The start of Q4 has opened with renewed optimism across the altcoin market, and three names, Stellar (XLM), Hedera (HBAR), and Remittix (RTX), are standing out for their strong fundamentals and growth potential.

Enthusiasts say these assets could deliver some of the highest ROI opportunities this October as momentum builds across both institutional and retail sectors.

Stellar (XLM) Rides Its Strong October History

Stellar continues to benefit from its long-standing trend of positive October performances. The crypto market has gained 10 of the past 12 Octobers, and XLM appears to be following suit. XLM has risen 10% in 24 hours to $0.40 on 130% trading volume.

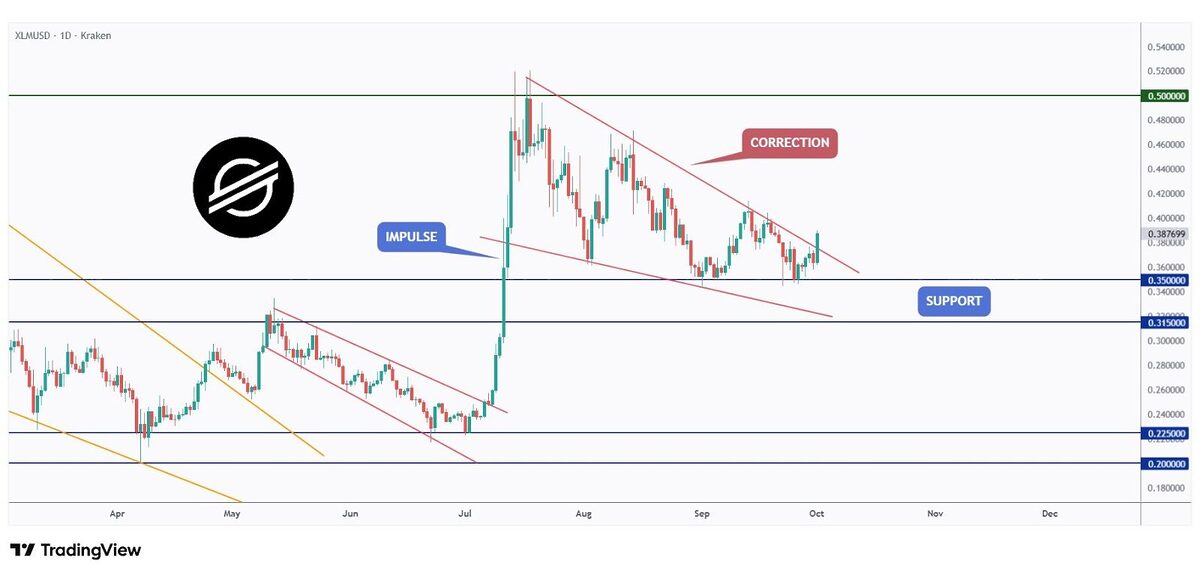

XLM Price Chart | Source: AltCryptoTalk on X

Technically, XLM recently broke out of a falling wedge pattern, a bullish setup that could trigger a 60–70% rally if confirmed. Analysts have set near-term targets around $0.50–$0.56, driven by improving sentiment and institutional participation in tokenized payments.

Hedera (HBAR) Prepares for a Breakout

Hedera has held steady at $0.22, consolidating within a descending channel while maintaining a strong $9.4 billion market cap. Despite the short-term range, technical indicators hint that accumulation is underway.

Hedera Price Chart | Source: Steph Is Crypto on X

Meanwhile, investors continue to trust Hedera’s enterprise-grade technology and partnerships in the Web3 and financial sectors. Usersare monitoring the $0.20 support and $0.24 resistance levels as critical zones, a breakout above could validate a bullish reversal.

Remittix (RTX): The PayFi Pioneer Gaining Global Momentum

Unlike typical altcoins, Remittix (RTX) is pioneering the PayFi (Payment Finance) sector, connecting blockchain with global remittances and digital payments. At its core, Remittix values security, transparency, and accessibility, focusing on real-world financial inclusion rather than speculation.

The project recently crossed $27 million raised and 675 million tokens sold, while earning recognition for progress towards new exchange listings and successful wallet beta testing to support its roadmap.

The strong community interaction and transparent audits have made RTX one of the most trustworthy and utility-driven projects of 2025.

Why RTX Could Lead the Next Bull Cycle

Remittix is rapidly emerging as the frontrunner ahead of XLM and HBAR, and here’s why:

- Utility First: RTX’s PayFi model solves real-world payment inefficiencies rather than chasing trends.

- Security and Trust: CertiK verification and a transparent development roadmap boost investor confidence.

- Strong exchange prospects with new listings building institutional interest.

- Innovative community incentives that drive daily participation and liquidity.

- Growing Ecosystem: A wallet, web app, and remittance infrastructure built for real adoption.

With fundamentals this strong, RTX stands out as a project worth watching for investors targeting high ROI, potentially outpacing both XLM and HBAR in the coming market cycle.