Bitcoin Hits New $126,000 Record While Retail Engagement Sleeps

Bitcoin’s record-breaking rally to $126,000 signals a new era led by institutions, not retail traders. Analysts now question whether this shift has permanently rewritten the rules of crypto market behavior.

Bitcoin reached a new all-time high, breaking $126,000 despite an apparent lack of engagement from retail traders. Corporate inflows overwhelmed a huge volume in short positions, creating an unusual situation.

If institutional investors really are directing the valuation of BTC, it might invalidate years of data on crypto price cycles. The future may be harder to predict than ever before.

Bitcoin’s Unusual All-Time High

Bitcoin hit an all-time high yesterday, but this apparently hasn’t slowed the train down one bit. Throughout 17 years of price data, new heights typically recede somewhat, with records manifesting as brief spikes on an upward trend.

Profit-taking and other hedging activities often cause this, pulling prices back despite fierce enthusiasm.

Today, however, has been a little different. BTC did recede a little after yesterday’s all-time high, but investment continued, causing massive liquidations among short positions.

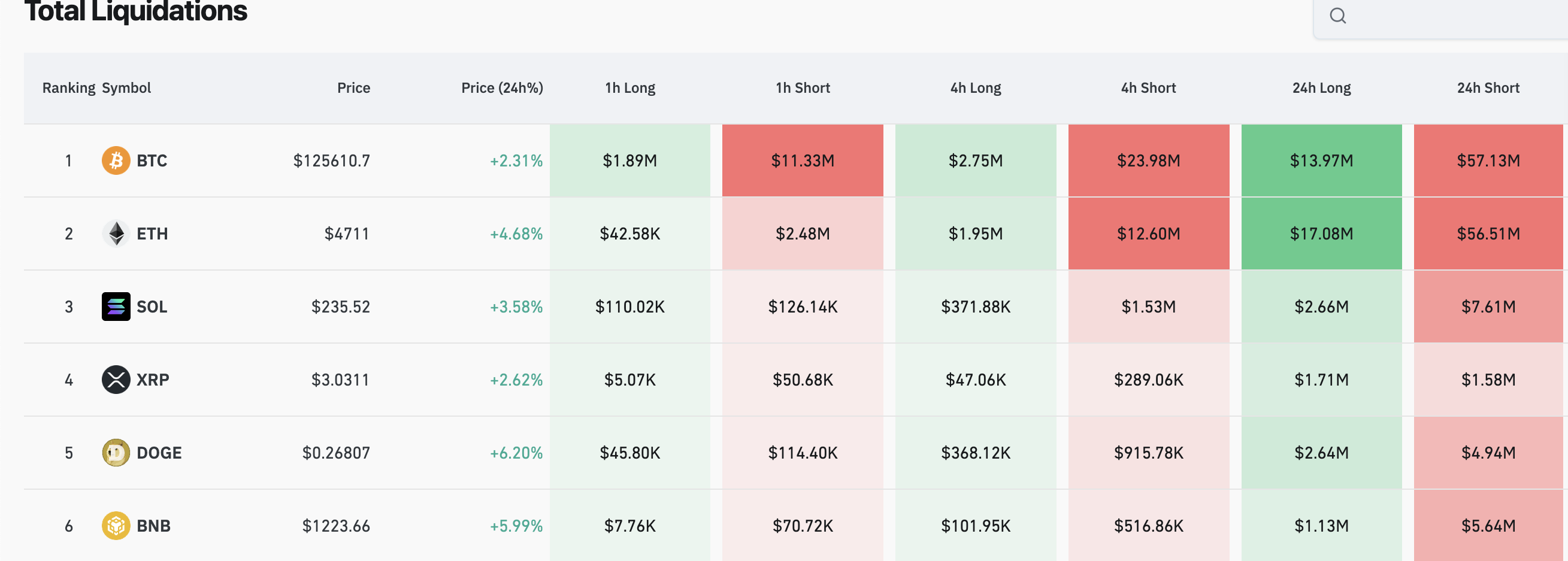

Ethereum is also flirting with a new record price level, but Bitcoin’s rise to $126,000 is causing the biggest impact:

Bitcoin and Altcoin Liquidations. Source:

Bitcoin and Altcoin Liquidations. Source:

Although this should ostensibly be bullish, Bitcoin’s newest all-time high is causing a little consternation among analysts. Some experts have feared that corporate inflows are powering this growth, representing a broader narrative shift from expectation of future gains to monetary panic.

