PayPal’s PYUSD stablecoin supply doubles to $2.5b in a month

PayPal’s PYUSD supply has surged 113% month-over-month, hitting an all-time high of $2.54 billion.

- PayPal’s PYUSD stablecoin doubled its circulating supply, reaching $2.54 billion

- Over the past month, the token’s supply surged 113%

- USDT and USDC still dwarf all other stablecoins combined

PayPal’s stablecoin PYUSD has broken out of its quiet launch phase. On Friday, Oct. 3, the stablecoin reached an all-time high in circulating supply at $2.54 billion. Over the past month, this figure rose 113%. At the same time:

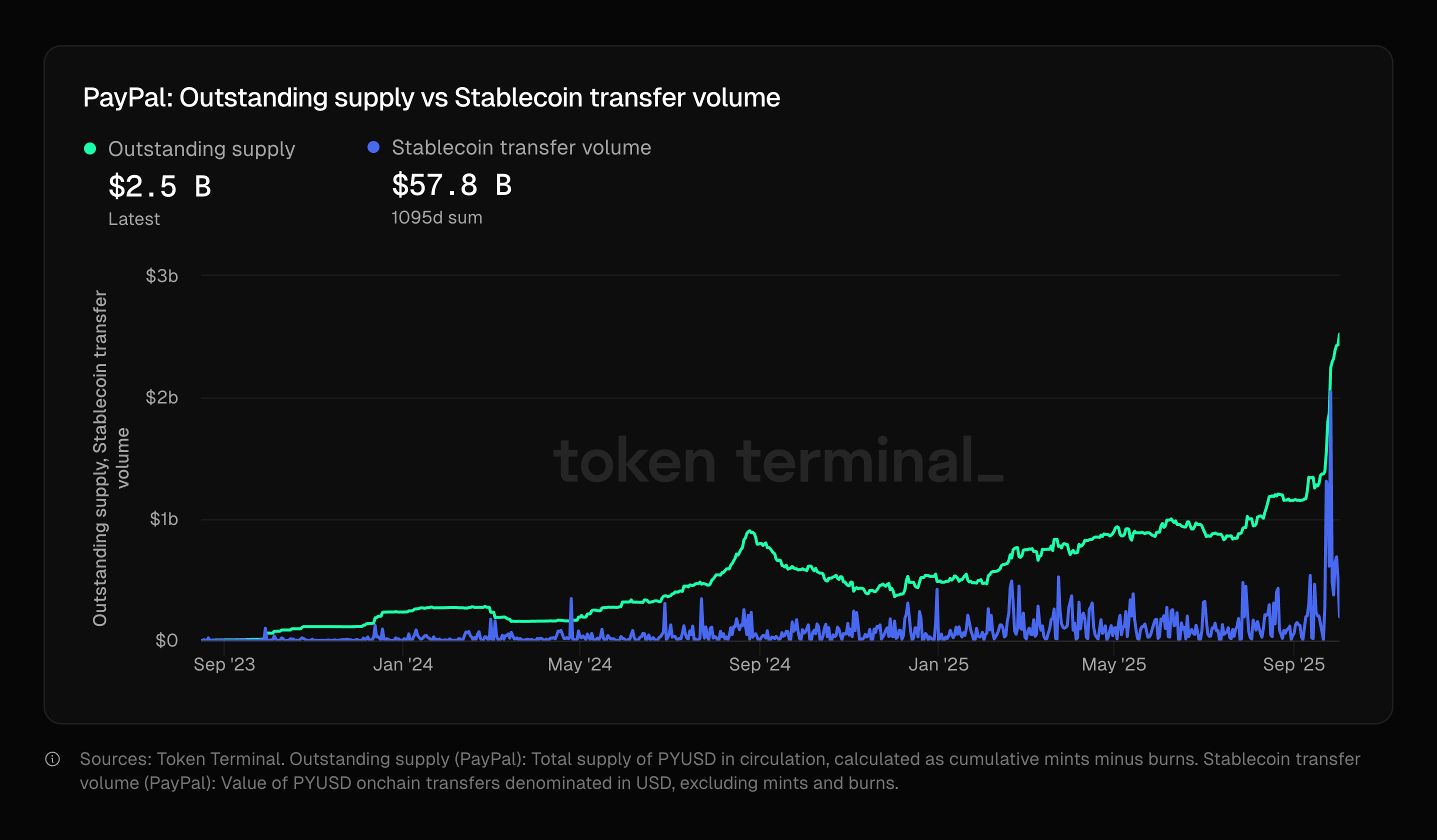

PayPal’s PYUSD outstanding supply and stablecoin transfer volume | Source: Token Terminal

PayPal’s PYUSD outstanding supply and stablecoin transfer volume | Source: Token Terminal

A circulating supply of $2.54 billion puts PYUSD in seventh place among stablecoins, behind USDe, USDS, DAI, and USD1. Much of that supply, specifically $1.84 billion, is on Ethereum (ETH) . At the same time, $624 million worth of PYUSD is on Solana (SOL) .

PYUSD transfer volume peaked at $2 billion daily on Sept. 26, according to data from Token Terminal. So far, the stablecoin has facilitated almost $60 billion in total transfers. PYUSD has also reached a milestone of 40,000 holders, a figure that has risen consistently since January 2025.

Still, giants Tether and USDC continue to dominate the market, with $176 billion and $75.9 billion in circulating supply. Together, they account for almost 85% of all circulating supply. PYUSD itself accounts for 0.84% of the stablecoin market.

PYUSD stablecoin is taking off

At launch, many called the PYUSD stablecoin a “nothing burger” , citing its limited reach beyond the PayPal and Venmo ecosystem. Still, the firm has worked on decentralizing PYUSD, enabling users to send to external wallets and holding it non-custodially.

PYUSD’s all-time high coincided with the stablecoin market cap breaking the total value of $300 billion. U.S.-denominated stablecoins lead the charge, with USDC growing rapidly. What is more, the monthly stablecoin transfer volume reached $3.27 trillion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investing in the Next Generation of Decentralized Trading: The Emergence and Impact of Hyperliquid

- Hyperliquid dominates 73% of decentralized perpetual trading in 2025 through HIP-3 upgrades slashing fees and enabling permissionless market creation. - Institutional validation grows as $420M HYPE staking by Hyperliquid Strategy locks 3.5% supply, generating $9.9M annual yields and reducing selling pressure. - TVL surged to $5B with $47B weekly volumes, driven by equity perpetuals and EVM-compatible HyperEVM, positioning it as a foundational DeFi infrastructure layer. - Retail investors face asymmetric

PENGU Token's Technical Surge: Could This Spark Sustained Institutional Interest?

- PENGU token's $174M trading volume and 2.9x whale accumulation in Q4 2025 signal strong institutional interest. - Technical analysis shows bullish patterns (symmetrical triangles, $0.040 price target) and sustained liquidity across 50 exchanges. - Utility expansion via penguSOL, Pudgy World integrations, and 112k+ daily active wallets validates ecosystem adoption. - $430K institutional inflows and 76% institutional crypto adoption plans by 2026 highlight strategic investment potential. - Risks persist: 1