Dogecoin’s Big Breakout Incoming? Analyst Calls To “Stay Alert”

An analyst has pointed out how a Dogecoin breakout could be coming, based on this technical pattern that the asset has followed over the years.

Dogecoin Is Currently Inside Accumulation Zone Of Long-Term Channel

In a new post on X, analyst Ali Martinez has talked about how Dogecoin is still in the accumulation phase of a technical analysis (TA) channel. The pattern in question is an “Ascending Channel,” a type of Parallel Channel.

Parallel Channels form when the price of an asset travels between two parallel trendlines. There are a few different variations of the pattern, depending on how the trendlines are oriented with respect to the chart axes. The Ascending Channel, the type that’s of interest in the context of the current discussion, involves trendlines that are sloped upward. That is, these channels correspond to a phase of upward consolidation in an asset’s price.

The upper line of the pattern tends to be a source of resistance, while the lower one is a source of support. Either of these levels not holding up can imply a continuation of the trend in that direction. This means that a surge above the channel could signal a bullish breakout, while a fall below it may lead to bearish action.

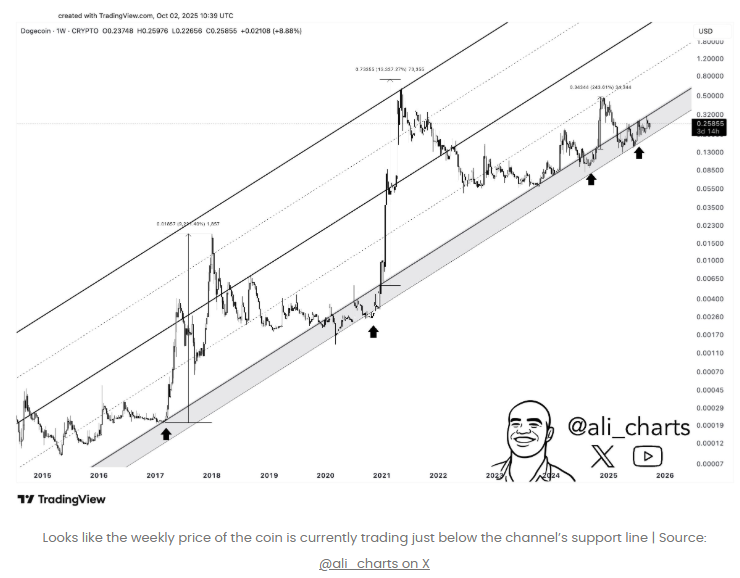

Now, here is the chart shared by Martinez that shows the Ascending Channel that the 1-week price of Dogecoin has followed over the past decade:

As displayed in the above graph, Dogecoin slipped below the support line of the Ascending Channel earlier in the year. This fall, however, didn’t immediately confirm a bearish breakdown, as the memecoin has seen a few instances over its history where temporary declines below the line have taken place.

During each of them, the coin ended up finding support in a zone bounded by the channel’s lower level and another parallel support line just some distance below.

From the chart, it’s visible that this same pattern could be playing out once more, as the asset has stabilized since entering this historical “accumulation” phase. For now, the coin is still trading inside this zone, but a surge back into the Ascending Channel could eventually arrive, if the past pattern is anything to go by.

Each of the previous returns into the channel led to notable gains for Dogecoin. “The breakout is coming,” says the analyst. “Stay alert!”

Another altcoin, Chainlink (LINK), has also been following an Ascending Channel recently, as Martinez has pointed out in another X post.

As is visible in the chart, Chainlink’s 3-day price is currently trading near the mid-line of its multi-year long Ascending Channel. The analyst believes a surge to $47 could be next for the coin, corresponding to the upper line of the pattern.

DOGE Price

At the time of writing, Dogecoin is trading around $0.255, up more than 13% over the last week.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.