The world of traditional banking seems behind the times. Financial systems are largely controlled by centralized entities, leaving decisions about deposits, loans, and borrowing in the hands of institutions and middlemen. But stepping to transform this outdated system is the PayDax Protocol (PDP), offering a fresh perspective on finance.

More than a billion people worldwide are excluded from financial services, and average savings rates struggle to reach over 1%. Banks frequently lend out deposited funds at substantially higher rates, unfairly enriching themselves. However, Paydax has emerged to challenge this narrative with its fully decentralized peer-to-peer (P2P) financial system.

Paydax's top-tier decentralized finance (DeFi) banking solutions allow investors to secure loans with cryptocurrencies or tokenized real-world assets (RWAs), earn greater yields through peer-to-peer lending, or stake assets to support the protocol's ecosystem and receive returns.

Paydax, The People's DeFi Bank

Consider a crypto investor with $100,000 in digital assets but not willing to sell his coins to access liquidity. Paydax now allows crypto investors to borrow up to $97,000 in stablecoins like USDT or USDC, while using their asset as collateral, which is also applicable to real-world assets.

Paydax provides a unique possibility for users to borrow against a variety of RWAs, including gold, real estate, high-value art, and luxury watches. Notably, borrowers who choose the protocol's solutions, can use loan-to-value (LTV) ratios ranging from 50% to 97%, adjusting borrowing options to their risk preferences.

For lenders, the protocol offers 15.2% annual percentage yield (APY) by funding collateralized loans directly. Investors can also participate in the Redemption Pool, which serves as decentralized insurance and provides stakeholder 20% APY. Advanced users can experiment with leveraged yield farming, which can produce returns of more than 40% APY.

Focus On Security, Transparency, And Future Partnerships

What distinguishes Paydax's future is its commitment to partner with leading infrastructure providers such as Chainlink (LINK), Jumio, MoonPay, and Prosegur, ensuring institutional-grade trust and stability. Their technology is now being deployed on PayDax's decentralized application (dApp), which showcases the protocol's model.

Onfido provides Know-Your-Customer (KYC) verification, QuillAudits, Hacken, Rapid Innovation, and Assure DeFi do smart contract audits , and Gnosis Safe offers multi-signature wallets to prevent single-party control.

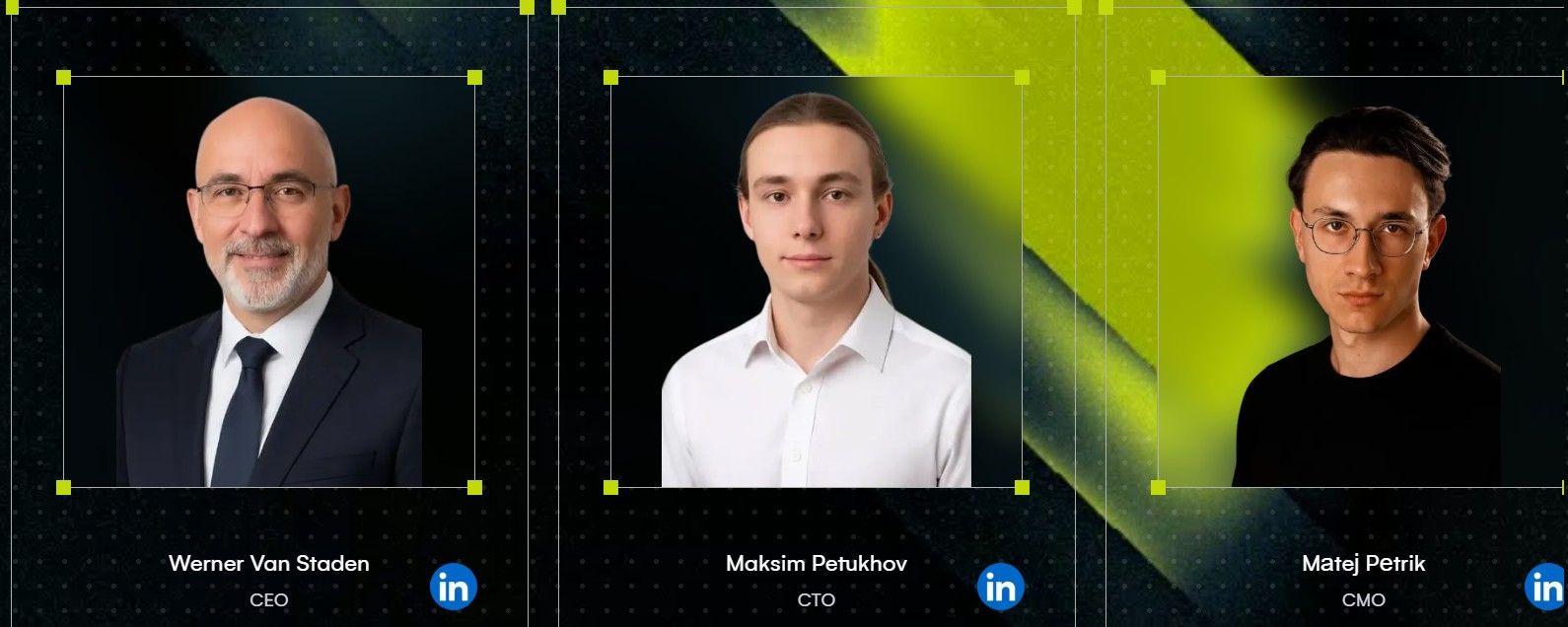

CTO Maksim Petukhov emphasizes the importance of smart contract safety, citing various audits and developing partnerships that position Paydax to lead in RWA lending. CMO Matej Petrik emphasizes the protocol's transparency, with the leadership team, including its CEO Werner Van Staden, hosting regular AMAs to demonstrate their commitment to openness.

Investors now have a unique opportunity to engage in a financial ecosystem that prioritizes transparency and optimizes asset utility for their proprietors. Would you rather trust traditional banks or carve your own path using the PayDax Protocol (PDP)?