Ethereum Slips Below $4,500 Despite Grayscale Staking 300,000 ETH

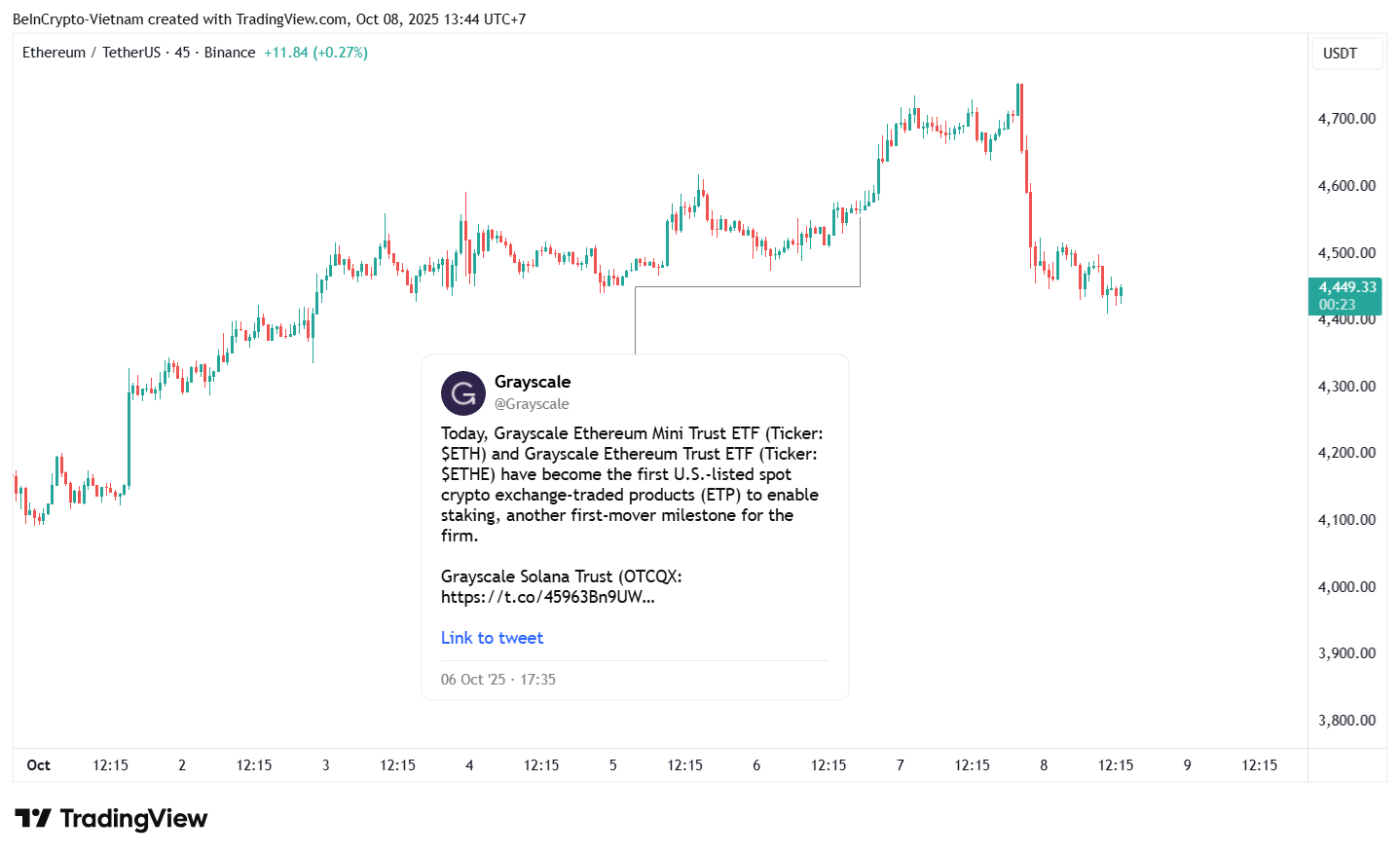

Grayscale’s announcement that its Grayscale Ethereum Trust ETF became the first US-listed spot crypto ETF allowing staking helped push ETH’s price above $4,700 in October.

However, Grayscale’s ETH staking activity has not been strong enough to keep prices above that level for long.

