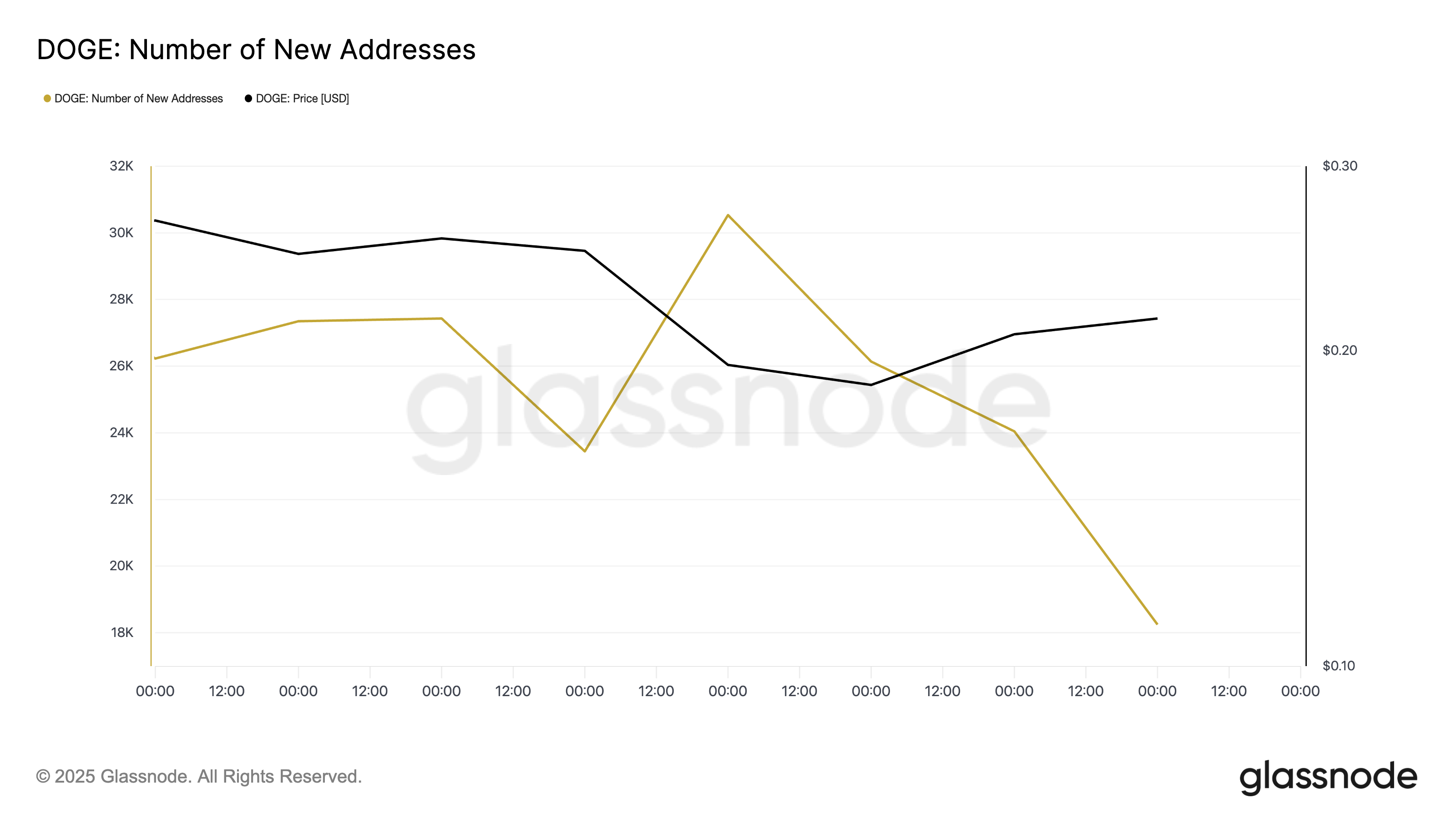

According to Glassnode’s data, new demand for DOGE continues to decline steadily, with fewer new addresses interacting with the asset daily since last Friday.

