Bitcoin Distribution Exposed: Few Holders Control the Majority

Bitcoin has become an increasingly prominent part of global finance. Some governments, companies, and funds now include it in their reserves, while many individuals continue to grow their holdings. On the surface, ownership appears widespread, with more than 54 million Bitcoin addresses recorded on the blockchain. However, a closer look shows that these numbers can be misleading, as they do not fully reflect who actually controls the asset.

In brief

- Fewer than 20,000 wallets hold over 60% of all Bitcoin, showing how concentrated ownership really is.

- Institutional wallets including exchanges, custodians, and miners control a large portion of Bitcoin on behalf of multiple clients.

- After filtering out tiny balances and pooled accounts, around 3.9 million active users remain who control the majority of Bitcoin outside institutions.

Whales and Institutions Dominate Bitcoin Ownership

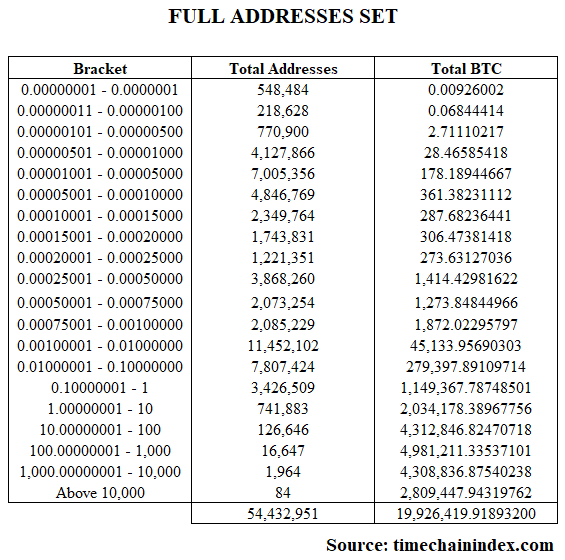

Sani, founder of the analytics platform Time Chain Index, reviewed blockchain data to measure how ownership is distributed. His analysis revealed that most of the supply is concentrated in the hands of a very small group. Out of the total addresses, only 18,695 are classified as whale wallets, but together they control more than 60% of all Bitcoin in circulation.

A significant portion of addresses also belong to institutions rather than individual users. Of the 54.4 million addresses, about 271,883 are linked to exchanges, custodians, companies, ETFs, and miners. Together, these pooled wallets hold around 8,789,113 BTC, or roughly 44% of the total supply. Since they represent funds stored on behalf of many clients, they do not reflect individual ownership.

Image showing a few wallets hold most BTC, while millions own only tiny fractions.

Image showing a few wallets hold most BTC, while millions own only tiny fractions.

Filtering the Data Reveals the True Bitcoin User Base

After removing institutional and pooled wallets, the remaining addresses still reveal how Bitcoin is distributed and which holdings are significant

- The leftover addresses collectively held 11,137,306 Bitcoin, though many contained only very small fragments from earlier transactions.

- To focus on meaningful balances, Sani excluded wallets holding less than 0.001 Bitcoin and also removed those linked to companies and custodians.

- This refinement left 23.43 million addresses, which together controlled 11,131,336 Bitcoin, highlighting the bulk of holdings outside large pooled accounts.

Based on this filtered dataset, Sani noted that the total number of wallets does not reflect the number of individual users , since most people control multiple addresses. Taking an average of six addresses per person, he estimated the network likely has around 3.9 million active users, who collectively hold the majority of Bitcoin outside institutional wallets.

This shows that the raw figure of 54 million addresses creates a distorted picture of adoption. While whales hold a dominant share and custodians manage nearly half the supply, the filtered dataset gives a more accurate view of genuine network participation. Even then, the actual user base is far smaller than the headline address count suggests.

Market Trends Signal Caution Amid Price Gains

Meanwhile, Bitcoin is trading around $111,000, up about 2% in the past 24 hours. Glassnode recently reported that the Accumulation Trend Score has softened , reflecting a more cautious approach from larger holders.

If demand does not pick up, the market could face additional pressure from available Bitcoin supply, leaving prices exposed in the near term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

COAI Experiences Significant Price Decline and Its Impact on the Market

- COAI index plummeted 88% YTD in 2025 due to governance failures, regulatory uncertainty, and speculative trading. - C3.ai leadership issues and CLARITY Act triggered sector-wide selloffs, while 88% token concentration enabled market manipulation. - AI-generated disinformation accelerated panic selling, exposing systemic risks in AI-driven crypto ecosystems. - Investors now prioritize diversified portfolios, transparent governance, and blockchain verification tools to mitigate AI-era risks. - Alternative

The Emergence of Hyperliquid (HYPE): Unveiling the Driving Force Behind Its Latest Price Rally

- Hyperliquid's HYPE token surged to $37.54 in Nov 2025 via DeFi 2.0 upgrades and regulatory alignment, but later retreated to $30–$31 amid unlocking pressures. - Institutional staking (425,000 HYPE) and 11% HLP yields boosted TVL to $5B, creating a "liquidity flywheel" while aligning with CLARITY Act/MiCA compliance frameworks. - November's 23.8% token unlock ($11.9B potential liquidity) triggered $2.2M team sales and 23.4% OTC dumping, weakening HYPE's price stability despite 40% re-staking. - Buybacks a

The Influence of Evolving Academic Research on Industries Powered by STEM

- Global STEM education investments strongly correlate with tech sector growth, boosting employment and innovation in computing, engineering, and advanced manufacturing. - U.S. STEM funding cuts risk lagging behind China in talent pipelines, while OECD data links higher STEM graduates per capita to increased GDP per capita. - Educational R&D innovations like AI-integrated programs show 20-75% operational efficiency gains, mirroring tech industry productivity demands. - Persistent challenges include 411,500

COAI Token Fraud and Widespread Dangers in DeFi: Urgent Need for Stronger Protections for Investors

- COAI token's 2025 collapse caused $116.8M losses, exposing DeFi's systemic risks in algorithmic stablecoins and governance. - Project exploited centralized reserves and opaque protocols, with 87.9% tokens controlled by ten wallets enabling market manipulation. - Regulators struggle with cross-border enforcement as Southeast Asia remains a crypto fraud haven despite U.S. and EU reforms. - Investors now prioritize transparent, overcollateralized stablecoins and use blockchain analytics to detect supply con