Grayscale Staked Over 300,000 ETH, But Selling Pressure Is Greater

On October 6, Grayscale said its Ethereum Trust ETFs (ETHE, ETH) and Solana Trust (GSOL) now allow investors to earn staking yields directly through traditional brokerage accounts.

Industry leaders expressed optimism about the news, calling it a bullish signal for ETH and the broader Ethereum ecosystem.

“It’s great news that Grayscale’s ETH ETFs are now able to stake their $ETH. This is a major milestone for the ecosystem and bullish for Ethereum overall. Having worked on BlackRock’s Bitcoin and Ethereum ETFs, I’ve seen how powerful these vehicles are for institutional access and adoption,” Joseph Chalom, co-founder of SharpLink (SBET), said.

Despite this, ETH’s price fell below $4,500, lower than when the news was announced.

According to the on-chain analytics account EmberCN, since receiving staking approval, Grayscale has staked 304,000 ETH, worth over $1.3 billion.

This move demonstrates Grayscale’s strong commitment to supporting the Ethereum network. Reducing the circulating supply could also help stabilize ETH’s price.

However, current Ethereum network data suggests this effort may not be enough to create a strong positive impact.

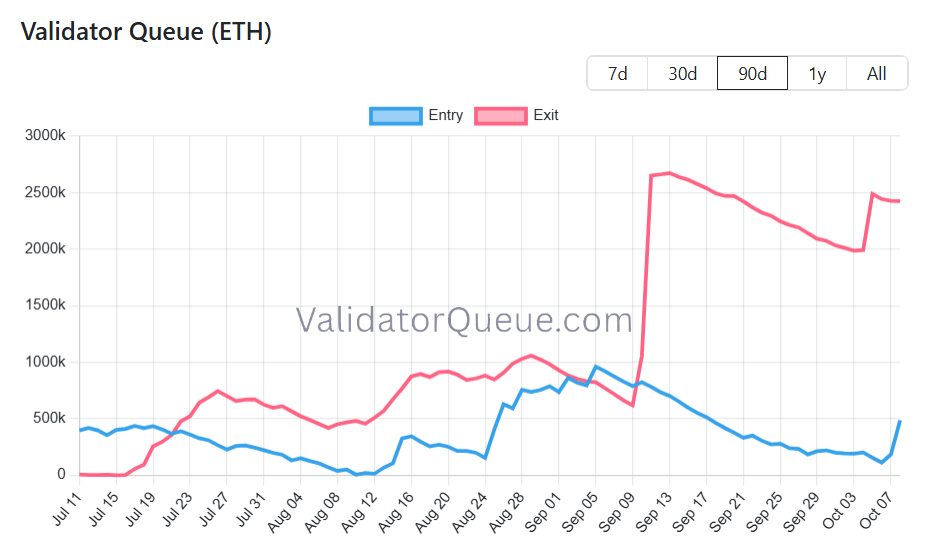

Data from ValidatorQueue shows that about 489,000 ETH are waiting to be staked, most of which belong to Grayscale. In contrast, the amount of ETH waiting to unstake is much higher and has been rising since early October, with over 2.4 million ETH queued for withdrawal.

This large imbalance signals potential selling pressure, which could increase ETH’s circulating supply and put downward pressure on prices.

Long-Dormant Ethereum Whales Awaken, Adding More Selling Pressure

Meanwhile, several long-time Ethereum whales have started to move and sell their holdings.

- According to Lookonchain, one whale wallet woke up after four years of inactivity, selling 1,800 ETH for a profit of about $8.12 million. Four years ago, the wallet had withdrawn 5,999 ETH from Kraken at just $2,523 per ETH.

- Similarly, SpotOnChain reported another dormant whale transferring 15,000 ETH (worth roughly $68.2 million) to Bitfinex after five years of inactivity.

A similar pattern is emerging among Bitcoin OG wallets, reflecting a general profit-taking sentiment among long-term and large-scale investors.

The combination of reactivated Ethereum whales and the rising unstaking queue in October could weaken the positive impact of Grayscale’s staking efforts.

While staking more ETH helps strengthen network security and generate staking rewards, the selling pressure from unstaking activity and whale movements may outweigh these benefits — making it difficult for ETH’s price to sustain its upward momentum.

The post Ethereum Slips Below $4,500 Despite Grayscale Staking 300,000 ETH appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.