Yesterday, 18,251 unique addresses appeared for the first time in a DOGE transaction on the network. This marked a 40% drop from the 30,534 active addresses that traded the meme coin during the Black Friday liquidation event.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

DOGE Number of New Addresses. Source:

Glassnode

DOGE Number of New Addresses. Source:

Glassnode

The drop signals that DOGE’s 5% rebound may be driven more by short-term market relief than by genuine investor demand for the altcoin, which puts its price at risk of a correction in the near term.

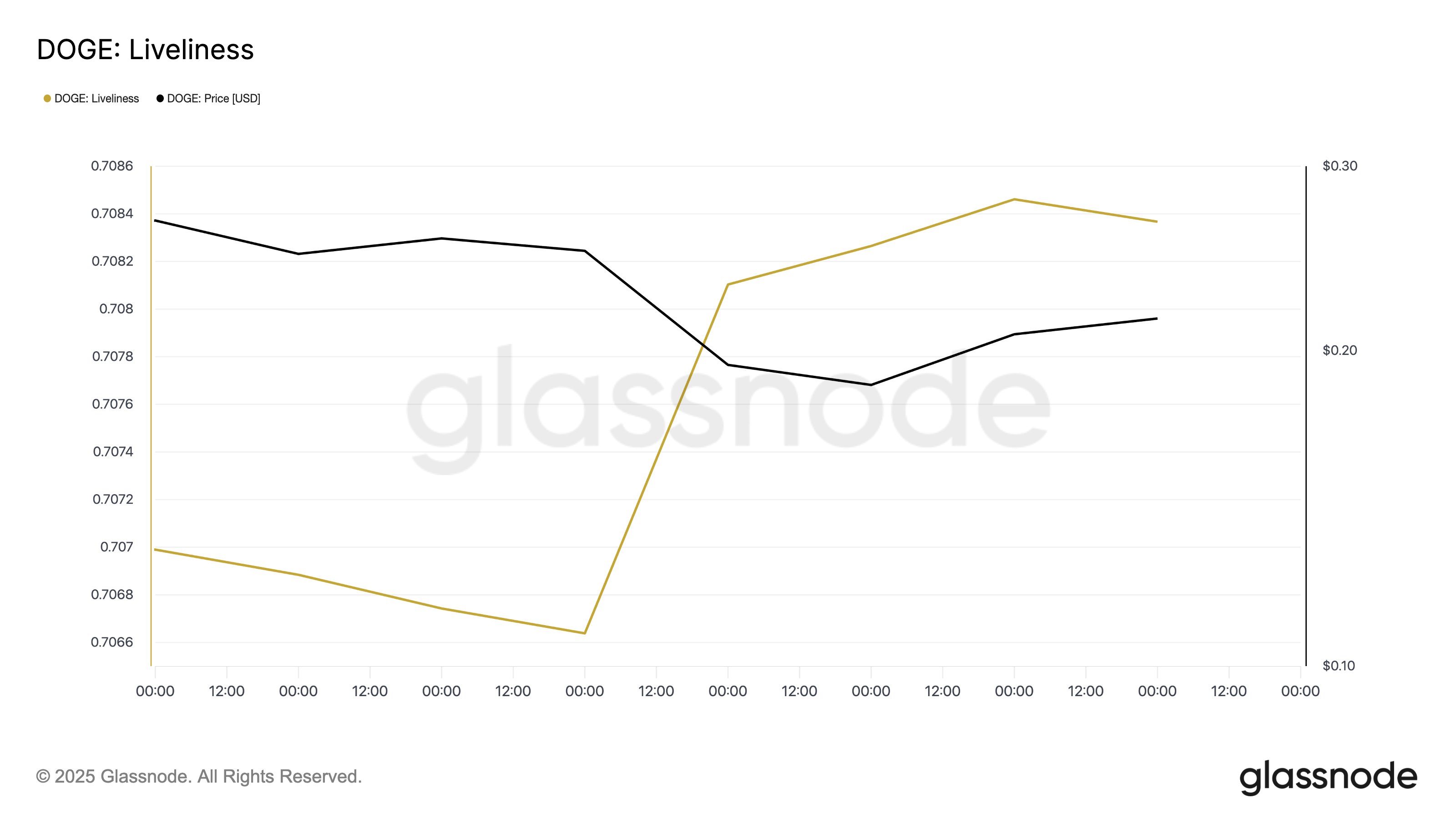

Furthermore, DOGE’s liveliness has risen steadily over the past few trading sessions, suggesting that its long-term holders (LTHs) view the price rebound as an opportunity to offload their holdings.

