Can Bitcoin ETFs Fuel the Biggest Price Surge Yet?

Bitcoin price is once again at the center of Wall Street’s attention. After a week of heavy outflows, U.S. spot Bitcoin ETFs have come roaring back with $3.24 billion in fresh inflows—their second-best week since launch. At the same time, BTC is pressing against its all-time high near $124,000, a level that could define whether October becomes the month Bitcoin breaks into uncharted territory. With BlackRock’s IBIT ETF leading the charge and Fidelity’s FBTC adding significant support, the surge in institutional demand raises one pressing question: are ETFs about to drive Bitcoin price into a new price discovery phase?

Bitcoin ETF Inflows Rebound Sharply

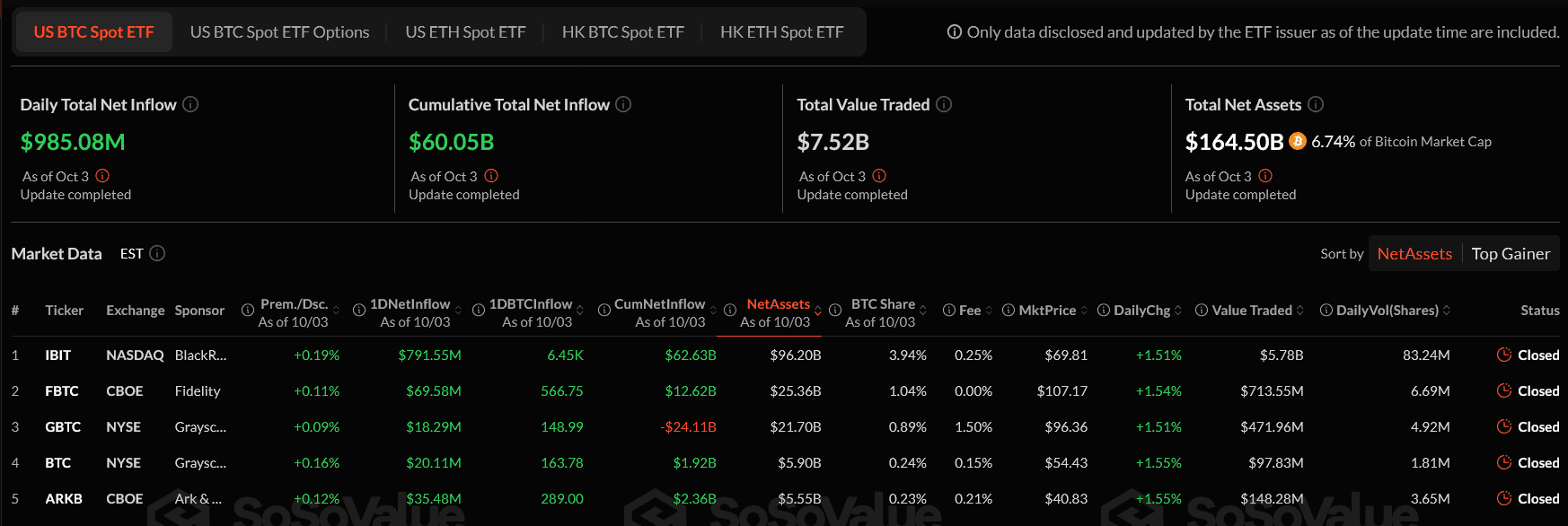

US BTC Spot ETF: Image Source: SoSoValue data

.

US BTC Spot ETF: Image Source: SoSoValue data

.

Bitcoin spot ETFs in the U.S. just posted their second-strongest weekly inflows on record. According to SoSoValue data , these funds pulled in $3.24 billion last week, a massive turnaround after the prior week’s outflows. To put it in perspective, this surge was only eclipsed once before, back in November 2024, when inflows peaked at $3.38 billion.

BlackRock’s IBIT ETF dominated the landscape, attracting $1.8 billion in inflows and handling several billion dollars in daily trading volume. With $96.2 billion in assets under management, IBIT has established itself as the heavyweight in this space. Fidelity’s FBTC followed with $692 million in inflows, roughly 38% of IBIT’s haul, but still a strong second. Grayscale’s GBTC, in contrast, showed modest inflows but remains weighed down by prior outflows.

The total net assets across U.S. Bitcoin spot ETFs now stand at $164.5 billion, representing nearly 7% of Bitcoin’s entire market capitalization. That concentration underscores just how significant ETFs have become in Bitcoin’s market structure.

Why Are Inflows Surging Again?

The reversal in sentiment looks tied to two factors. First, Bitcoin is retesting its all-time high of around $124,000, first reached in August. Historically, October has been one of Bitcoin’s strongest months, often setting up momentum into year-end rallies. Second, the ongoing U.S. government shutdown may be creating a risk-on environment. When investors distrust traditional systems and data flow is disrupted, hard assets like Bitcoin start to look more attractive.

The $4.14 billion swing in flows compared to the previous week highlights how fast institutional positioning can change. ETF demand acts as a proxy for institutional appetite, and right now that appetite looks bullish.

Can October Push Bitcoin Price Into Price Discovery?

