Why Solana’s Latest Uptrend Could Be a Bear Trap

Solana’s rally shows cracks as liquidity weakens and network demand drops. While bulls eye $253.66, fading strength risks a drop to $205.02.

Layer-1 coin Solana has climbed nearly 10% over the past week, fueled by renewed momentum across the broader crypto market. Bitcoin’s recent surge has helped lift the wider market, dragging SOL and other altcoins higher.

However, a closer assessment of SOL performance suggests that its rally lacks strong backing and could face a reversal soon.

Solana’s Price Gains at Risk: Data Hints at Trouble

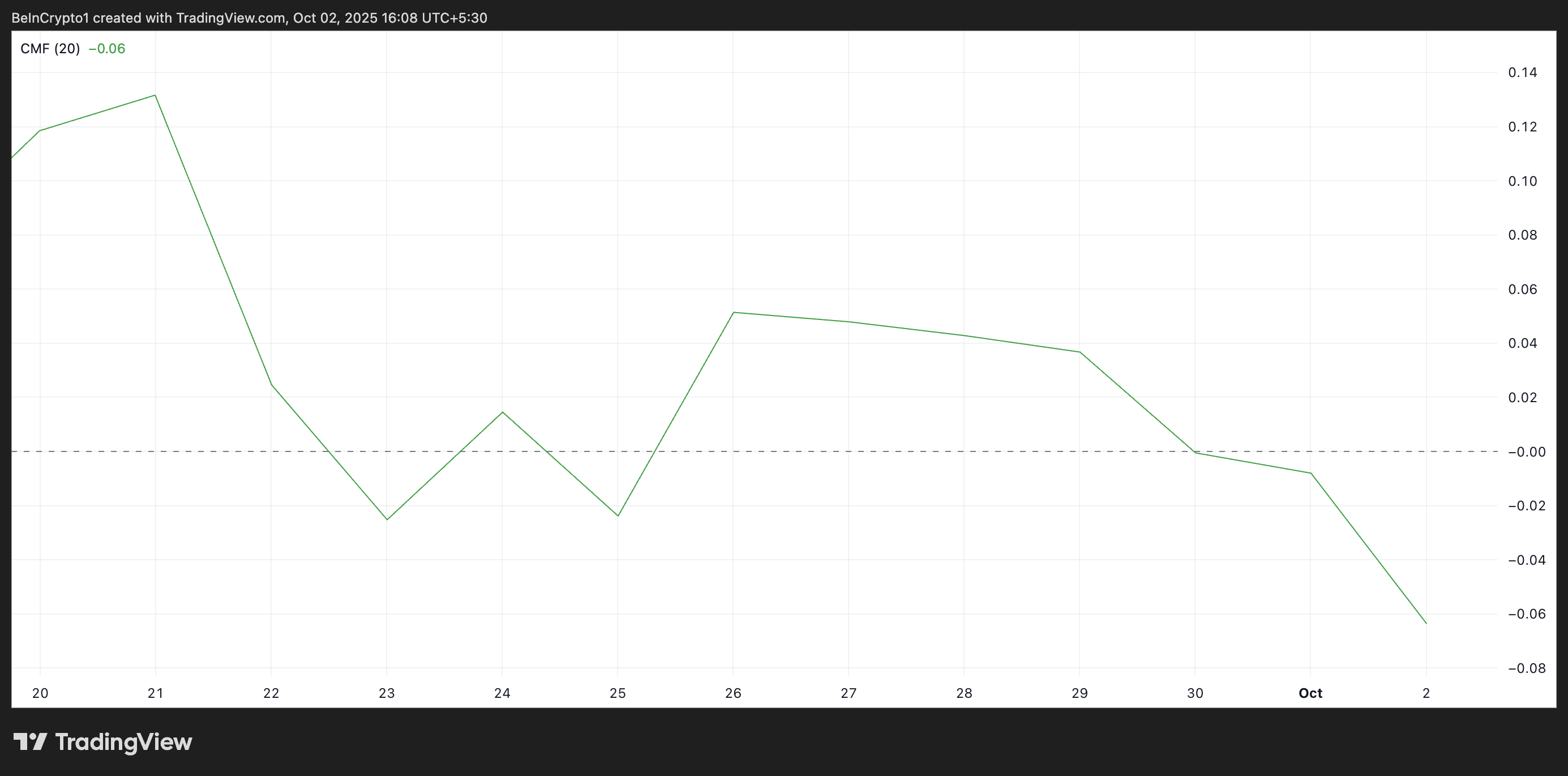

SOL’s rally faces a threat of decline as its Chaikin Money Flow (CMF) trends downward, forming a bearish divergence. As of this writing, the momentum indicator rests below the zero line at -0.06 and continues to trend lower.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Solana CMF. Source:

TradingView

Solana CMF. Source:

TradingView

The CMF indicator measures how money flows into and out of an asset. When it returns negative values while an asset’s price climbs, it forms a bearish divergence, indicating weakening liquidity.

This pattern suggests that even though SOL buyers are still pushing the price higher, capital inflow into the asset is declining and could trigger a reversal in the near term.