According to Glassnode, the metric closed October 13 at 0.708.

DOGE Liveliness. Source:

Glassnode

DOGE Liveliness. Source:

Glassnode

The Liveliness metric tracks the movement of long-held/dormant tokens or coins. When its value falls, LTHs are removing their assets from exchanges, which is usually a bullish sign of accumulation.

On the other hand, when an asset’s liveliness climbs, as with DOGE, more long-held coins are being moved or sold, signaling increased profit-taking by long-term holders.

For DOGE, readings from its Liveliness suggest that its LTHs are taking advantage of the ongoing rebound to sell their holdings. This further increases the likelihood of a near-term correction.

Is $0.095 Back on the Cards?

On the daily chart, DOGE continues to face downward pressure, trading below its 20-day Exponential Moving Average (EMA). The 20-day EMA currently forms dynamic resistance at $0.249, while DOGE trades around $0.199 at the time of writing.

The 20-day EMA measures an asset’s average price over the past 20 trading sessions, giving more weight to recent prices. When the price remains below this line, it signals that bears maintain control, and short-term sentiment is tilted toward the downside.

Without renewed buyer interest or an uptick in network activity, DOGE risks sliding toward the next support level at $0.167.

Failure to defend this price floor could open the door for a deeper correction. It could potentially retest its 13-month low of $0.095, recorded during the recent market crash.

DOGE Price Analysis. Source:

TradingView

DOGE Price Analysis. Source:

TradingView

However, if sentiment improves and bullish momentum returns, DOGE could stage a breakout above $0.224. This will invalidate the bearish setup and pave the way for a rally toward $0.264.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Astar (ASTR) Price Spike: Unraveling the Reasons for Recent Market Fluctuations

- Astar (ASTR) price surged amid Tokenomics 3.0 reforms, institutional capital inflows, and strategic partnerships in November 2025. - Deflationary mechanisms like Burndrop and a $29.15M buyback program reduced circulating supply to 8.24B tokens. - Galaxy Digital's $3. 3M OTC purchase and Coinbase listing roadmap signaled institutional confidence in ASTR's long-term potential. - Partnerships with Sony , Toyota , and Japan Airlines expanded ASTR's real-world utility in logistics and digital identity sectors

The Increasing Importance of STEM Education as a Strategic Asset in a Technology-Focused World Economy

- U.S. STEM education is reshaping curricula and partnerships to meet AI, cybersecurity, and renewable energy demands, driven by $75M investments like Farmingdale State College's expanded Computer Sciences Center. - Public-private collaborations, including NSF AI Education Act and Google/IBM workforce pledges, are accelerating workforce readiness through AI research and micro-credential programs. - STEM-focused universities achieved 11.5% average endowment returns in 2025, but proposed excise taxes threate

Aster DEX: Redefining the Landscape of Decentralized Trading

- Aster DEX is reshaping DeFi by bridging retail and institutional markets through hybrid AMM-CEX architecture and strategic partnerships. - The platform achieved 1.848 million users and $3.32B weekly trading volume in 2025, with $5.7B institutional buy volume in late 2025. - RWA integrations (gold, equities) and 7% staking rewards drive institutional adoption, while gasless trading and TWAP orders enhance execution efficiency. - Aster's 400% TVL growth and 5-7% annual token burns create scarcity, supporti

ZK Technology Experiences Rapid Growth in 2025: The Role of Institutional Involvement in Driving the Latest Crypto Bull Market

- Zero-knowledge (ZK) proofs drive 2025's crypto inflection point, enabling scalable, private blockchain solutions adopted by institutions like Goldman Sachs and Sony . - ZK rollups achieve 43,000 TPS, slashing costs and enabling compliance with GDPR/BSA, while Polygon's $1B investment accelerates gaming/NFT infrastructure. - Regulatory clarity via U.S. GENIUS Act and EU MiCA, plus ZK's privacy-preserving capabilities, reduce institutional risks and fuel $28B+ TVL in ZK-based protocols. - ZK token prices s