Today’s new data seems to further corroborate these concerns. Bitcoin ETF investment is flourishing, and digital asset treasuries reported $1.3 billion in acquisitions last week.

This impressive figure doesn’t even include MicroStrategy or Metaplanet. Meanwhile, how is retail sentiment reacting to Bitcoin’s new all-time high?

A New Price Cycle?

These pieces of information, especially when paired with the liquidation data, could present a concerning sign. “Concern” might be an overstatement; it’s hard to be outright bearish when Bitcoin hits an all-time high.

Still, today’s market raises an interesting question: how can we predict future price moves in these unprecedented circumstances?

Ever since the SEC approved BTC ETFs in 2024, analysts have been wondering if institutional inflows will permanently break well-established price dynamics.

Bitcoin hit two all-time highs in two days without much retail participation, which seems like an aberration if ever there was one. Where do we go from here?

If the rules really have changed forever, we’ll need to independently verify each time-tested industry truism to see if it still applies in 2025. Is Bitcoin actually a good inflation or recession hedge?

Can we continue trusting that crypto winters will always end, even if it takes multiple years? Your guess might be as good as mine.

That sort of chaos could be very unsettling and have deleterious impacts on investor confidence. Hopefully, we’ll get some answers soon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The ChainOpera AI Token Crash: A Warning Story for AI-Based Cryptocurrency Initiatives Facing Regulatory and Market Challenges

- COAI token's 90% collapse highlights risks of centralized governance and unregulated AI in crypto. - Regulatory ambiguity under the CLARITY Act exacerbated volatility and investor uncertainty. - Unaudited AI algorithms and lack of stress-testing mirrored past financial crises, prompting calls for global oversight. - Investors now prioritize decentralized, auditable projects amid lessons from COAI's implosion.

Momentum (MMT) Gaining Traction Through Key Alliances and Growing Attention from Institutions

- Momentum (MMT) gains traction in 2025 via strategic partnerships with Sui , Coinbase , and OKX, boosting institutional adoption. - A $10M HashKey Capital funding round and regulatory clarity underpin MMT's cross-chain DEX launch and RWA tokenization efforts. - Ve(3,3) governance and buybacks drive deflationary dynamics, with TVL exceeding $600M and $1.1B daily trading volumes. - Technical indicators signal potential bullish reversal at $0.52–$0.54, despite 70% post-TGE price correction and volatile forec

ALGO Falls by 3.33% Amidst Market Developments and Announced Restructuring Plans

- ALGO drops 3.33% in 24 hours, part of a broader 61.02% annual decline amid volatile market conditions. - Upcoming Swiss rate decisions, U.S. jobless claims, and bond auctions may intensify market uncertainty affecting crypto assets. - Argo Blockchain's approved restructuring plan, including new mining equipment, could indirectly impact ALGO supply/demand dynamics. - Market participants monitor macroeconomic indicators and blockchain sector developments to gauge ALGO's future trajectory.

LUNA Value Increases by 10.29% Over 24 Hours as Network Upgrade and Growing Inflows Drive Momentum

- LUNA surged 10.29% in 24 hours, driven by a network upgrade and rising on-chain inflows. - The terrad v3.6.1 upgrade aims to resolve legacy contract issues and enhance blockchain security ahead of December 18 implementation. - Derivatives open interest in LUNC futures rose to $25.55M, signaling renewed investor confidence linked to the upgrade. - Technical indicators show LUNA trading above 50-week EMA with RSI at 56, suggesting sustained upward momentum. - Analysts project continued gains if the upgrade