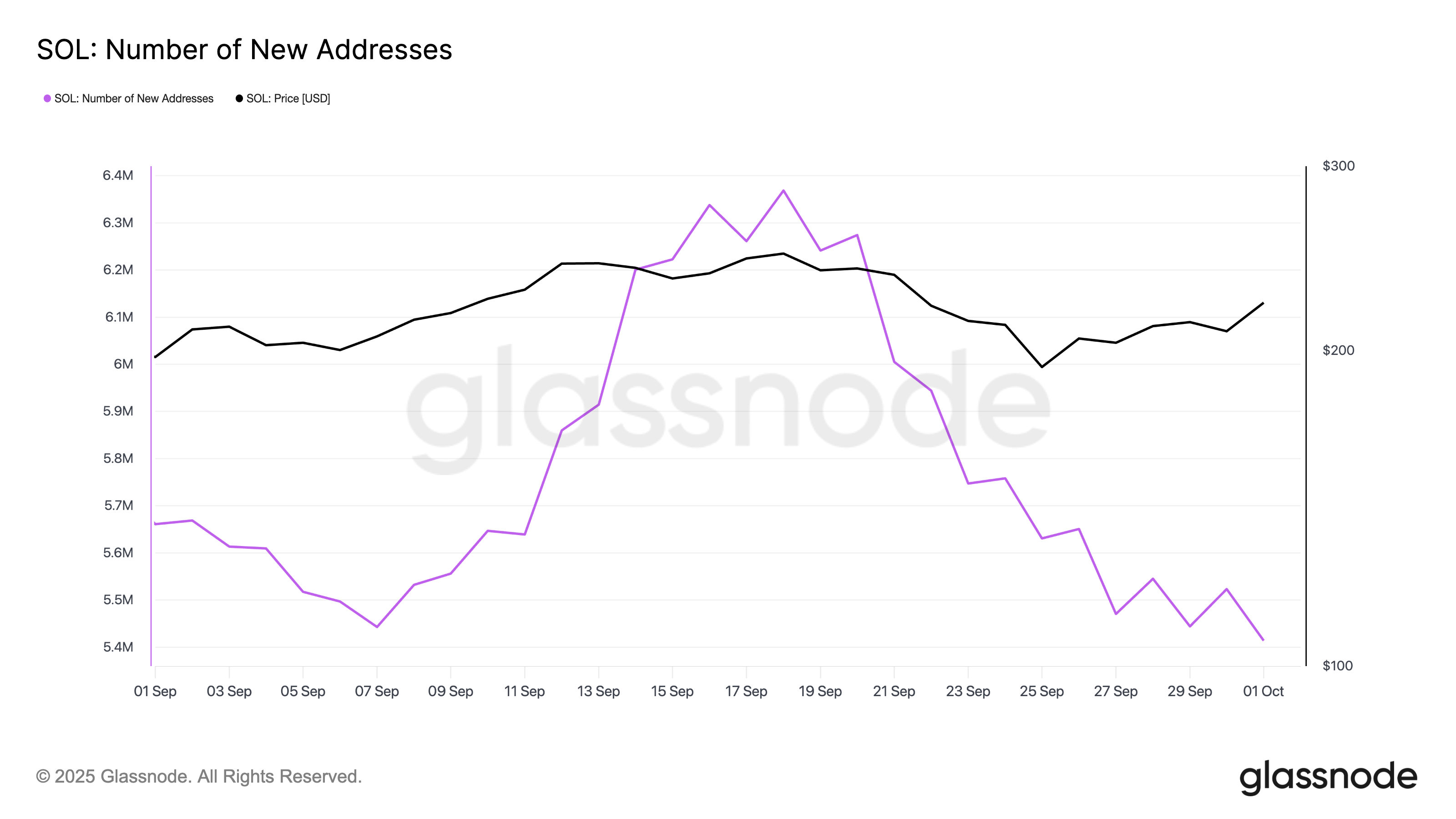

Moreover, the number of new addresses engaging with the Solana network daily has declined, signaling reduced activity and waning demand. Per Glassnode, the daily count of new wallet addresses on Solana has plunged by 15% since September 18.

Solana Number of New Addresses. Source:

Glassnode

Solana Number of New Addresses. Source:

Glassnode

A drop in daily active addresses reflects a slowdown in network participation, which can be a warning sign for an asset’s underlying demand.

This may translate into lower buying pressure for SOL, reducing the likelihood of sustained upward price movement.

Weak Demand Clouds Solana Rally

SOL’s rally in the past week has put its price in an ascending parallel channel, which generally signals a bullish trend. However, with the underlying demand losing strength, the token’s price could break below this pattern and fall toward $205.02.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

Conversely, if the altcoin maintains its rally, its price could reach $253.66.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin's ‘momentum is igniting,’ but these are BTC price levels to watch

Bitcoin accumulation trends strengthen as realized losses near $5.8B

Data-Anchored Tokens (DAT) and ERC-8028: The Native AI Asset Standard for the Decentralized AI (dAI) Era on Ethereum

If Ethereum is to become the settlement and coordination layer for AI agents, it will need a way to represent native AI assets—something as universal as ERC-20, but also capable of meeting the specific economic model requirements of AI.

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."