Glassnode Co-Founders Say Bitcoin Flashing Major Momentum Signal, Detail Timeline for Bull Market Top

The co-founders of the analytics firm Glassnode say the bull market top for Bitcoin ( BTC ) is in sight.

Jan Happel and Yann Alleman, who go by the pseudonym Negentropic, tell their 63,900 followers on X that traders shorting Bitcoin right now will likely absorb losses.

According to the Glassnode co-founders, BTC is flashing signals witnessed exactly a year ago that drove Bitcoin to breach $100,000 for the first time ever.

“Our major momentum signal is in and accelerating deployment.

Last time this happened was October 2024, things about to heat up.

Bottom Confirmation with aggregated impulse.

BTC Trend and reversal confirmation with systematic strategies.

ETH systematic signals will be next, once BTC goes over all-time highs (ATHs).

If you are shorting this move, you are out of your mind.”

While the pair is bullish on Bitcoin and altcoins, they warn that the end of crypto’s bullish phase is on the horizon.

“There is a good chance BTC tops out in 4-5 weeks, and alts in 6-8 weeks.”

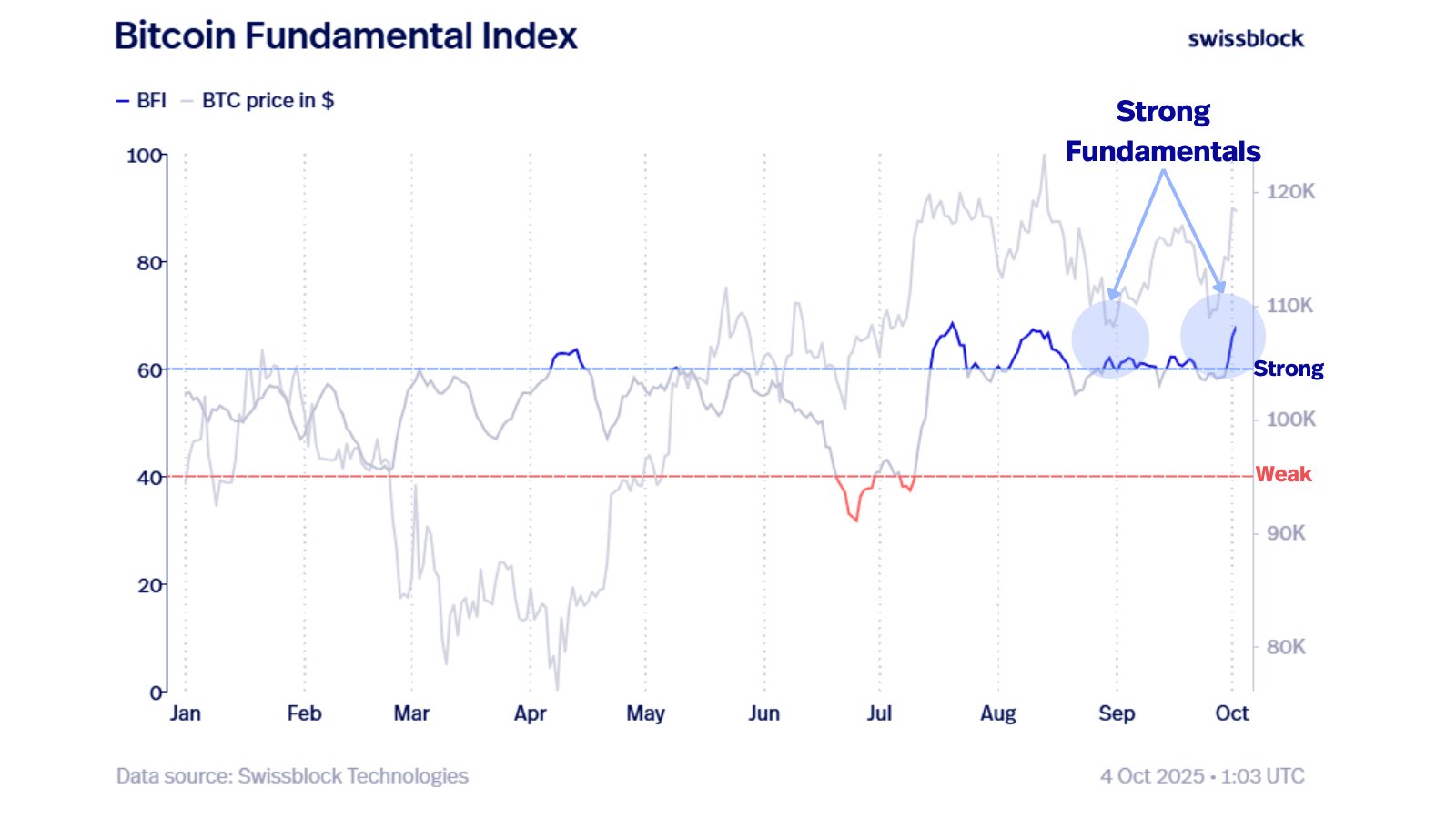

Meanwhile, analytics firm Swissblock says strong fundamentals are carrying BTC to new all-time high levels.

“Now, with Bitcoin trending into the ATH zone, it’s clear: fundamentals were the launchpad. Liquidity and network growth built the base, turning a bearish setup into the foundation of the current bullish trend. The lesson: when price and sentiment diverge from fundamentals, it often marks structural inflection points.”

Source: Swissblock/X

Source: Swissblock/X

At time of writing, Bitcoin is trading at $124,144, very close to its all-time high of $125,782.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New Prospects in Higher Education Programs Fueled by STEM

- U.S. higher education is reorienting STEM programs to align with labor market demands, addressing a projected 1.4M worker shortfall by 2030 through workforce-ready curricula and industry partnerships. - Education ETFs, private equity, and university endowments are increasingly investing in STEM-focused institutions, driven by sector growth rates 3.5x higher than non-STEM fields and scalable digital learning platforms. - Systemic inequities in STEM are being tackled via mentorship programs and basic needs

The Emergence of DASH Aster DEX and Its Impact on the Decentralized Finance Sector

- Aster DEX, a BNB Chain-based DeFi platform, achieved $1.399B TVL and $27.7B daily trading volumes in Q3 2025, redefining institutional-grade decentralized trading. - Its hybrid AMM-CEX model and ZKP-enabled privacy attracted 2M users, with 77% transactions masked, while institutional adoption grew via RWA tokenization and cross-chain upgrades. - Regulatory clarity (MiCA/CLARITY Act) and innovations like Aster Chain (10k TPS) position DeFi as a capital-efficient alternative to traditional finance, despite

BlackRock CEO Larry Fink: Sovereign Wealth Funds Are Buying Bitcoin During Price Declines

Rare XRP Buy Signal Sparks Institutional Interest in ETFs