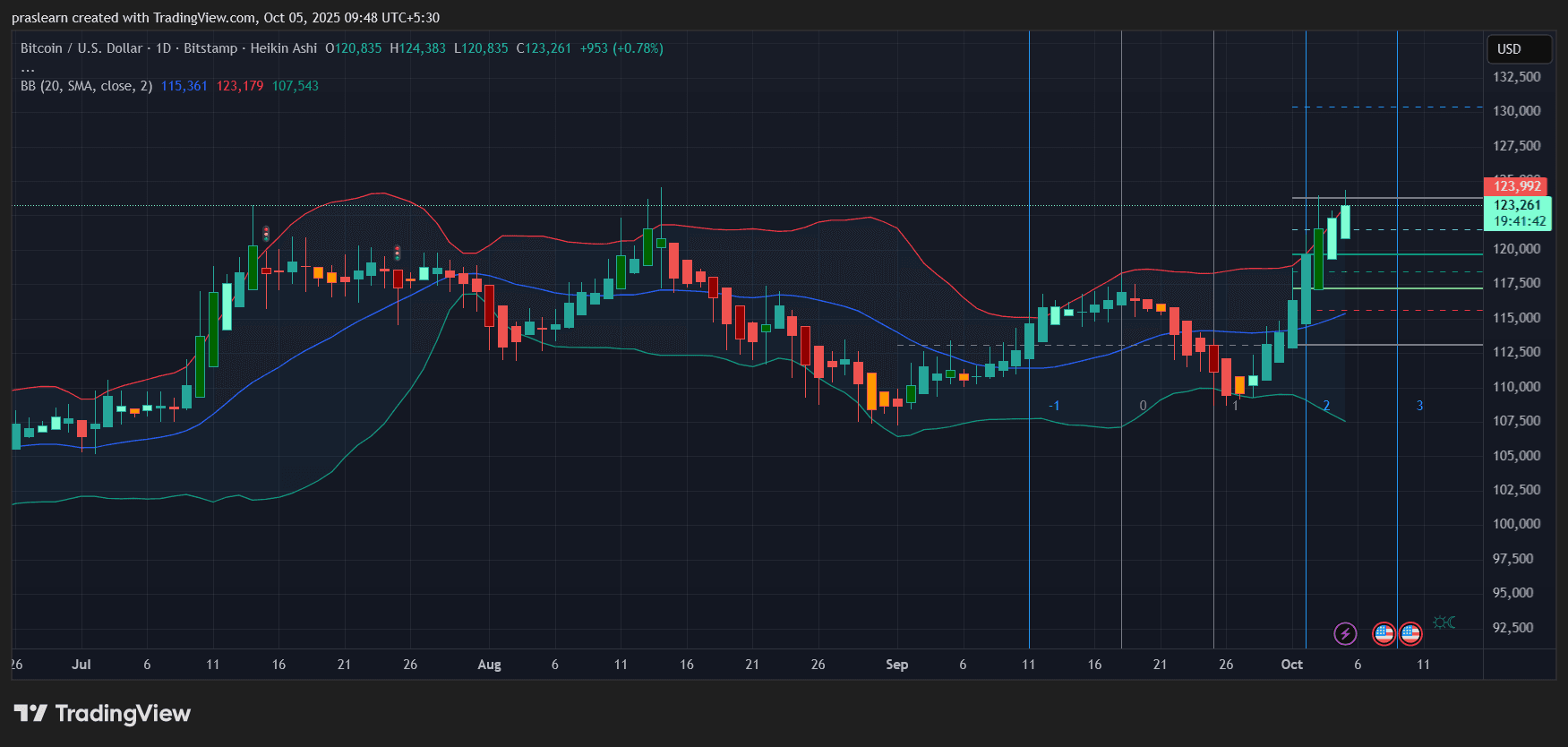

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Bitcoin price has already rebounded 1.37% on the week, but the real test will come if it can break past the $124,000 ceiling. If Bitcoin ETF inflows continue at the current pace, there’s a strong probability of fresh all-time highs this month. The daily inflow of nearly $1 billion on October 3 alone suggests momentum is accelerating rather than cooling.

At the same time, Bitcoin ETF data shows concentration risk. With BlackRock holding nearly $100 billion in assets, a sharp reversal in IBIT flows could quickly flip market sentiment. Traders will need to watch not just the aggregate inflow numbers, but how they are distributed across funds.

What Happens If Flows Slow Down?

If inflows taper off or turn negative again, $BTC could stall below $124,000 and retest the $110,000–$115,000 support band. The market remains extremely sensitive to liquidity conditions, and ETF demand has become the key barometer of near-term price action. A dip in enthusiasm from BlackRock or Fidelity clients would be enough to trigger a corrective phase.

Outlook: A Breakout Month Ahead?

October has the ingredients to be a breakout month for $Bitcoin. Strong ETF inflows, seasonal tailwinds, and macro uncertainty all lean in favor of higher prices. The critical line to watch is $124,000. A clean breakout above it, supported by multi-billion-dollar ETF inflows, could launch Bitcoin into uncharted territory and set the stage for a Q4 rally.

If momentum fades, however, expect consolidation before any next leg higher. The deciding factor isn’t retail FOMO this time—it’s institutional flows through ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.